Receivables Finance | 2025 Guide

The above Supply Chain Finance techniques have been defined by the Global Supply Chain Finance Forum (BAFT, EBA, FCI, ICC and ITFA)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Receivables Finance

Welcome to TFG’s receivables finance hub. Find out how our team can help your company unlock working capital from accounts receivable financing, on both a recourse and non-recourse basis. Alternatively, learn more about the different types of receivables and receivables finance: be that from a discounting or factoring perspective, or through our latest research, information and insights, right here, in our receivables finance hub.

What is receivables finance?

Simply put, receivables finance comprises:

Any arrangement providing credit to a party, using an amount payable by one party to another for goods or services, should be included in the scope of receivables finance.

The generation of receivables is a key factor in any trade finance arrangement. A party (the seller) sells something to another party (the buyer), and the payment by the buyer, until the time when it is paid, is a receivable. It is an asset which the seller has, and a liability which the buyer has. The speed with which the seller converts the receivable into cash is important for their business; faster conversion of receivables into cash reduces the amount of working capital the seller needs to run its business. The measurement of how long that takes is often called ‘days sale outstanding’ (DSO). The seller will often be looking for solutions that turn its receivables into cash more quickly.

On the other hand, the buyer wants as much time as possible before they must pay the receivable. The more quickly it has to pay, the more working capital it needs for its business before it can utilise whatever it has bought. The longer the buyer has to pay, the better it is for the buyer. The measurement for the buyer is its ‘Days payable outstanding’ (DPO). See also Chapter 8: Cross-border supply chain finance.

Given this apparent conflict, it is possible to see how each party might seek help to achieve a shorter DSO period, in the case of the seller, and a longer DPO period, in the case of the buyer. It is for these reasons that the parties seek solutions in the arena of receivables financing.

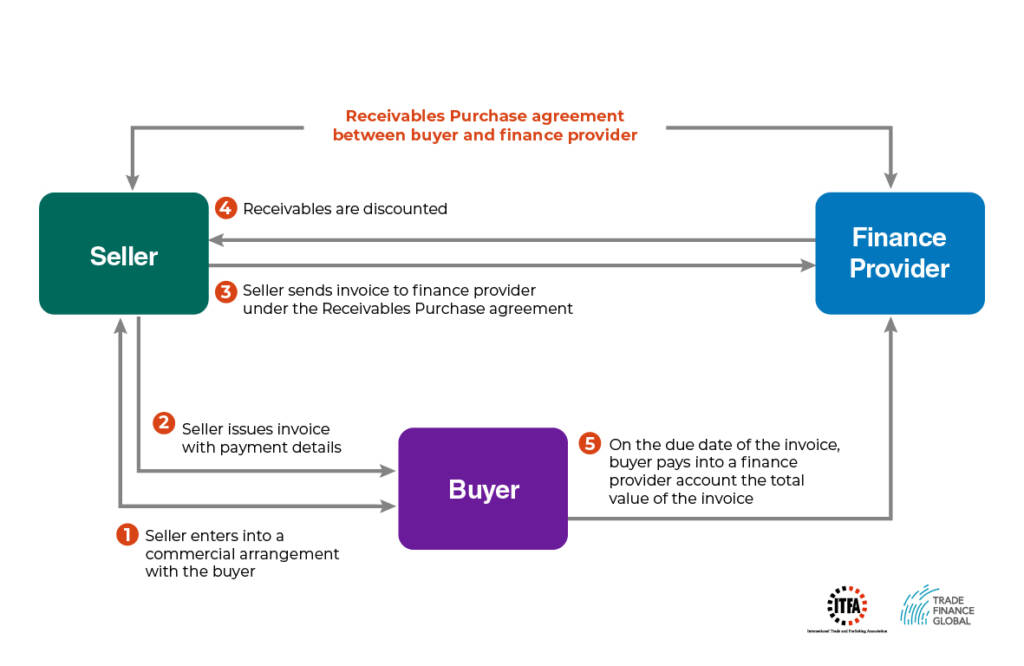

Diagram: How receivables finance actually works

We teamed up with the International Trade & Forfaiting Association (ITFA) to put together this diagram on how a receivables purchase agreement works between a buyer and a finance provider

How do receivables arise?

Receivables represent the culmination of most, if not all, trading arrangements where a product or service is sold, and which can result in some form of financing. It may well be the case that, in the time from producing a raw material to creating a finished product, there is more than one sale and purchase involved. The producer of raw materials sells them to a buyer. That buyer processes the raw material and sells the finished product to another buyer, and so on. Each of these sales and purchases would create a receivable, which could be the subject of a financing.

In all these cases, either of, or both, the seller and buyer might see the need to obtain financial support for such a transaction. Equally, such a transaction provides an opportunity for a financer to offer an arrangement to one or other party to improve its DSO or DPO position, whichever is relevant. In addition, other parties have become more involved in arranging for this to happen and more parties have become interested in participating in such arrangements. All of these scenarios are considered below.

