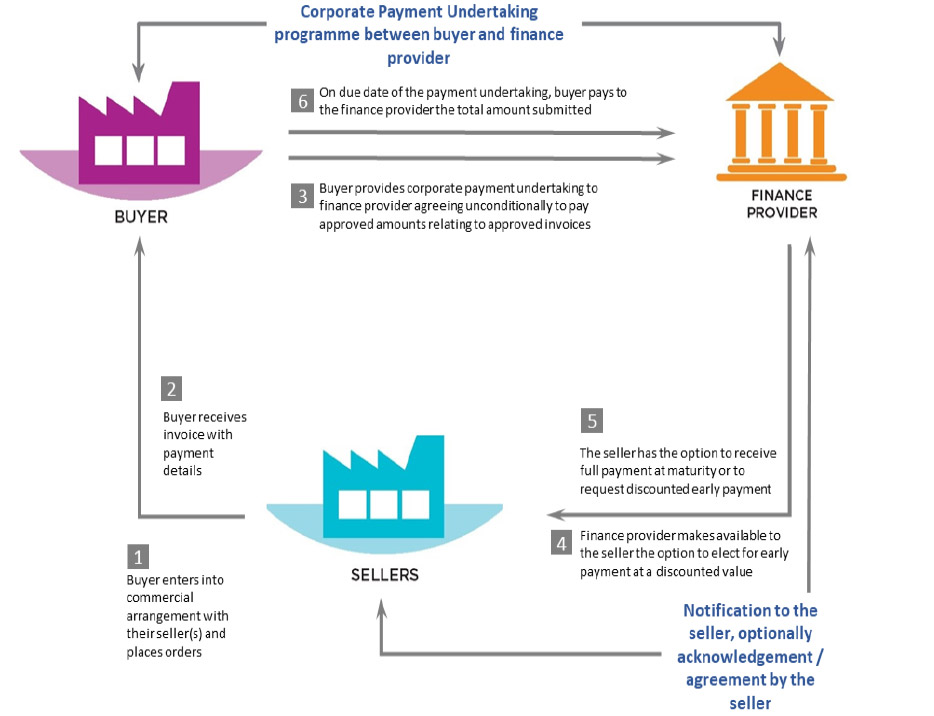

- The technique is ‘buyer-centric’ in that the buyer typically arranges a Corporate Payment Undertaking programme with one or more finance providers in favour of its sellers.

- The buyer may encourage its sellers to consider the use of this Corporate Payment Undertaking programme; the sellers however make an independent decision to participate in a Corporate Payment Undertaking programme.

- The buyer identifies invoice(s) for which it instructs (subject to agreed terms and conditions) the finance provider to pay the confirmed invoice on its due date and for which it gives the finance provider an unconditional and irrevocable commitment to pay an approved amount on the confirmed invoice due date(s).

- The seller has the option to request from the finance provider an early payment at a discount.

- The finance provider relies on the creditworthiness of the buyer and typically offers early payments of approved invoices ‘without recourse’ to the seller. Such ‘without recourse’ terminology relates to the risk of non-payment by the buyer of the approved amount at the confirmed invoice due date.

- The finance provider typically has discretion to offer early payment on terms or not (i.e. on an uncommitted basis).

- It is possible that certain elements of recourse are retained against the seller, such as for breaches of representations and warranties, but this will depend on what arrangement is put in place between the finance provider and the sellers. However, the corporate payment undertaking given by the buyer is unconditional and irrevocable and as such significant reliance on rights of recourse to the seller should not be a feature.

- The buyer will pay the approved amount at the confirmed invoice due date, such payment made directly to the finance provider pursuant to the corporate payment undertaking. If there are any commercial disputes or other dilution events between the buyer and seller, it would usually be resolved outside of this corporate payment undertaking structure (given the unconditional and irrevocable nature of the payment undertaking) although the structure may accommodate credit notes and offsets against invoices due for payment (but not yet paid).

- Approved invoice amounts that have not been paid on an early discount basis may be processed on a pay when paid basis by the finance provider – that is, finance provider being in receipt of relevant funds from the buyer to be paid on the relevant confirmed invoice due date.

Corporate Payment Undertaking | A GSCFF 2024 Guide

GSCFF defines the Corporate Payment Undertaking as a buyer-led programme within which sellers in the buyer’s supply chain can, at their option, access liquidity by means of receiving discounted early payment. Such payment to a seller covers seller’s invoices (or buyer approved amounts relating to such invoices). The technique provides a seller of goods or services (seller) with the option of receiving the discounted value as early payment of outstanding invoices (that have an unconditional approval by the buyer to pay on the due date) prior to their actual due date and typically at a discount with cost of early payment more aligned to the credit risk of the buyer.

