Shop Talk: We heard from BCG’s Sukand Ramachandran on the consequences of trade wars and Brexit for global trade, and what this could mean for 2020. Will there be a downturn or disruptive shock, or will innovation and new capital help trade in the next 12 months?

In this 2020 interview series, TFG spoke to 20 experts in trade, receivables and supply chain finance.

An Interview with BCG

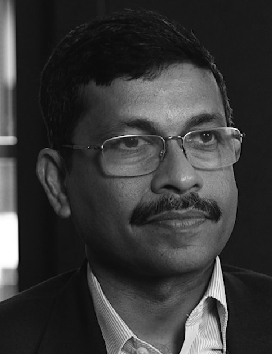

Name: Sukand Ramachandran

Position: Managing Director and Senior Partner

Organization: BCG

Interviewed by Nikhil Patel (NP), Analyst, Trade Finance Global

The Global Interplay: Geopolitics, Trade and Technology

Nikhil: In 200 words, what were the key highlights and opportunities of 2019 from an industry perspective in trade, receivables and supply chain finance?

2019 was a year where there was significant increase in geopolitical risk, be it alignment on progress in NAFTA, US-China tariffs, US-Europe challenges around airlines and other sectors or material local challenges in Latin America, amongst others. In the UK, a lack of clarity on Brexit created significant uncertainty in terms of investment and supply chains, which introduced risks into the ecosystems.

Global trade slowed down as a consequence (though still growing at 1.5-2%) and there is an overhang of potential downturns after the longest US expansion on record since the major depression a century ago.

Innovation continued in the local market, with more players providing services into the receivables and supply chain financing market – both from the major banks, specialists like Bibby but also various startups like Iwoca.

Globally, the SME financing gap only continued to rise and as there are disruptions in the market (be it trade tariffs or downturns) more and more challenges will arise around that.

Various ecosystems of banks and fintechs have continued to build out solutions in the market, including announcing real live transactions on blockchain, but these have tended to be a very small proportion of volumes in the market.

ICC announcing that in 2020 they will focus on defining standards to help digitization in trade will only support the acceleration and inter-operability of various innovative solutions in the market.

Digital Ecosystem within BCG – Seeing beyond the technology – A Trade Finance Talks TV interview with BCG

NP: What are your top predictions for trade, supply chain and receivables in 2020?

With the current state of geopolitics and going into an election year in the US, the one thing we can expect is more uncertainty and risks introduced into the global trade supply chain.

Many markets could be looking at the start of a (hopefully small) downturn given the significant period of expansion, which will introduce more risks into the world of trade and trade finance.

Innovation will continue as part of a structured, conservative journey, including improvement and alignment on standards, more interoperability and better adoption of common protocols and tools.

Unless there is a disruptive shock, we expect trade to grow but possibly at sub-GDP growth levels (e.g. 0.5-1.5% growth), with various corridors shrinking while others will grow. SME financing will continue to be a challenge given this context.

Regulations on capital and compliance as well as IBOR transitions will distract and occupy many executives mind in 2020.

We expect the sustainability of supply chains and meeting climate goals to occupy a lot of airtime in the coming months – that will be the significant shift we see in 2020!

2020 Predictions in Trade and Supply Chain Finance – A BCG Perspective

NP: In 200 words, what are the biggest challenges in trade, receivables and supply chain finance you predict for 2020?

- Geopolitical shocks

- Risk of downturn

- SME financing

- Sustainability as a topic

NP: What are the key priorities for BCG in 2020?

Being more relevant to our clients as they go through these complex transitions!

NP: What’s your top prediction for a technology that you think will truly kick off / have the most success in 2020?

Whilst all technologies are at various levels of maturity and of the hype cycle, they will all make progress and be increasingly adopted by players to drive internal and inter-connected efficiencies in trade supply chains

Podcast: Sukand Ramachandran , From Mesopotamian Tablets to 2020: A BCG View on Trade Finance Ecosystems

Read our trade finance 2020 predictions here

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.