Quality of the receivable

The quality of the receivable is a major determining factor as to what financing is available when it is produced in a trading arrangement. A financer might require, or offer, some sort of credit enhancement for that receivable. This might be by way of a guarantee of the payment obligation of the buyer, or by way of some other form of credit support like credit insurance or involving a surety. Another way of improving the quality of the receivable is by making it an irrevocable payment obligation. This can be in terms of the receivable itself, or because the receivable is replaced by something such as a separate irrevocable payment undertaking (IPU) or promissory note, which, by statute, constitutes an irrevocable obligation to make the payment. In order to achieve this, the buyer must give up its rights to stop payment if goods are faulty, although it may retain the right to claim against the seller.

As will be seen below the potential for using electronic negotiable instruments has the ability to increase receivables financing and introduce more investors to receivables finance.

Similarly, the timing and likelihood of a payment will affect the value of the receivable from a financing point of view. A financer may well be prepared to finance a seller who needs time to produce the product being sold and then further time to transport it to the buyer. The financer will look at the time from production to the time the buyer is obliged to pay and calculate the cost of financing that receivable and its value at various times until payment is due. By contrast, a seller who produces an invoice which states payment is due in, say, 30 days has a more valuable receivable.

How can a receivable be financed?

Once the quality of the receivable is ascertained, the question of how to finance it becomes simpler to answer. Where the receivable has not become an unconditional payment obligation, certain types of financing may not be available. For example, a financer may not want to purchase a receivable, or find a purchaser for that receivable, where the seller has to perform further actions to turn the receivable into an unconditional payment obligation. Whether the financer is taking any performance risk on the seller is a key element to consider in financing a receivable.

Once a receivable becomes an unconditional obligation of the buyer, then the credit risk of the buyer is the main issue to consider. In many ways, this is a more quantifiable risk.

Copyright© 2021 Deutsche Bank AG, Sullivan & Worcester UK LLP and the International Trade & Forfaiting Association (ITFA). All rights reserved.

Excerpts from the text of the Guide, updated by Geoffrey Wynne who originally authored the chapter ‘An introduction to receivables finance’, are reproduced with permission from Deutsche Bank AG, Sullivan & Worcester UK LLP and ITFA.

The full paper can be downloaded here.

How can receivables finance benefit my business?

Is factoring receivables a good idea for your business? Here are some of the key benefits of receivables finance:

- The receivables financier will sometimes take on the responsibility to look after your sales ledger which means more time to focus on the business

- A receivables financier will conduct know-your-customer or due diligence on clients and suppliers, in order to assess and price any possible risk of default

- Receivables discounting can also be done in a confidential manner (confidential receivables discounting), which means that your clients won’t know that you are using a discounting facility; one for consideration when it comes to reputation

- Receivables finance can also help businesses grow their trade lines and fulfil customer orders without having to worry about working capital and cash flow cycles

How can TFG help?

The TFG receivables finance team works with the key decision-makers at over 270 banks, funds and alternative lenders globally, assisting companies in accessing receivables finance facilities.

Our team are here to help you scale up to take advantage of both your domestic and international customers. We have product specialists based around the world, from automotive and vehicles, to media and data.

Often the financing solution that our clients may require can be complicated, and it’s our job is to help you find the appropriate receivables solutions for your business.

Read more about Trade Finance Global and our team.

Want to learn more about receivables finance?

Look no further! Here you can find our latest features, receivables research and trending articles in the world of accounts receivables finance. So put your feet up, and dig in to the latest thought leadership and interviews from the TFG, listen to podcasts and digest the top stories in the world of receivables finance right below.

Case Study

Receivables Finance ( Virtual Creators Inc )

Virtual Creators is a hardware start-up that is looking to expand its business. This firm sells its goods in mass quantities to online and brick & mortar retailers. They produce their goods in Shenzhen and have recently moved to a new producer in the region. Virtual Inc does not have any prior affiliation with this new manufacturer. The latter does not offer trade credit and requires immediate payment on the arrival of goods at the U.S. port.

Virtual Creators keeps its gross margins fixed at 40% at wholesale to their retail buyers. However, the retailers do not pay before the end of 60-day period after getting the product. Virtual Inc depends upon receivables finance to generate the cash required for the immediate payment that its manufacturer needs upon the arrival of goods at the U.S. port.

Get started – talk to our team

If you have an invoice finance enquiry, please use the contact form.

Otherwise, you can reach us on the email addresses below.

Trade Finance Global

- 201 Haverstock Hill

- Second Floor

- London

- NW3 4QG

Telephone: +44 (0)203 865 3705

FAQ

Our trade finance partners

- Receivables Finance Resources

- All Receivables Finance Topics

- Podcasts

- Videos

- Conferences