Welcome to the TFG Trade Finance hub. Find out how we can help you access trade finance to increase your cross-border imports and exports, or learn about trade finance through our latest research, information, and insights here.

What is trade finance?

Trade finance is the financing of goods or services in a trade transaction, at any point from a supplier all the way through to the end buyer.

Managing cash and working capital is critical to the success of any business, and trade finance is a tool that can be used to unlock capital from a company’s existing stock, receivables, or purchase orders.

In turn, trade finance allows businesses to offer more competitive terms to both suppliers and customers, by reducing payment gaps in a business’s trade cycle.

Put simply, trade finance helps to facilitate the growth of a business and is a powerful driver of economic development.

The World Trade Organization (WTO) estimates that up to 80% of global trade uses trade finance, and in 2020, the International Chamber of Commerce (ICC) put the value of the global trade finance industry at $9 trillion.

Financial institutions support international trade through a wide range of products that help traders manage their international payments and associated risks, and cater to working capital needs.

Trade finance deals typically involve at least three parties: an importer (buyer), an exporter (seller), and a financier.

These deals differ from other types of credit products, and should have the following features:

- An underlying supply of a product or service

- A purchase and sales contract

- Shipping and delivery details

- Other required documentation (e.g. certificates of origin)

- Insurance cover

- Terms and instruments of payment

Trade finance is an umbrella term that can refer to a variety of financial instruments used by importers and exporters.

These include:

- Purchase order (PO) finance

- Stock or warehouse finance

- Structured commodity finance

- Invoice and receivables finance (discounting and factoring)

- Supply chain finance (also known as payables finance)

- Letters of credit (LCs)

- Bonds and bank guarantees

The terms import finance and export finance are also used interchangeably with trade finance.

What are the main benefits of trade finance for companies?

Trade finance helps businesses grow by guaranteeing or providing finance to help them to buy goods and stock, which is often necessary when they don’t know or trust other parties in the supply chain.

Many companies use trade finance because it helps them unlock capital from their stock or receivables, which can then be used to finance future growth and development.

Similarly, using trade finance allows businesses to request higher volumes of stock or place larger orders with suppliers, leading to economies of scale and bulk discounts.

A trade finance facility may allow you to offer more competitive terms to both suppliers and customers, by reducing payment gaps in your trade cycle.

It is therefore beneficial not only for business growth, but also for supply chain relationships.

It also increases the revenue potential of a business, as earlier payments may allow for higher margins.

Managing cashflow and working capital is critical to the success of any business, which require reducing metrics such as days payable outstanding (DPO) or days sale outstanding (DSO).

Who benefits from trade finance?

SMEs, large corporations, and even governments use trade finance to achieve a range of growth goals.

This could include increasing the size and scope of the goods and services they trade in, scaling up their global operations, or helping them fulfil large contracts.

SMEs can benefit because trade finance focuses more on the trade itself rather than the underlying borrower.

This means that small businesses with weaker balance sheets can use trade finance to trade larger volumes and work with end customers that have stronger balance sheets and credit ratings.

The embedded risk mitigants that surround trade finance lending promote greater diversity in a trader’s supplier base, leading to increased competition and efficiency in markets and supply chains.

Companies can further mitigate business risks by using appropriate trade finance structures.

Since late payments from debtors, bad debts, excess stock, and demanding creditors can have detrimental effects, businesses can use external financing or revolving credit facilities to ease this pressure by effectively financing trade flows.

How can we help?

The TFG team works with the key decision-makers with over 300 banks, funds and alternative lenders globally, assisting companies in accessing trade & receivables finance.

Our international team are on hand to help you scale up to take advantage of trade opportunities. We have product specialists, from machinery experts to soybean gurus, as well as geographical specialists.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate trade finance solutions for your business.

Read more about Trade Finance Global and our global team.

Trade finance frequently asked questions

The UCP 600 (“Uniform Customs & Practice for Documentary Credits”) is the official publication issued by the ICC (International Chamber of Commerce) for trade finance governance.

It is a body of rules on the issuance and use of a letter of credit and applies to 175 countries.

The aim has been to standardise a set of rules aimed to benefit all parties during a trade finance transaction – for that reason, it is designed by industry experts rather than through legislation.

The UCP was originally created in 1933 and has been revised repeatedly by the ICC, with the most recent UCP 600 coming into force on 1 July 2007. Read more →

Export finance specifically refers to the financing mechanisms used by exporters in cross-border transactions.

The term trade finance is an umbrella term that includes export finance, as well as other financing mechanisms like import financing and can even be used for domestic transactions.