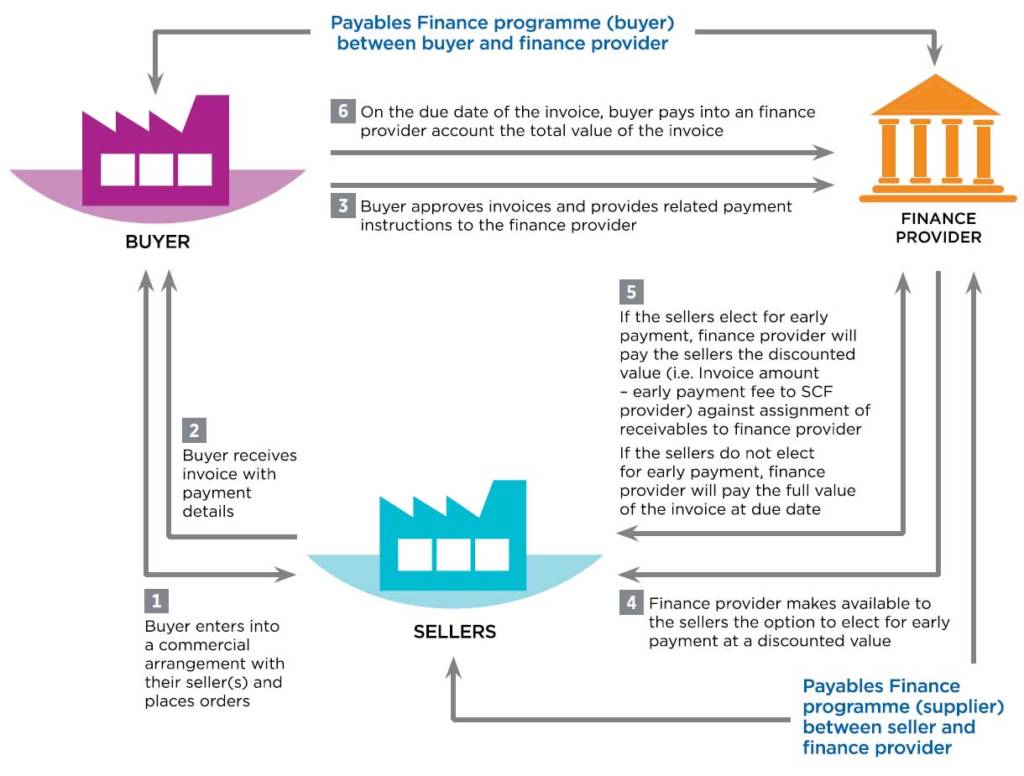

Whereas in Payables Finance the finance provider enters into receivables purchase arrangements with a seller, under a Corporate Payment Undertaking programme the early payment does not require receivables purchase but may require the seller to confirm the finance provider’s right to receive buyer payment and/or pass-through arrangements and/or acceptance as full payment of the approved invoice amount.

This SCF technique is subject to several naming conventions (consistency should be encouraged), which can overlap with Payables Finance. The Forum decided that the term Corporate Payment Undertaking is an appropriate name that captures the essence of the technique.

Source: Global Supply Chain Finance Forum

Diagram - Corporate Payment Undertaking

- The buyer will usually have established a Corporate Payment Undertaking programme with the finance provider(s) which aims to provide benefit to all or a sub-set of its sellers.

- The seller(s) and finance provider(s) will typically communicate with each other in relation to the basis for provision of early payments and on-boarding procedures, including any relevant KYC/AML and risk-based checks.

- Whilst uncommon, in some instances the finance provider may purely act on instruction of the buyer (without interaction with the seller(s)) in which case it is for the buyer to ensure seller(s) has/have sufficient information to understand and accept why the buyer has instructed the finance provider to make a discounted early payment to such seller(s).

- The key ‘trigger’ for the provision of early payments is the corporate payment undertaking given by the buyer confirming approved invoice amounts.

- Partial early payment of an approved invoice amount would be unusual.

- The process may be manual, semi-manual or automated.

- Electronic invoicing may play a vital role since it will usually accelerate invoice approval and the ability for the seller to promptly receive early payment.

- The seller has the option to receive full payment of the confirmed invoice on its due date or to request an early discounted payment.

