Payables Finance

The above Supply Chain Finance techniques have been defined by the Global Supply Chain Finance Forum (BAFT, EBA, FCI, ICC and ITFA)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

The GSCFF defines payables finance in its 2016 Standard Definitions for Techniques of Supply Chain Finance as “a buyer-led programme within which sellers in the buyer’s supply chain are able to access finance by means of receivables purchase”.

As such, if the seller elects to be paid earlier than the buyer’s standard terms of engagement, this technique “provides a seller of goods or services with the option of receiving the discounted value of the receivables (represented by outstanding invoices) prior to their actual due date”. The cost of such a program to the supplier is aligned with the credit risk of its buyer. The buyer, meanwhile, pays the total value of the receivable to the financier on the due date. In this context, the buyer’s creditworthiness assists the seller with improved financing conditions. Such an arrangement creates commercial benefits for both sides of the transaction.

The common deployment of an intermediary platform provides ease of use and increases automation of the process making it even more operationally efficient. This has enabled financial technology companies to offer such service in addition to medium- and large-size banks.

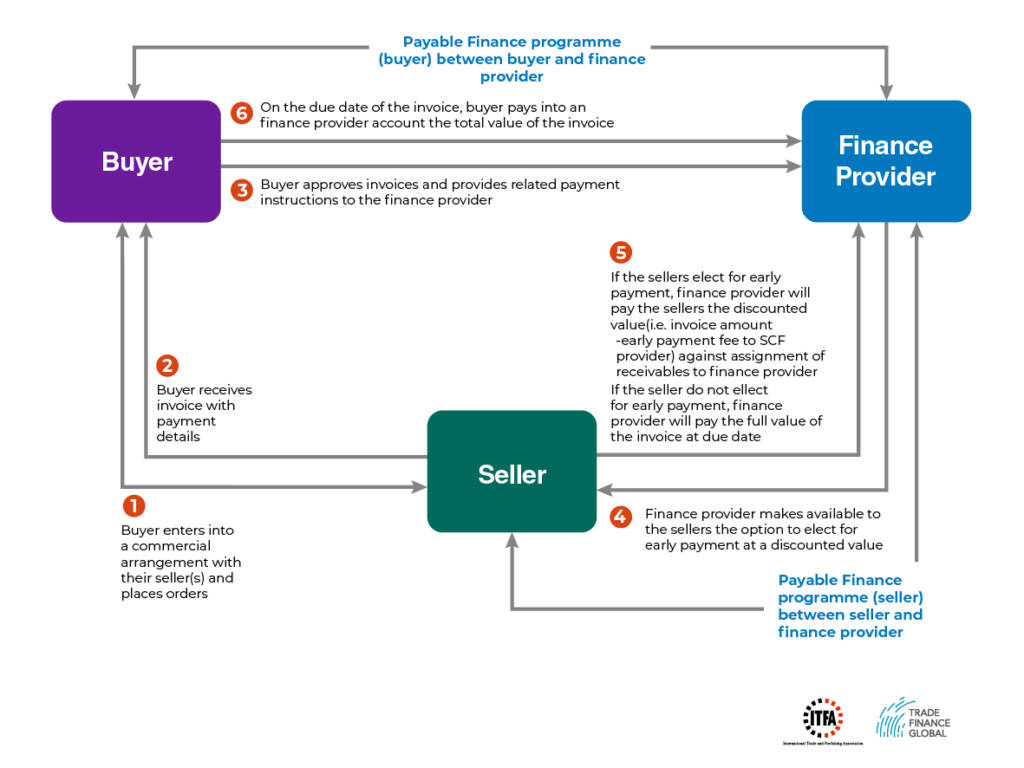

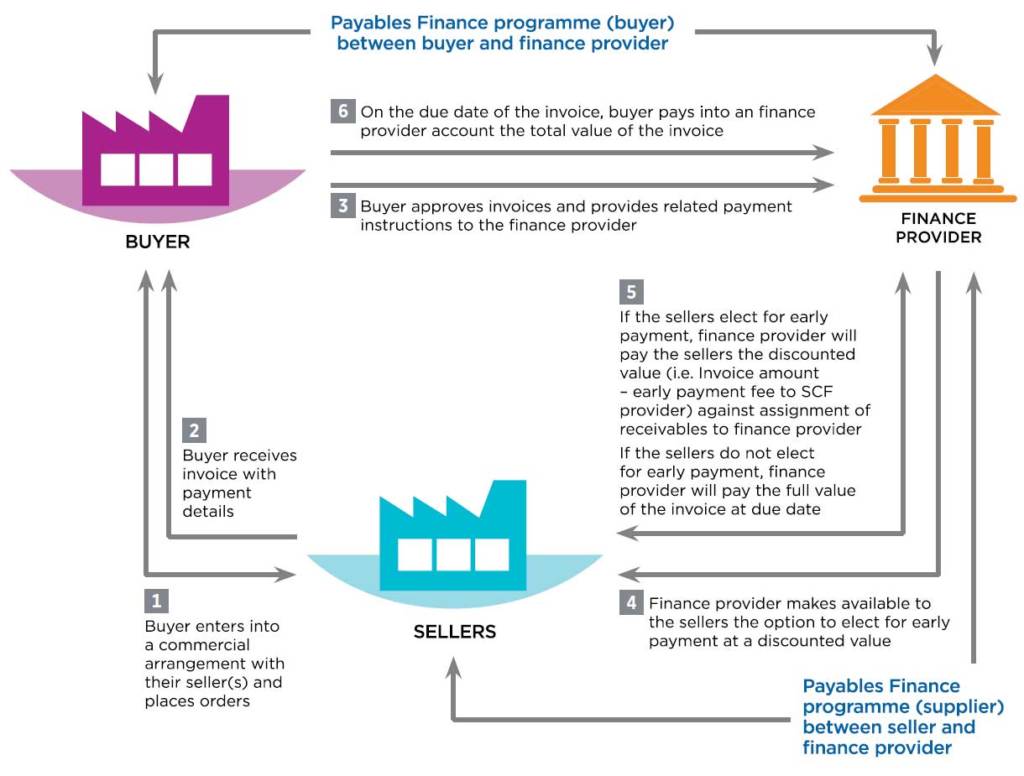

Source: Global Supply Chain Finance Forum

Diagram – Payables Finance

Payables finance – how it helps global supply chains

The supply chain finance technique of payables finance is widely regarded by the industry as a highly useful and beneficial tool for both buyers and suppliers. Payables Finance offers substantial benefits to both trading parties:

Payables Finance – for the buyer

- Improved payment and commercial terms and liquidity and working capital optimisation (see below for an explanation of the “Cash Conversion Cycle”)

- Greater supply chain stability and improved operating processes through automation

For the seller

- Alternative source of funding with reduced use of credit availability from traditional banking sources

- Lower implied cost of funding for finance raised against a stronger i.e. buyer, credit rating

- Working capital optimisation, improved cash flow forecasting and flexibility

In spite of these obvious benefits, Payables Finance has received controversial press in recent times, particularly following the collapse of certain companies that have misused it, and such misuses are of significant concern for the industry.

With this in mind, the Global Supply Chain Finance Forum (GSCFF) made up of the major global associations representing the trade finance market, BAFT, FCI the ICC, the ITFA and the EBA, would like to allay such concerns by clarifying what Payables Finance is and how it works.

