Export Credit Agencies (ECAs) | ECA Finance

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedExplore Export Credit Agencies around the world with our ECA finder

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

An export credit agency (ECA) is a specialist, typically government-backed financial institution that offers financing for domestic companies’ export operations.

They are also known as investment insurance agencies, or simply ECAs for short.

Export credit agencies structure their financing through the provision of specific loans and insurance that cater to non-conventional risks, such as political risk or overseas commercial liabilities.

These agencies permit further investment flows through effective transactional fluidity in international trade.

Consequently, there is no fixed model for an export credit agency, hence why some ECAs are partly controlled by government departments, and some are privately-owned brokerages.

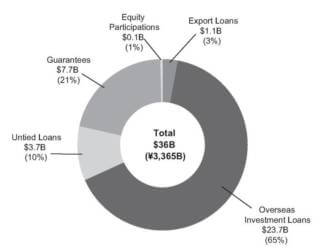

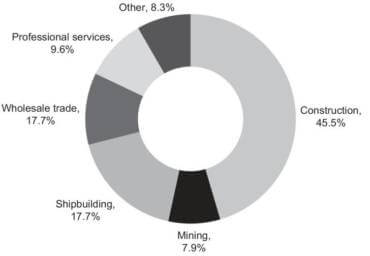

Composition of ECA contribution within project finance

Involvement of ECAs by industry

Export credit agencies principally utilize three methods to provide funds to an importing entity.

Direct lending, which is the simplest structure whereby the loan is conditioned upon the purchase of goods or services from businesses in the organizing country.

Financial Intermediary Loans, where the export-import bank lends funds to a financial intermediary, such as a commercial bank, that in turn loans the funds to the importing entity.

Interest rate equalization, whereby, a commercial lender provides a loan to the importing entity at below-market interest rates, and in turn receives compensation from the export-import bank for the difference between the below-market-rate and the commercial rate.

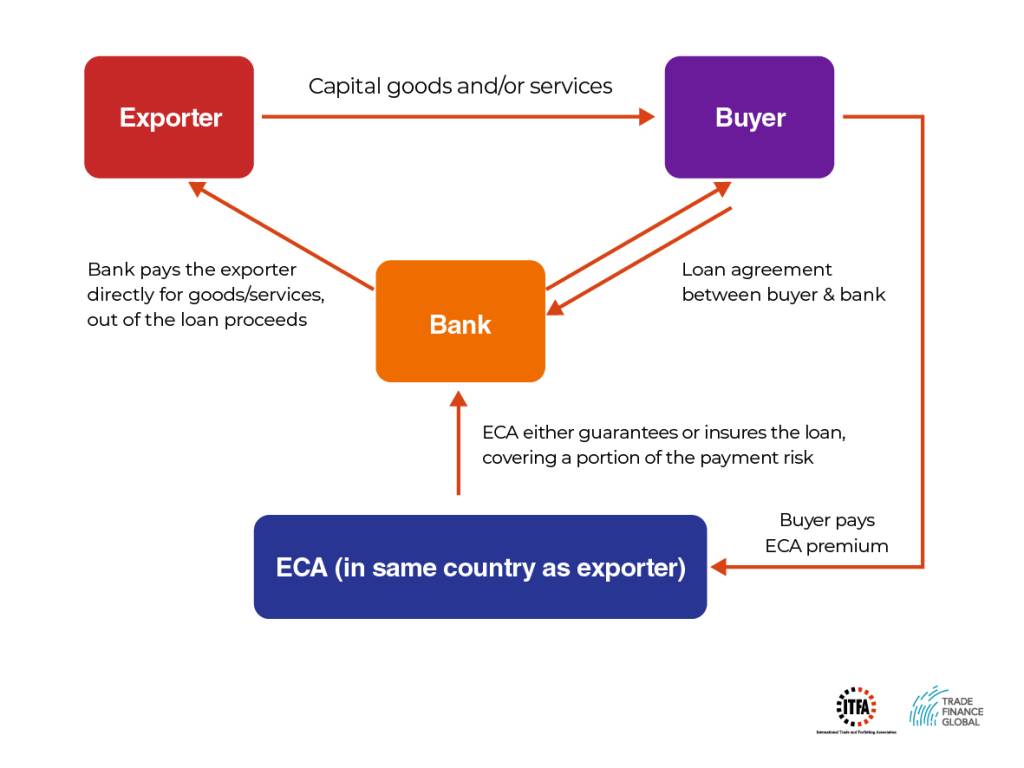

Diagram – How export finance works

Most exportation credit agencies are structured to provide finance for the medium (2>5 years) to long term (5> 10 years) however some can specialize in short term (<2 years). It is important to note that the credit, insurance and guarantees risks are almost always under the responsibility of the sponsoring borrower.

Export Credit Agencies usually limit financing from countries that are deemed unsafe in terms of creditworthiness in an attempt to control the risk effectively. Additionally, committees of government officials and the export credit agency officials will review the larger and more complex financing endeavours as these transactions are prone to a significant amount of risk relative to normal transactions.

Authoritatively supported export credit is connected to official development assistance (ODA) which makes the agency subject to the regulations set by the Organisation for Economic Co-operation and Development (OECD). This has provided a framework for export credit agencies to legally abide by where the arrangement sets forth the most (generous) export credit terms and conditions that can be officially supported. This ensures that competition is based on the price and quality of the exported goods and not the financial terms provided. Furthermore, theoretically speaking, this should eliminate excessive subsidies and trade distortions related to officially supported export credits.

Since 1999, countries have been assigned into risk categories harmonized with minimum premium rates that have been allocated to the various risk categories this is not inclusive of agricultural exports or military-related trade which was a relatively recent decision implemented by the World Trade Union.

Many disregard officially approved export credits as export subsidies correspondingly, the facilitation of export credit agencies are accepted by many to be a type of corporate welfare. Another issue with an export credit agency is that it not motivated by developmental goals such as trade finance but instead generates supplementary debt in relatively poorer economies to support industries in relatively well-developed economies, this leads to export credits interfering with aid money and debt relief programs where the debt gets repaid back to better-developed economies

In saying this, however, many advocates for export credit agencies assert that export credits permit importers to have access to goods that would not normally be available generating another market within the importers domestic country. Export Credits also provide the derivative of implementing broader trade policies, bilateral and even multinational agreements which achieve results that the private sector alone cannot endeavour.

List of Export Credit Agencies (ECAs)

Europe

North America

Oceania

Middle East

Asia

References

Organisation for Economic Co-operation and Development [2018], Country Risk Classifications of the participants to the arrangement on officially supported export credits,

www.oecd.org/trade/xcred/cre-crc-current-english.pdf, retrieved 30-08-2018.

Organisation for Economic Co-operation and Development [2018], Arrangement for officially supported export credits, https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?doclanguage=en&cote=tad/pg(2018)1, retrieved 30-08-2018.

Policy Review and Recommendations [2009], Handbook for 108th Congress, CATO Institute, https://object.cato.org/sites/cato.org/files/serials/files/cato-handbook-policymakers/2003/9/hb108-33.pdf, retrieved 30-08-2018.

Our trade finance partners

- Export Credit Agencies Resources

- All Export Credit Agencies Topics

- Podcasts

- Videos

- Conferences