- The buyer makes payment in full of the approved invoice amount to the finance provider at the confirmed invoice due date.

CPU – Key Parties

Buyer: the entity (finance provider’s customer) that enters into a corporate payment undertaking with a finance provider, which facilitates access to discounted early payments by the finance provider for the benefit of its supply chain. The buyer approves the invoices and submits the details of the approved invoices and amounts to the finance provider together with a corporate payment undertaking to make payment of the approved amount to the finance provider at the confirmed invoice due date.

Seller: the entity selling goods or services to the buyer which agrees or acknowledges interest in arrangements for receiving optional early payments at a discount and may agree with the finance provider that the finance provider and the buyer shall have no further obligations to the seller for the approved invoice amounts (and may confirm transfer of rights or obligations) for which early payment has been received.

- A service agreement, which could take the form of an accounts payable management arrangement, is entered into between the finance provider and the buyer.

- This service agreement will contain a confirmed corporate payment undertaking by the buyer agreeing unconditionally to pay, on the invoice due date, the approved amounts relating to those approved invoices that have been submitted to the finance provider.

- Notification to and/or acknowledgement/agreement by the seller and finance provider of discount arrangements allowing for early payments to the seller, which may include terms for acceptance of discounted early payment as full payment of the approved invoice amount; terms may also cover, for example, seller’s election for receipt of early payments via a manual, automated or semi-automated process. If required by the finance provider, the arrangements between seller and finance provider will include terms of use of any electronic platform and relevant representations or warranties given by the seller.

- Potential for Buyer to obtain more favourable payment / commercial terms with its sellers by agreement and in line with standard industry terms.

- Liquidity optimisation (buyers and sellers).

- Greater supply chain stability.

- Improved automation may be included to enhance/facilitate the transactions within the solution.

- Flexible seller access to potentially lower cost working capital than might be available from traditional forms of finance.

- Facilitates seller’s ability to manage / accept longer payment terms.

- Potential for less legal documentation, less complexity in documentation and faster seller onboarding.

- Facilitates transaction-based short term early payment discounting based on the credit of a buyer.

Source: Global Supply Chain Finance Forum

Risks and risk mitigation for the CPU

Relevant risks and mitigants include the following:

- Buyer non-payment risk mitigated by completing standard credit analysis / risk assessment at on boarding and continual monitoring

- Seller commercial disputes and/or other dilution events may be handled by credit notes and offsets against invoices due for payment (but not yet paid); the risk this could otherwise pose to the finance provider is mitigated by the corporate payment undertaking

- Appropriate KYC/AML and/or compliance review on the buyer and risk-based checks on the seller, handled during the on-boarding procedures and subsequent post-transaction reviews

- Risk of double financing is mitigated by any relevant contractual warranties and/or representations and can also be mitigated by finance provider’s due diligence review(s)

- Pre-existing security arrangements entered into by or affecting the seller; the risk this could otherwise pose to the finance provider is mitigated by relevant contractual warranties and/or representations and the corporate payment undertaking

- Lack of corporate or signing officer authority, mitigated by appropriate due diligence following the finance provider’s relevant internal procedures

All the above risks are also mitigated by a robust monitoring, reporting and audit process regarding transactions, systems and controls.

Accounting Treatment of Payables Finance

Accounting treatment Because of questionable practices by a few identifying certain transactions as supply chain finance rather than loans, the accounting treatment of trade payables is under increased scrutiny. Trade payables by nature are short term. If a buyer borrows to settle its trade payables, this will be reflected as bank debt. However, if the same buyer develops a payables finance programme for its suppliers, the trade payables may remain as trade payables on its balance sheet if certain criteria are met.

While there is no exhaustive list of criteria to minimize re-characterisation or clear guidance , it is useful to highlight some key criteria that have been mentioned as relevant in this context:

- There should be no triparty agreements. Rather there must be separate contractual agreements between the buyer and its bank as its paying agent as well as between the suppliers that join the program and the bank or another entity providing payment under the contractual relationship between the bank and the supplier

- The commercial purpose of the Payables Finance program should be to support the buyer’s suppliers in obtaining affordable credit

- The payment terms agreed between the buyer and its seller should remain unchanged after establishing a program or be in line with industry norms

- The payment terms should apply across a buyer’s supplier base independent of whether a supplier opts into a Payables Finance program

- The buyer should irrevocably agree to pay its obligation on the agreed invoice maturity date.