Often, this will cover invoice finance, purchase order finance, off-balance sheet lending, letters of credit, and similar funding instruments.

Trade finance is generally not well known in the market but many practitioners regard it as a way of financing trade through the use of a lender’s funds. Read more →

Trade finance includes the following:

- Bonds and guarantees

- Lending facilities

- Issuing letters of credit (LCs)

- Export factoring (companies receive funds against invoices or accounts receivable)

- Forfaiting (purchasing the receivables or traded goods from an exporter)

- Receivables financing, invoice factoring, and invoice discounting

- Export credits (to reduce risks to funders when providing trade or supply chain finance)

- Insurance (during delivery and shipping, also covers currency risk and exposure)

- Supply chain finance

- Foreign exchange and currency products

Cash advances

As the least risky product for the seller, a cash advance requires payment to the exporter or seller before the goods or services have been shipped.

Cash advances are very common with lower value orders, and help provide exporters (sellers) with the upfront cash needed to ship the goods and no risk of late or no payment.

Letters of credit (LCs)

Letters of credit (LCs), also known as documentary credits, are financial, legally binding instruments, issued by banks or specialist trade finance institutions that pay the exporter on behalf of the buyer if the terms specified in the LC are fulfilled.

An LC requires an importer and an exporter, with an issuing bank and a confirming (or advising) bank.

The financiers and their creditworthiness are crucial for this type of trade finance: it is called credit enhancement – the issuing and confirming bank replaces the guarantee of payment from the importer and exporter.

In this section, and in most cases, we may consider the importer as the buyer and the exporter as the seller.

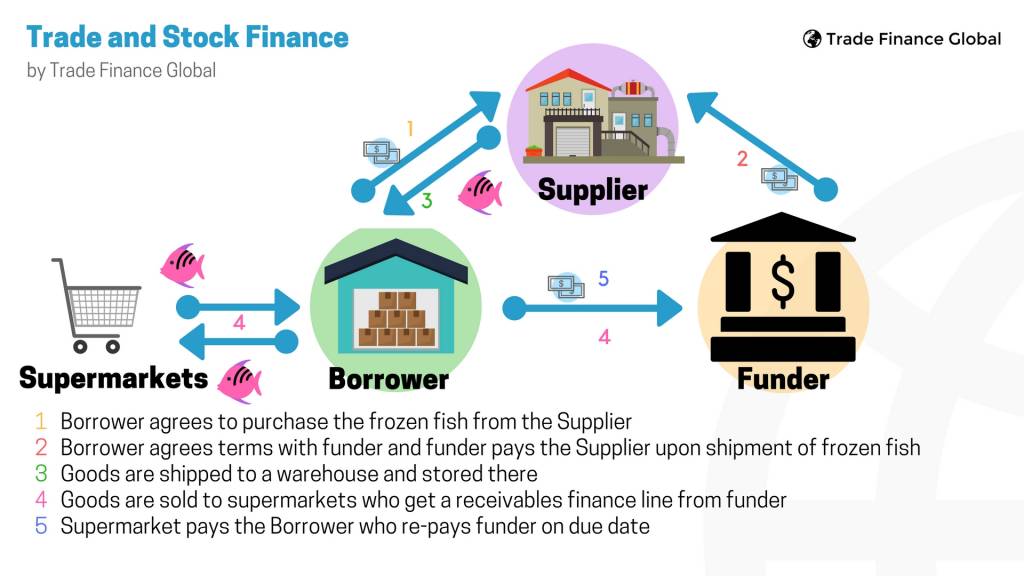

See a worked example here of how trade finance can be used to finance the purchasing of frozen fish from a supplier, to be sold on to end customers:

Documentary collection

Documentary collections differ from a Letter of Credit (read our blog post on the differences between DCs and LCs).

In the case of DC, the exporter will request payment by presenting its shipping and collection documents to its remitting bank.

The remitting bank then forwards these documents to the importer’s bank, which then pays the exporters bank, which will credit those funds to the exporter.

Open accounts

An open account is a transaction where the importer pays the exporter 30 – 90+ days after the goods have arrived from the exporter.

This is advantageous to the importer but carries substantial risk for the exporter – it often occurs if the relationship and trust between the two parties are strong.

Open accounts help increase competitiveness in export markets, and buyers often push for exporters and sellers to trade on open account terms.

As a result, exporters may seek export finance to fund working capital while waiting for the payment.

Retail and commercial banks

Some commercial banks have specialised trade finance divisions that offer facilities to businesses.

Commercial banks represent the majority share of financial institutions globally, although they range in size from small and niche banks to large multinational banks.

