Sports Receivables Finance (SIC 42990)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedBenefits

- Fulfil large orders and differentiate your product offering

- Grow your existing business by investing in profitable ventures

- Service new customers to expand into new markets

Content

Sports Receivables Finance

Sports receivables finance is now a common practice in the world of sports and entertainment. Modern-day commercialisation has transformed sports into an industry, and like any other industry, the sports sector needs viable financial solutions to thrive.

For example, Football is one of the most popular sports in the world. However, it is a known fact that football clubs are run more like a business nowadays. Not many pay attention to how these football clubs work when it comes to finances.

You may hear about sports clubs worth millions, but they are not immune to financial challenges, such as inadequate cash flow. Therefore, these clubs rely on available financial tools to maximize their output, both on and off the pitch. Receivables finance is one option that has become prevalent in the sports business in recent years.

Receivables Finance: An Overview

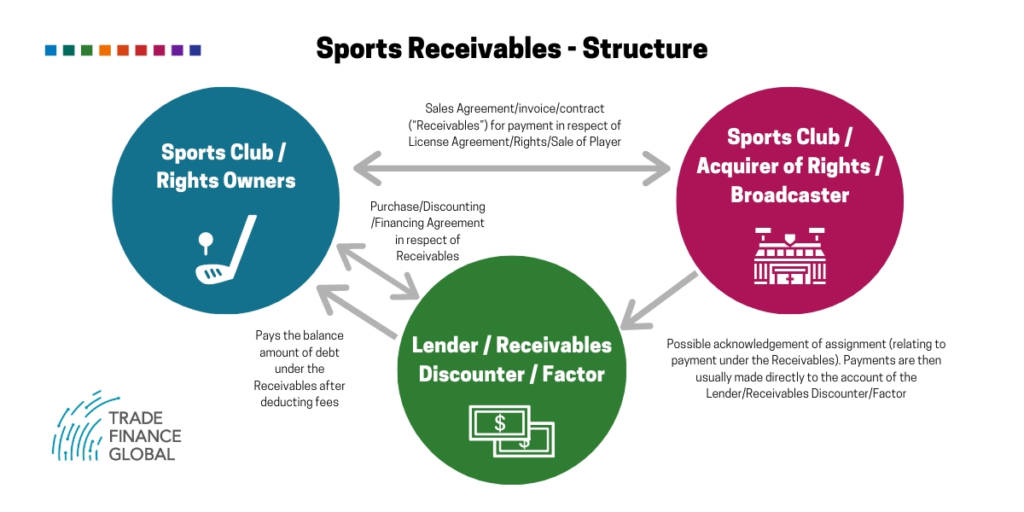

Receivables finance encompasses different financing modules. One of them involves a company (in this case, a sports club) selling receivables to a financer or a bank at a discounted rate. However, in exchange, the sports club gets immediate access to the credit facility. It allows the club to utilize cash funds made available by the bank or alternative financier well before the receivables actually fall due.

Think of it as an advance payment for a service or a player transfer, etc. For example, in the English Premier League, a football club sells a player to another club after the season ends. However, they will not have the money until the transfer happens, and the purchasing club pays them based on the credit days provided e.g. payment falls due one year from payment date. In sports transfers, these payments are usually staggered and are typically up to two years. In this scenario, the selling club can opt to borrow. A bank or a financer will give the selling club the money with a discount based on the total value of the player. The bank will charge the sports club a fee for this service. This structure of financing is also available in relation to other obligations to pay, such as broadcasting or media rights payments.

Types of Receivables finance

There are two types of receivables financing options. However, in both cases, the aim is to provide a company with immediate access to cash for smooth operations.

- Invoice Discounting

In this case, a business sells its receivables or invoices to a financer and collects the money upfront. When the receivables become due, the business will collect the money from the customer and pay the financer with a fee. Just like the example mentioned above for football clubs.

- Invoice Factoring

Where the financer not only gives the money to the business but also takes on the responsibility to collect the receivables when they become due. For example, a football club commits to transfer its player to another club after the current season ends. The supplying club will get a financer on board who will provide them the money immediately following the completion of a sales contract. The financier will then be responsible for collecting the money directly from the buying club when the funds fall due.