- The finance provider should have no greater surety of being paid for the purchased invoices than from the invoice purchase itself rather than having an additional confirmation, obligation or guarantee from the buyer itself or a third party to be paid

- The financing conditions for the purchase of invoices should be exclusively negotiated between the Finance provider and the supplier without any intervention from the buyer

- A seller’s invoice should usually be assigned to a finance provider rather than extinguished by e.g. novation of the invoice

- The fee or interest pertaining to the purchase of the invoices should be fully paid by the supplier to the finance provider

In recent years, rating agencies have begun to place heightened levels of scrutiny on supply chain finance and its accounting practices. In 2015, using Spanish company Abengoa as an example, Moody’s reported that reverse factoring had debt-like features, Subsequently through Industry advocacy led by the ITFA, Moody’s have taken a more nuanced and balanced view.

In January 2018, concerns resurfaced with the collapse of Carillion.

Following these events in October 2018, ITFA published a report, Payables Finance – what can we learn from the Abengoa and Carillion experiences? The paper references both companies as case studies, providing an overview of considerations required to assess payables finance arrangements and calling for increased transparency from companies, as well as greater dialogue between all stakeholders to clarify methodology and best practices.

A recent publication from Moodys takes a closer look at how Payables Finance is reflected on a corporate’s balance sheet and provides three cautions of note:

- Greater Transparency: Many buyers are not required to make public their Payables Finance programs, so users of financial statements may not be aware, despite the potential material consequences

- Extension of Terms: There is a leverage impact of hidden debt like obligations where payables finance allows payments to suppliers to be stretched beyond normal commercial

- Impact on Future Liquidity: Because of the potential size of these Payables Finance programs, the cancellation of such programs can lead to a sudden working capital outflow over a short period of time, leading to a liquidity crunch.

It is important to note that Moody’s does not conclude that Payables Finance is harmful or bad for SME’s. Rather, the Moody’s publication asks for greater transparency so that its impact on buyer’s balance sheets can be assessed and properly evaluated.

Working Capital Solution – Payables Finance

While the examples of misuse of payables finance to force a supplier into accepting uncommercial payments terms are few, they are nevertheless very worrying. While such cases have been prominently highlighted in the media, they are not representative of how payables finance programs are used by the majority of buyers and sellers in mutually supportive supply chains. Payables finance – correctly implemented – continues to be used as a means for buyers and sellers to optimise their working capital, and strengthen their relationships with each other. The GSCFF acknowledges the need for buyers and sellers to continue to improve their working capital. To support this goal, the GSCFF advocates for the continued use of payables finance programmes, as they present significant benefits for all stakeholders when applied in a reasonable and appropriate manner. To help further increase awareness and understanding of payables finance, and other SCF techniques, the GSCFF is building on its 2016 Standard Definitions for Techniques of Supply Chain Finance with individual reports on each of the eight techniques. The first, on receivables finance, was published in June 2019. The second, to cover payables finance, will be released in Q1 2020.

Podcasts – Global Supply Chain Finance Forum

References & Sources

With thanks to:

- Global Supply Chain Finance Forum

- BAFT

- ABE / EBA

- FCI

- International Chamber of Commerce

- ITFA

Payables Finance Posts

Football, factoring and fraud: Kicking out the bad actors, creating rules and standards

20th February 2024 / 0 Comments

The evolution of Supply Chain Finance: From banks to distribution

9th August 2023 / 0 Comments

Marco Polo Network runs insolvent with €5.2m debts

23rd February 2023 / 0 Comments

SWIFT and MonetaGo achieve milestone in the fight against trade finance fraud

26th October 2022 / 0 Comments

Speak to our trade finance team

Latest Articles – Supply Chain Finance and Payables

Football, factoring and fraud: Kicking out the bad actors, creating rules and standards

0 Comments

The evolution of Supply Chain Finance: From banks to distribution

0 Comments

Marco Polo Network runs insolvent with €5.2m debts

0 Comments

SWIFT and MonetaGo achieve milestone in the fight against trade finance fraud

0 Comments

VIDEO: Post-mortem analysis on Greensill and other cases studies

0 Comments

VIDEO: ITFA market practice update – Structured LCs, MRPAs, the LIBOR transition

0 Comments

Bank of America, IBM see opportunity in delivering post-pandemic, digital trade finance solutions

0 Comments

ICC Trade Register 2021 – 6 top takeaways and the low-risk nature of trade finance as an asset class

0 Comments

The fusion of working capital solutions in developing a sustainable financing strategy

0 Comments

Podcast: WOA Insights: Receivables rebounding and the role of open account finance post COVID-19

0 Comments

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom