Supply Chain Finance | 2025 Supply Chain Finance (SCF) Guide

The above Supply Chain Finance techniques have been defined by the Global Supply Chain Finance Forum (BAFT, EBA, FCI, ICC and ITFA)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Supply Chain Finance | 2024 Supply Chain Finance (SCF) Guide

Welcome to the TFG Supply Chain Finance (SCF) and Payables Finance hub. Find out about how we help corporates and large businesses access supply chain finance programmes, or keep up to date with the latest research, information and insights on supply chain finance.

What is Supply Chain Finance?

Supply Chain Finance (also known as SCF, payables, reverse factoring and supplier finance), is a cash flow solution which helps businesses free up working capital trapped in global supply chains. Supply Chain Finance has recently been defined as a much broader category of trade financing, encompassing all the financing opportunities across a supply chain. Notwithstanding, the product is still very much seen from a narrower perspective, where its key feature is that it is buyer/debtor driven. In such a case, a buyer approaches its financial provider for the establishment of a receivables discounting line for its suppliers to use and discount the invoices they issued to that buyer.

It is a solution designed to benefit both suppliers and buyers; suppliers get paid early and buyers can extend their payment terms. This solution allows businesses which import goods to unlock working capital as well as reduce the risk associated with buying goods in bulk and/or transporting them globally. SCF is generally defined as ‘an arrangement whereby a buyer agrees to approve his suppliers’ invoices for financing by a bank or other financier’.

The term Supply Chain Finance (SCF) is often also referred to as

- Supplier Finance

- Payables finance

- Supplier payments

- Approved payables finance

- Reverse factoring

- Confirming

Given that there are no ICC rules for SCF (like there are for Letter of Credit or Incoterms), it’s often up to each provider to decide what they call it.

Despite the publishing of the ‘Standard Definitions for Techniques of Supply Chain Finance‘ by the International Chamber of Commerce in 2016, the definition is not yet widely adopted and providers of SCF often use various terms to describe their product offerings.

Receivables finance on the other hand, is well defined as ‘the purchasing of receivables or invoices from a seller, with or without recourse’.

In order to address some of the common issues and misunderstandings around SCF, we have put together this short guide.

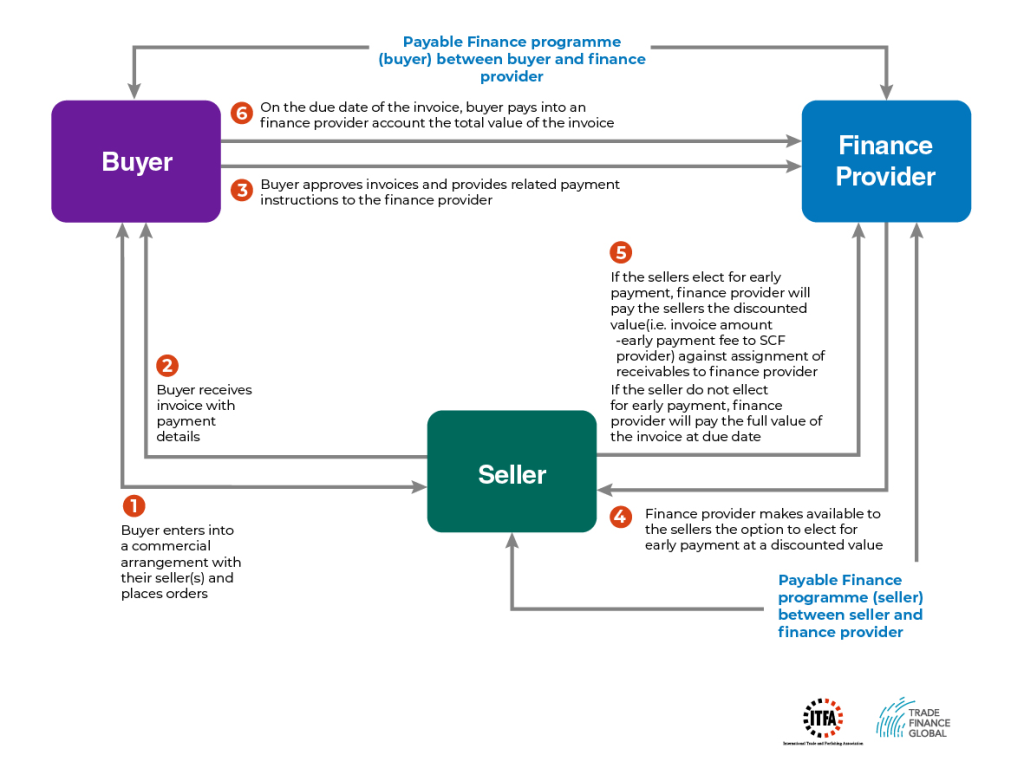

Diagram: How does Supply Chain Finance work?

How can Supply Chain Finance benefit my business?

SCF is a very efficient way to underpin the stability of a Buyer’s supply chain and market reach vis-a-vis its suppliers, allowing it to benefit from better credit terms and streamlined invoice payment procedures (supply chain finance tends to be made available through online platforms). It is also very beneficial to suppliers, as it allows them to shorten their receivables cycle and therefore reinvest their operational cash-flow at a faster pace. The advantages also tend to include financing in better terms for both parties, as suppliers don’t need to take out financing under their own credit lines and may benefit from their clients’ access to credit at lower rates, and buyers may get credit from their suppliers at a lower cost than that of taking out a loan.

Benefits to buyers/ importers

- Buyers can maintain a healthy balance sheet

- Buyers maintain a good relationship with suppliers

- Promotes competition/ diversity in suppliers

- Allows buyers to make purchases in bulk to save costs

- Buyers can work with complex end-to-end supply chains

- SCF doesn’t disturb existing bank relationships or overdrafts

Benefits to suppliers/ exporters

- Suppliers can get paid earlier than their usual 30-day credit terms

- Little financial risk – insurance is sorted through a supply chain financier

- Doesn’t cost the supplier any extra

- Allows supplier to have the cashflow to work on numerous deals simultaneously

- Helps provide liquidity and reduces financing costs

How can we help?

The TFG supply chain finance team works with the key decision-makers at 270+ banks, funds and alternative lenders globally, assisting companies in accessing trade & supply chain finance.

Our international team are here to help you scale up to take advantage of trade opportunities. We have product specialists, from machinery experts to soybean gurus.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate trade finance solutions for your business.

Read more about Trade Finance Global and our global team.

Get started – talk to our team

Contact Information

If you have a supply chain finance enquiry, please use the contact form.

Otherwise, you can reach us on the email addresses below.

Trade Finance Global

201 Haverstock Hill

Second Floor

London

NW3 4QG

Telephone: +44 (0)203 865 3705

Want to learn more about Supply Chain Finance?

Look no further. We’ve put together our feature trade finance insights, research and articles, and you can catch the latest thought leadership from the TFG, listen to podcasts and digest the latest in international trade right here.

Supply Chain Finance – Frequently Asked Questions

Our trade finance partners

- Supply Chain and Payables Finance Resources

- All Payables Finance Topics

- Podcasts

- Videos

- Conferences