Trade Finance Introduction

This content was produced in conjunction with ITFA.

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Welcome to the TFG Trade Finance hub. Find out how we can help you access trade finance to increase your cross-border imports and exports, or learn about trade finance through our latest research, information, and insights here.

What is trade finance?

Trade finance is the financing of goods or services in a trade transaction, at any point from a supplier all the way through to the end buyer.

Managing cash and working capital is critical to the success of any business, and trade finance is a tool that can be used to unlock capital from a company’s existing stock, receivables, or purchase orders.

In turn, trade finance allows businesses to offer more competitive terms to both suppliers and customers, by reducing payment gaps in a business’s trade cycle.

Put simply, trade finance helps to facilitate the growth of a business and is a powerful driver of economic development.

The World Trade Organization (WTO) estimates that up to 80% of global trade uses trade finance, and in 2020, the International Chamber of Commerce (ICC) put the value of the global trade finance industry at $9 trillion.

Financial institutions support international trade through a wide range of products that help traders manage their international payments and associated risks, and cater to working capital needs.

Trade finance deals typically involve at least three parties: an importer (buyer), an exporter (seller), and a financier.

These deals differ from other types of credit products, and should have the following features:

- An underlying supply of a product or service

- A purchase and sales contract

- Shipping and delivery details

- Other required documentation (e.g. certificates of origin)

- Insurance cover

- Terms and instruments of payment

Trade finance is an umbrella term that can refer to a variety of financial instruments used by importers and exporters.

These include:

- Purchase order (PO) finance

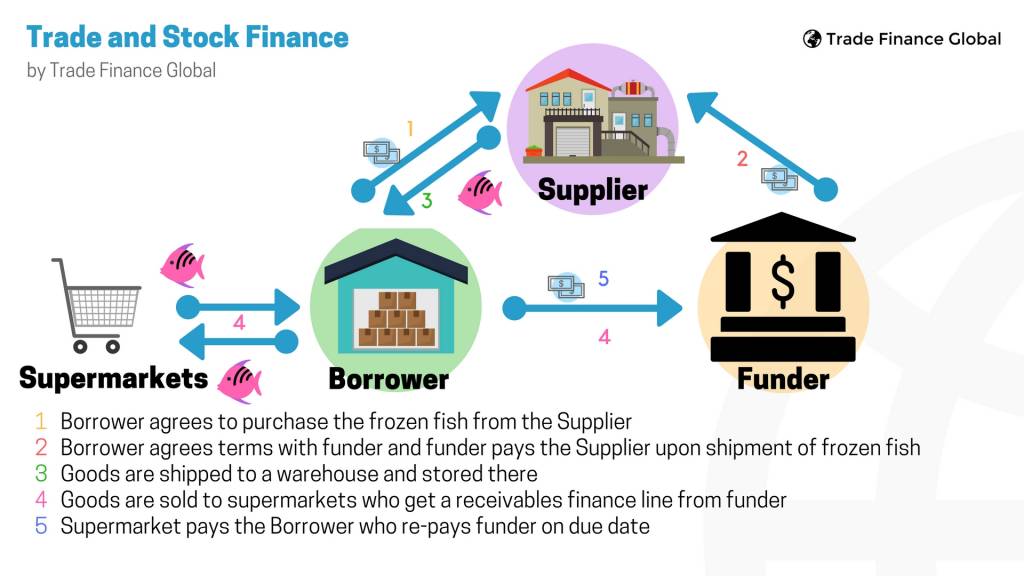

- Stock or warehouse finance

- Structured commodity finance

- Invoice and receivables finance (discounting and factoring)

- Supply chain finance (also known as payables finance)

- Letters of credit (LCs)

- Bonds and bank guarantees

The terms import finance and export finance are also used interchangeably with trade finance.

What are the main benefits of trade finance for companies?

Trade finance helps businesses grow by guaranteeing or providing finance to help them to buy goods and stock, which is often necessary when they don’t know or trust other parties in the supply chain.

Many companies use trade finance because it helps them unlock capital from their stock or receivables, which can then be used to finance future growth and development.

Similarly, using trade finance allows businesses to request higher volumes of stock or place larger orders with suppliers, leading to economies of scale and bulk discounts.

A trade finance facility may allow you to offer more competitive terms to both suppliers and customers, by reducing payment gaps in your trade cycle.

It is therefore beneficial not only for business growth, but also for supply chain relationships.

It also increases the revenue potential of a business, as earlier payments may allow for higher margins.

Managing cashflow and working capital is critical to the success of any business, which require reducing metrics such as days payable outstanding (DPO) or days sale outstanding (DSO).

Who benefits from trade finance?

SMEs, large corporations, and even governments use trade finance to achieve a range of growth goals.

This could include increasing the size and scope of the goods and services they trade in, scaling up their global operations, or helping them fulfil large contracts.

SMEs can benefit because trade finance focuses more on the trade itself rather than the underlying borrower.

This means that small businesses with weaker balance sheets can use trade finance to trade larger volumes and work with end customers that have stronger balance sheets and credit ratings.

The embedded risk mitigants that surround trade finance lending promote greater diversity in a trader’s supplier base, leading to increased competition and efficiency in markets and supply chains.

Companies can further mitigate business risks by using appropriate trade finance structures.

Since late payments from debtors, bad debts, excess stock, and demanding creditors can have detrimental effects, businesses can use external financing or revolving credit facilities to ease this pressure by effectively financing trade flows.

How can we help?

The TFG team works with the key decision-makers with over 300 banks, funds and alternative lenders globally, assisting companies in accessing trade & receivables finance.

Our international team are on hand to help you scale up to take advantage of trade opportunities. We have product specialists, from machinery experts to soybean gurus, as well as geographical specialists.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate trade finance solutions for your business.

Read more about Trade Finance Global and our global team.

Trade finance frequently asked questions

Want to learn more about trade finance?

Look no further! We’ve put together our feature trade finance insights, research, and articles, and you can catch the latest thought leadership from the TFG, listen to podcasts and digest the latest in international trade right here.

Our trade finance partners

- Trade Finance Resources

- All Trade Finance Topics

- Podcasts

- Videos

- Conferences

- Products we finance