Onboard Bill of Lading

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

Onboard Bills of Lading: An Overview

Simply put, onboard bills of lading signify that goods have been loaded onto a cargo ship.

Technically, it is a document released by the goods carriers to their clients that serves as a confirmation of the cargo they have received.

Onboard bills of lading are used by the global trade community to ensure the safe transfer of payment and merchandise to the exporters and importers respectively.

Considered one of the most important documents in world trade, the bill of lading is proof of the traded merchandise being transferred or transported.

Different types of Onboard bills of lading

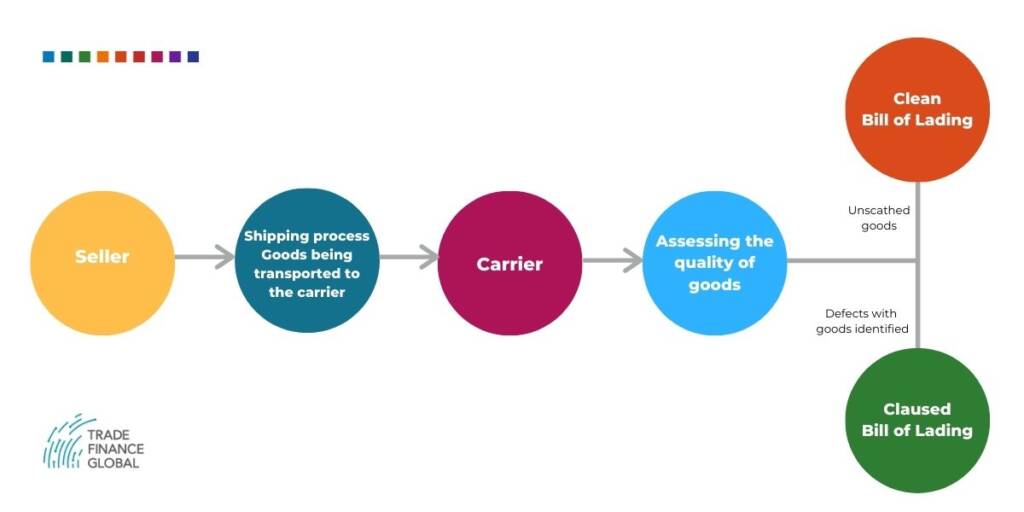

Once the goods are received by the carrier, the condition of the goods is analyzed before preparing the onboard bill of lading.

If the quality of the goods is not up to the mark, the carriers add a clause to the onboard bill of lading signifying that the received goods were not in a good condition when they were received.

On the other hand, the goods that pass all the quality tests are given a clean bill of lading.

The diagram below sums up the entire process.

Clean onboard bill of lading

A clean bill of lading is the desired outcome for the sellers because once it is issued, they no longer have to worry about the quality of the goods.

This is because immediately with the release of a clean bill of lading, the responsibility of maintaining the quality of goods falls on the shoulders of the carrier.

Not only is it their desired outcome, but a clean bill of lading is also very important for sellers to obtain in cases where banks have guaranteed to pay the seller for goods, as the contract is formalized in the form of a ‘letter of credit’.

Banks also reserve the right to demand a clean bill of lading as a pre-requisite to finalizing the deal, thereby making it necessary for the sellers to obtain one.

Claused onboard bill of lading

Carriers have the right to inspect the goods thoroughly before issuing an onboard bill of lading, and meticulous checking may reveal defects with the cargo.

If such is the case, then contractors have the right to add a clause to the onboard bill of lading.

This is supposed to be a red flag for the sellers as it shows that the goods do not fit the description that has been provided.

The clause saves carriers from the buyer’s claims and the blame for poor handling of goods does not fall on them during the delivery phase.

It is the carrier’s choice to add additional remarks to specify the defect such as ‘decaying goods’ and ‘damaged cargo’.

However, this is only an acceptable practice when the carrier and the booking party have agreed upon the claused onboard bill of lading.

It is possible for the bank funding the deal to reject the claused bill of lading as the shipping documents have to be prepared according to the demands of the bank.

Shipping documents are considered evidence of the deal.

What is the purpose of Onboard Bills of Lading?

There are only a few countries where freight charges have to be documented on the bill of lading.

There are numerous purposes for onboard bills of lading such as the ones listed here:

- It acts as a document of title, allowing for the sale of goods in shipment and also the boosting of financial credit.

- Now considered as a document of title by many local and global systems, onboard bills of lading authorize the relevant person to make delivery to the possessor.

- Quite understandably it keeps track of the terms and conditions under which the transportation of goods has been carried out.

- Also, serves as proof of payment and shows that the carrier has received the product in good condition and according to the terms and conditions laid out in the contract.

- All Topics

- Key Terms

- Incoterms Resources

- Podcasts

- Videos

- Conferences