The metaverse could spell a watershed moment in human economic history. It will reinforce the concept of global human culture, set rules for worldwide continuous automated trading 24/7, and forever alter our understanding of trade markets.

Metaverse

The metaverse is a virtual environment that operates 24/7 just like the actual world but it is much more than a virtual world; it has its own economy, which is supported by creators and infrastructure suppliers.

Facebook recently rebranded itself as Meta and is investing billions of dollars into developing the metaverse.

Some metaverse projects, such as Sandbox and Decentraland, are already utilising metaverse concepts and providing an early view of how this largely hypothetical notion might be actualised in the coming years.

The notion of a metaverse is already in evidence: massive global markets like Amazon and Alibaba are all metaverses by definition.

The future of a single, overarching ‘universe’ – The Metaverse, if you like – will require the full integration of all marketplaces, social media, bank systems, email systems, search engines, recreational software, and any piece of data accessible online.

In this context, the metaverse is envisioned as a network of interconnected data with minimal to zero delays in data access for everyone everywhere.

This has huge implications in terms of trade.

Changing future of global trade

The metaverse will transform global trade into a far more efficient, automated process that operates 24 hours a day, seven days a week.

This will bring about both good and bad consequences for companies.

The elimination or decrease of delays in information access will level the playing field while some businesses will lose their competitive advantage from years of direct engagement with suppliers and customers.

However, it will be much easier to discover new suppliers and customers.

What does it imply for your business if you and your competitors can find a supplier from anywhere in the world at any time and have your items delivered to whatever location you want, regardless of time or date?

The flip side is that your clients will also be able to do the same!

This will be accomplished through the use of the metaverse (at the software level) and the complete automation of supply chains.

This is a procedure that has already begun at the warehouse level.

Only 20% of worldwide warehouses are fully automated at the moment, however, this number is rapidly increasing.

It is predicted that by 2023, the automation of warehouses will have grown by over 38% and by 2025, the majority of the world’s warehouses will be largely – or totally – automated and drone-operated.

Add to that the ability to work remotely – even when performing physical tasks – as well as the ability to receive goods remotely – via drones – visiting “virtual” destinations for 3D meetings, or communicating via virtual call real-life 3D video chats to conduct business and you get a clear picture of what the future of global trade will look like.

Trade finance opportunities

The metaverse will be treated as if it were a whole new territory.

Businesses from anywhere in the world will be able to engage in a single market economy without facing trade obstacles.

The metaverse’s influence on real-world trade norms, international treaties and trade sanctions is unknown currently but at its foundation, companies will be able to trade freely without regard for actual geography.

Eventually, whole trading marketplaces and stock exchanges may be constructed in the metaverse, which would open up a considerably bigger pool of investors than would ever be conceivable in the real world due to geographical and political restrictions.

This would present ripe opportunities for entities utilising trade finance to increase their clients from regional and national clients to international ones and operate on a truly global basis from the comfort of any office with a high-speed internet link and a virtual reality headset.

Blockchain technology

Blockchain is a distributed database that keeps track of a growing chain of transactions in units called blocks, each of which has a timestamp and a hash link to the preceding block to prevent manipulation.

Decentralised individuals or organisations can collaborate in a blockchain network to capture and retain data without any single entity asserting continuous market dominance or control.

The core concept behind blockchain technology is to decentralise data storage so that it cannot be manipulated or controlled by a single party.

The use of blockchain technology enables the digitisation of trade finance products such as letters of credit, trade finance contracts, and trade insurance which are stored in an open ledger on the blocks themselves.

These products will be made smarter, more efficient, and also make it feasible for trade finance operations to go paperless and promptly deliver error-free smart contracts to counterparties, lowering printing and verification costs.

Challenges

As with any new form of technology, there are challenges to overcome and in the context of trade finance, the identified issues for early adopters of trade finance products in the metaverse will be primarily the lack of a standard protocol for the various blockchain networks such as Bitcoin and Ethereum.