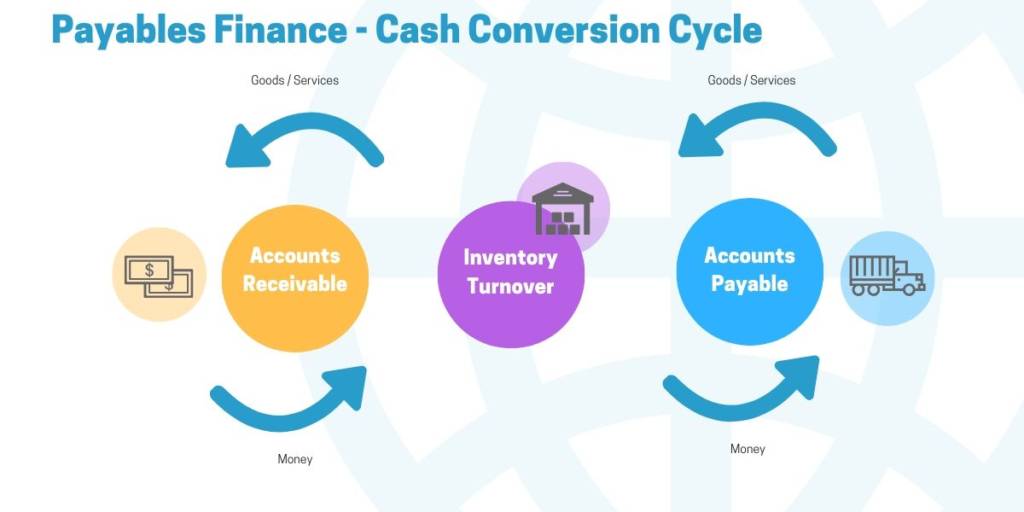

What is a Cash Conversion Cycle?

The cash conversion cycle (CCC) tracks and measures the flow of cash in a company as it is converted through inventory and accounts payable (AP), sales and accounts receivable (AR) and back into cash. This is measured by days payables outstanding (the time it takes to pay suppliers or DPO), days sales outstanding (the time between selling and being paid by buyers or DSO) and days inventory outstanding (the time to turn inventory into sales or DIO), meaning CCC = DSO + DIO – DPO.

The shorter the cycle, the more efficient a corporate’s operations, so treasurers must seek to increase DPO (extending time taken to pay outstanding invoices) and reduce DSO (ensuring incoming payments are received and processed as quickly as possible) if they are to be better able to unlock previously idle pools of liquidity. Payables Finance can help both buyers and sellers to optimize their Cash Conversion Cycle.

What are the payment terms for Payables Finance?

As governments are fully aware of the commercial impact to local economies if suppliers are paid late, payment terms between corporates – especially between large buyers and smaller suppliers are under scrutiny globally. For example, the European Commission established a regulatory framework in the form of the Late Payment Directive 2011/EU, which came into force in March 2013 and regulates commercial transactions between public authorities and businesses, and transactions between businesses. Under the directive, which is agnostic to whether a payables finance program is engaged or not, public authorities must pay for the goods and services they procure within 30 days, or in exceptional cases 60 days. Outside of the public sector, businesses must settle their invoices within 60 days, but a longer period can be agreed between the parties “providing it is not grossly unfair to the creditor”.

However, some data suggests this directive has not had the expected effect. A database called termscheck collects payment terms information in more than 184 countries and sells the data to those wishing to benchmark their own customers and supplier terms. Researchers noted that some old contracts are still in place from before the legislation came into force, while a surprising volume of suppliers are placed on immediate terms. This varies by industry and region, with 2017 figures citing 42% of Italian suppliers on up 60 days and 73% of suppliers in Finland below 15 days, for example. On a global scale, average payment terms range from 18 days in South Asia to 39 days in the African continent.

Increased governmental attention

Around the world, the power balance between small suppliers and large buyers is under scrutiny by governments. For example governments in Australia, the United Kingdom and the Netherlands have either passed new regulations, recommended new working practices or begun to look into the effect of payables pro-grammes on SMEs. Governmental action is also supportive of such programmes: the EU Commission, for example, has begun a comprehensive analysis of the market to identify and help overcome barriers to SCF growth whilst also establishing best practices.

In this context, payables finance is one of a number of tools the buyer can use to support its ecosystem of suppliers. Suppliers play a critical role in a buyer’s supply chain, and, as such, it is in their interest to support them . As highlighted herein, Payables Finance programmes are a very concrete way of doing so.

Accounting Treatment of Payables Finance

Accounting Treatment of Payables Finance

Accounting treatment Because of questionable practices by a few identifying certain transactions as supply chain finance rather than loans, the accounting treatment of trade payables is under increased scrutiny. Trade payables by nature are short term. If a buyer borrows to settle its trade payables, this will be reflected as bank debt. However, if the same buyer develops a payables finance programme for its suppliers, the trade payables may remain as trade payables on its balance sheet if certain criteria are met.