- Pros and Cons of Receivables finance

It is important to note that sports receivables finance is another form of debt and so there are associated costs and liabilities that come with this. Similarly, receivables finance has its advantages and disadvantages, just like any other financing structure.

Pros and Cons of Receivables finance

It is important to note that sports receivables finance is another form of debt and so there are associated costs and liabilities that come with this. Similarly, receivables finance has its advantages and disadvantages, just like any other financing structure.

Advantages

- Receivables finance is an unsecured financing option in business. You do not usually require collateral in any form, such as guarantors and other assets.

- You can retain the ownership of your business. It means when you take on financing, you do not have to worry about giving out or sharing your business ownership with the financer.

Disadvantages

- One of the biggest cons of receivables finance is its cost, like any debt product. Although it provides a sports club immediate access to cash, the financer may charge a high fee. Also, remember you will have to pay an increased amount in case of payment delays or failures within the agreed timeframe. Cost is usually related to the financial strength of both the selling and purchasing clubs.

- The agreement to finance provided by a bank or alternative financier may be quite lengthy and provide many obligations and long-term commitments. Therefore, always negotiate the length of your agreements to suit the needs of your sports club and underlying sales contract.

How the transaction works

Trade Finance Global can provide finance products and trade finance tools to maximise profits and minimise uncertainty for confectionery traders in two main ways. Firstly, conventional export factoring products secure finance for profitable ventures from a wide variety of private backers against firms’ accounts receivable. This avoids directors having to deprive their firms of funds to meet the high capital securities required by conventional commercial finance or reduce their control of the firm via extended equity sales. Second, TFG can administer a variety of trade finance tools, such as letters of credit or performance bonds, to ensure that buyers and sellers both receive the documentation and prompt payment they need to securely conduct international transactions across trade jurisdictions. This can empower buyers to negotiate discounts from suppliers who can expect to receive payment quickly and securely, whilst maintaining the consistent, timely flow of receivables critical to trading firms’ margins and profits.

Case Study: How Receivables Financing Works for Sports?

For better understanding, here are a couple of case studies from the world of Football.

Norwich City Promotion

The ascension of the Norwich City F.C into the premier league is another classic example of how sport receivables finance can be useful.

The unexpected promotion of Canaries to the premier league brought additional liabilities along with it. According to their accounts, a total payment of £22 million for the year 2018 became payable in 2019. Plus, they had to pay an additional £1 million to Everton for Steven Naismith. Plus, the club promised all players a share from a £10 million promotion bonus pool if they secured a position in the premier league.

All this made it difficult for Norwich City F.C, as all the revenues generated by promotions, and broadcast etc. comes in installments. Therefore, they assigned their entitlement to central funds of 2019/20, to a bank. Central Funds are broadcasting monies payable by the Premier League to a football club by virtue of being a member of the league. This way, Norwich F.C managed to get the money they needed to cover immediate liabilities, and the financier will collect the money from central funds when they become due.

What is the SIC Code for Sports?

SIC Code

42990

Sports

Other SIC Codes that could also be used are:

- 41201 Construction of indoor sports facilities

- 42990 Construction of outdoor sports facilities (except buildings)

- 42990 sports and recreation grounds, laying out

- 46499 sports goods (wholesale)

- 74909 Agents and agencies in sports attractions

- 93120 sports clubs

- 93199 Other sports activities (not including activities of racehorse owners) n.e.c. and sports leagues and regulating bodies

Case Study

AFC Bournemouth and Cherries

AFC Bournemouth sold two players Lys Mousset and Tyrone Mings, to the Cherries over the summer. Cherries were to pay AFC in July 2020 and July 2021 for Mousset and Mings, respectively. The club sold the future receivables for both players to a bank and opted to borrow cash in advance.

Their aim was to use the money for the club’s development project in relation to the training ground. It also helped AFC Bournemouth to mitigate the impact of the immediate player transfer financially (having a lack of cash flow and being without a player). It shows how football clubs can use sports receivables finance to their benefit.