Invoice Finance US- Factoring & Discounting from TFG

Access payables, receivables and supply chain finance

We assist companies to access supply chain finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

US Invoice Finance

Welcome to TFG’s US invoice and receivables finance hub. Find out how our team can help your US-based company unlock working capital from domestic and international invoices, on both a recourse and non-recourse basis. Alternatively, learn more about the different types of invoice finance: discounting and factoring, through our latest research, information and insights, right here, in our receivables finance hub.

What is invoice finance?

Invoice finance is a common form of business finance where funds are advanced against unpaid invoices prior to customer payment. Invoice finance houses include banks, alternative investment providers and private lenders, used by businesses who trade both domestically and globally. There are two types of invoice financing methods; discounting and factoring.

How can invoice finance benefit my business?

- The invoice financier will sometimes take on the responsibility to look after your sales ledger which means the business owner can have more time to focus on the business

- An invoice financier will conduct due diligence (including credit checks) on customers, which reduces the risk of not receiving funding

- Invoice discounting can be done on a confidential arrangement, which means that your customers will not know that you’re using a finance house; this can help protect your reputation

- Invoice finance allows you to maintain a good relationship with your customers, as you can fulfill larger orders on time without worrying about cash flow and working capital problems

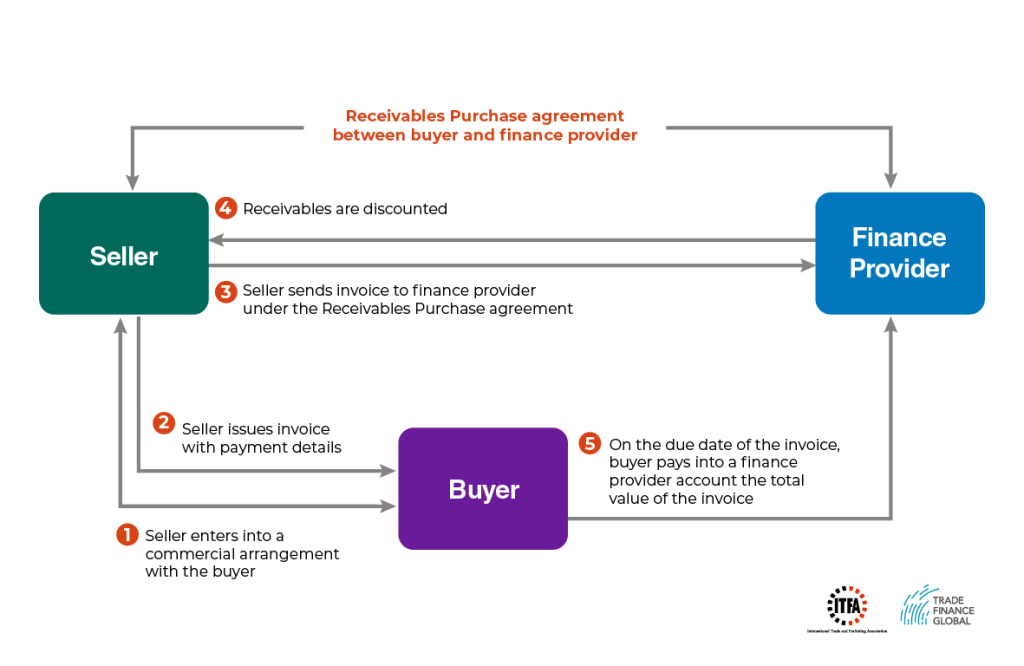

Diagram: How invoice finance (receivables purchase) works

How can we help?

The TFG’s US invoice and receivables finance team work with the key decision-makers at 270+ banks, funds and alternative lenders globally, assisting companies in accessing factoring and discounting facilities.

Our team are here to help you scale up to take advantage of both domestic and international opportunities. We have product specialists, from commodities to finished goods.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate invoice finance solutions for your business.

Read more about Trade Finance Global and our US team.

If you have an invoice finance or receivables enquiry, please use the contact form below.

Finance Queries:

us.team@tradefinanceglobal.com

trade.team@tradefinanceglobal.com

Partnership Queries:

introducers@tradefinanceglobal.com

Find out more about partnering with us here.

Want to learn more about Invoice Finance?

You’ve come to the right place. Here you can find our latest US features, receivables research, and trending articles in the world of invoice finance.

Sit back, and catch up with the latest thought leadership and interviews from the region, listen to podcasts and digest the top stories in invoice and receivables finance right below.

FAQ

Local Authors

Local Partners

- All Topics

- United States Trade Resources

- Export Finance & ECA Topics

- Local Conferences