While there is no exhaustive list of criteria to minimize re-characterisation or clear guidance , it is useful to highlight some key criteria that have been mentioned as relevant in this context:

Criterion for Payables Finance

- There should be no triparty agreements. Rather there must be separate contractual agreements between the buyer and its bank as its paying agent as well as between the suppliers that join the program and the bank or another entity providing payment under the contractual relationship between the bank and the supplier

- The commercial purpose of the Payables Finance program should be to support the buyer’s suppliers in obtaining affordable credit

- The payment terms agreed between the buyer and its seller should remain unchanged after establishing a program or be in line with industry norms

- The payment terms should apply across a buyer’s supplier base independent of whether a supplier opts into a Payables Finance program

- The buyer should irrevocably agree to pay its obligation on the agreed invoice maturity date.

- The finance provider should have no greater surety of being paid for the purchased invoices than from the invoice purchase itself rather than having an additional confirmation, obligation or guarantee from the buyer itself or a third party to be paid

- The financing conditions for the purchase of invoices should be exclusively negotiated between the Finance provider and the supplier without any intervention from the buyer

- A seller’s invoice should usually be assigned to a finance provider rather than extinguished by e.g. novation of the invoice

- The fee or interest pertaining to the purchase of the invoices should be fully paid by the supplier to the finance provider

In recent years, rating agencies have begun to place heightened levels of scrutiny on supply chain finance and its accounting practices. In 2015, using Spanish company Abengoa as an example, Moody’s reported that reverse factoring had debt-like features, Subsequently through Industry advocacy led by the ITFA, Moody’s have taken a more nuanced and balanced view.

In January 2018, concerns resurfaced with the collapse of Carillion.

Following these events in October 2018, ITFA published a report, Payables Finance – what can we learn from the Abengoa and Carillion experiences? The paper references both companies as case studies, providing an overview of considerations required to assess payables finance arrangements and calling for increased transparency from companies, as well as greater dialogue between all stakeholders to clarify methodology and best practices.

A recent publication from Moodys takes a closer look at how Payables Finance is reflected on a corporate’s balance sheet and provides three cautions of note:

- Greater Transparency: Many buyers are not required to make public their Payables Finance programs, so users of financial statements may not be aware, despite the potential material consequences

- Extension of Terms: There is a leverage impact of hidden debt like obligations where payables finance allows payments to suppliers to be stretched beyond normal commercial

- Impact on Future Liquidity: Because of the potential size of these Payables Finance programs, the cancellation of such programs can lead to a sudden working capital outflow over a short period of time, leading to a liquidity crunch.

It is important to note that Moody’s does not conclude that Payables Finance is harmful or bad for SME’s. Rather, the Moody’s publication asks for greater transparency so that its impact on buyer’s balance sheets can be assessed and properly evaluated.

Working Capital Solution – Payables Finance

While the examples of misuse of payables finance to force a supplier into accepting uncommercial payments terms are few, they are nevertheless very worrying. While such cases have been prominently highlighted in the media, they are not representative of how payables finance programs are used by the majority of buyers and sellers in mutually supportive supply chains. Payables finance – correctly implemented – continues to be used as a means for buyers and sellers to optimise their working capital, and strengthen their relationships with each other. The GSCFF acknowledges the need for buyers and sellers to continue to improve their working capital. To support this goal, the GSCFF advocates for the continued use of payables finance programmes, as they present significant benefits for all stakeholders when applied in a reasonable and appropriate manner. To help further increase awareness and understanding of payables finance, and other SCF techniques, the GSCFF is building on its 2016 Standard Definitions for Techniques of Supply Chain Finance with individual reports on each of the eight techniques. The first, on receivables finance, was published in June 2019. The second, to cover payables finance, will be released in Q1 2020.

References & Sources

With thanks to:

- Global Supply Chain Finance Forum

- BAFT

- ABE / EBA

- FCI

- International Chamber of Commerce

- ITFA

Our trade finance partners

- Invoice Finance Resources

- All Invoice Finance Topics

- Podcasts

- Videos

- Conferences