Construction Finance (SIC 41201)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedBenefits

- No security or directors guarantee required

- Supply chain finance available even if the banks refuse finance

- Our partners find you solutions to increase trade

- Fast turnaround – get construction finance in less than 24 hours

Contents

Construction Finance

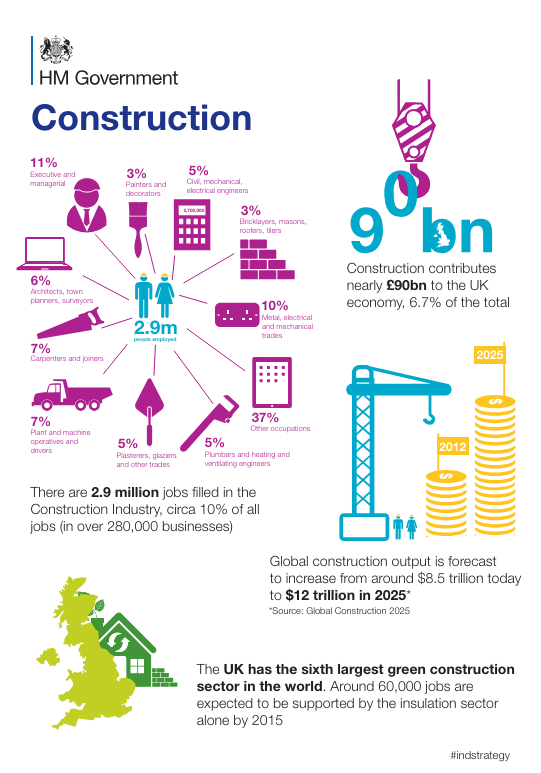

The global construction market is predicted to grow by over 75% in the next 10 years, offering large opportunities for UK businesses operating in this sector. Construction contributes nearly £90bn to the UK economy, which is 6.7% of the total. The UK government also supports growth in the UK construction industry – it’s a huge opportunity, which already fuels 2.9 million jobs.

At Trade Finance Global, our team can not only assess and advise your business, but also suggest the most appropriate financing mechanism, working with expert funders and financiers to help bridge the gap in your supply chain. Construction finance is often difficult and time consuming to obtain, especially for tradesmen or businesses which need to tender for large building contracts.

Examples of construction finance:

‘Construction 2025’ infographic:

- Servicing a sizeable building contract as a micro or small enterprise

- Importing building or construction materials

- Procurement of aggregates as a supplier to the construction industry

- Purchasing specialist construction equipment through asset backed lending

- Providing working capital or cash advances for a building project

- Invoice discounting or invoice factoring for construction projects

Trade credit in the UK construction industry is undercapitalised and relies heavily on importing raw materials. Debtor days, on average, are around 20% longer in the construction (according to some recent research by BIS), meaning that the need for cash flow solutions in this sector are important.

Products financed

Key construction finance includes:

- Raw materials

- Cement

- Aggregates

- Bricks and mortar

- Concrete

- Asphalt

- Outside of leasing and hire purchase, we can also work to provide asset refinancing for your current assets.

Construction Finance Requirements

- Your business is looking for £100k – £5m in supply chain finance

- You want to purchase stock and have customers/ buyers

- Your business is creditworthy

How the transaction works

When a customer wants to finance construction projects or materials, we will assist in creating a financing solution at the best rate that is based on your businesses circumstances. This is then repaid over time.

What is the SIC Code for Trade Finance for Electronic Data?

SIC Code

41201

Construction of commercial buildings

Other SIC Codes that could also be used are:

- 41202 Construction of domestic buildings

- 42110 Construction of roads and motorways

- 42120 Construction of railways and underground railways

- 42130 Construction of bridges and tunnels

- 42210 Construction of utility projects for fluids

- 42220 Construction of utility projects for electricity and telecommunications

- 42910 Construction of water projects

- 42990 Construction of other civil engineering projects n.e.c.

Case Study

Building Services Provider

The company based in Merseyside provided plastering, painting and interior decorating facilities to housing developers around the country. The construction finance facility provided through Trade Finance Global meant that the company had capital to grow and win contracts from blue-chip companies.