However, the World Trade Organization (WTO) and Asian Development Bank (ADB) are working together in supporting the International Chamber of Commerce’s (ICC) Digital Standards Initiative (DSI), which aims to standardise technical and business standards in the technology.

Global markets

The metaverse currently relies on trade transactions using digital cryptocurrencies such as Bitcoin and Ethereum and these are currently seen as high risk by countries such as the US due to the lack of regulatory oversight.

In 2021 the US moved a step closer to regulation by approving a document providing “preliminary conclusions” on the cryptocurrency industry.

Currently, risk can be mitigated for entities trading on the metaverse by transacting with asset-backed stable coins like Pax Gold or Tether, which are cryptocurrencies that peg value at par with assets like gold, or fiat currencies such as the US Dollar.

There are currently 80 countries including the US and UK that have Central Bank Digital Currency (CBDC) projects underway and it is predicted that from 2025, the metaverse money markets will be super boosted once these countries launch their respective currencies.

Retail

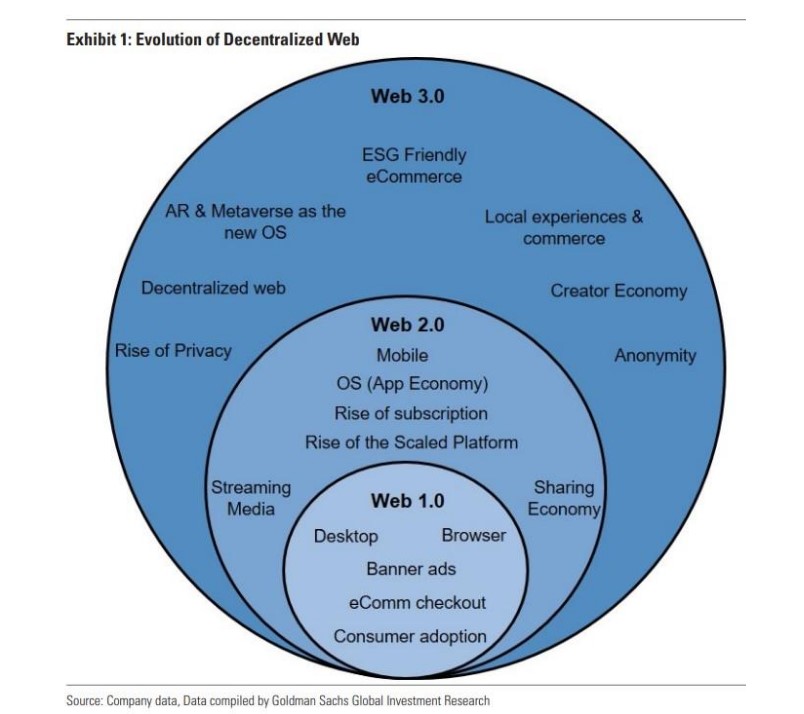

A recent report by Goldman Sachs titled “Framing the Future of Web 3.0” in Dec 2021, noted that the “metaverse will be an interoperable environment that allows users to move virtual assets with ease”.

This stands in contrast to the large-scale walled platforms currently in Web 2.0, requiring users to work within the limits of a particular application.

While these so-called ‘walled gardens’ have allowed companies like social media platforms to collect vast amounts of data, and innovate and improve their products, the experience ultimately disadvantages consumers (by limiting them to operating only within each respective ecosystem) and developers (by forcing them to develop for multiple devices and operating systems).

To operate within a unified metaverse, Goldman Sachs reported that many large-scale platforms will therefore need to disrupt their current business models.

Failing to plan means planning to fail

The old adage “if you fail to plan, you are planning to fail” by Benjamin Franklin bodes well for entities planning to take advantage of the vast trading opportunities that will be plentiful in the metaverse.

In this respect, it will be wise to form early relationships with trade finance professionals who will have experience and specialist knowledge of the requirements of the global metaverse platforms.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.