Alternative finance and non-bank funders

There are many types of financial institutions that do not use public deposits as a funding resource.

Funding sources include crowdfunded (pooled) investment, private investment, and public market sourced capital.

Read more here.

1. Application

The initial ‘credit’ application drives the process when applying for credit.

Lenders will often ask for information on current assets or collateral that the business owns, including debt and overdrafts, and assets that the company or directors own (such as property, equipment, or invoices).

2. Evaluating the application

The evaluation process will normally involve some kind of credit scoring process, taking into account any vulnerabilities such as the market the business is entering, the probability of default, and even the integrity and quality of management.

3. Negotiation

Eligible SMEs applying for trade finance can negotiate terms with lenders.

An SME’s aim with a lender is to secure finance on the most favourable terms and price.

Some of the terms that can be negotiated can include fees, fixed charges, and interest rates.

4. The approval process and documentation of a loan

Typically, the account officer who initially deals with the applicant and collects all of the documentation will do an initial credit and risk analysis.

This then goes to a specific committee or the next level of credit authority for approval.

If the loan is agreed upon (on a preliminary basis) it goes to the legal team to ensure that collateral can be secured/ protected and to mitigate any risks in the case of default.

Read our full ‘trade finance application process’ here.

From the bank’s perspective, as the regulation burden (i.e., Basel III) has become heavier, SMEs often don’t fulfil certain criteria for banks to justify lending.

As lending money has an associated transaction cost, it is more costly to assess and monitor loans to a smaller, riskier company where profit is less certain, relative to a larger, more profitable, and stable business.

Banks will often ask for the following from any company when filling out an application for any type of business finance:

- Audited financial statements

- Full business plans

- Financial forecasts

- Credit reports

- Details and references of the directors

- Information on assets and liabilities

As well as the cost of lending to SMEs being less profitable for banks, there is a much higher default risk and a greater chance of bankruptcies with SMEs in comparison to larger firms.

The other challenge banks have in lending to SMEs is the lack of security and collateral an SME can provide.

SMEs also face challenges in accessing finance from banks.

In a recent survey by the British Business Bank, 46% of SMEs were looking to grow in the next 6 months, yet awareness of types of finance available and finding sources of finance (especially after being rejected from a bank) are major concerns amongst SMEs.

The perceived high cost of borrowing, lengthy procedures for securing a loan and also the amount of paperwork and documentation required are often off-putting and cumbersome to SMEs.

Want to learn more about trade finance?

Look no further! We’ve put together our feature trade finance insights, research, and articles, and you can catch the latest thought leadership from the TFG, listen to podcasts and digest the latest in international trade right here.

From the Editor – trade finance insights

Updates from ITFA’s ITFIE, paving the way for institutional investors – Trade finance, traditionally dominated by banks, is integral to supporting global supply chains, acting as the lifeblood of international commerce.

Updates from ITFA’s ITFIE, paving the way for institutional investors – Trade finance, traditionally dominated by banks, is integral to supporting global supply chains, acting as the lifeblood of international commerce.  Demystifying payment modernisation: Separating fact from fiction – In the rapidly evolving digital age, the payments industry is undergoing one of its most significant transformations in recent years.

Demystifying payment modernisation: Separating fact from fiction – In the rapidly evolving digital age, the payments industry is undergoing one of its most significant transformations in recent years. PODCAST | Unlocking Mexico’s trade potential: Banorte and ICC Mexico’s Gerardo Gutierrez-Olvera discusses strategies for the future – In 2022, international trade represented 88% of the Mexican GDP, but the world of international trade is changing.

PODCAST | Unlocking Mexico’s trade potential: Banorte and ICC Mexico’s Gerardo Gutierrez-Olvera discusses strategies for the future – In 2022, international trade represented 88% of the Mexican GDP, but the world of international trade is changing. Latest insights on types of trade finance

Podcast | Short-term, self-liquidating, is trade finance as an asset class on the up? – At the ITFA annual conference in Abu Dhabi, TFG’s Mark Abrams spoke with Nishit Kumar, Senior Director, Head of Loan Syndications and Distribution at Mashreq Bank, and Kamola Burikhodjaeva, Executive Director, Head of Americas Distribution at J.P. Morgan.

Podcast | Short-term, self-liquidating, is trade finance as an asset class on the up? – At the ITFA annual conference in Abu Dhabi, TFG’s Mark Abrams spoke with Nishit Kumar, Senior Director, Head of Loan Syndications and Distribution at Mashreq Bank, and Kamola Burikhodjaeva, Executive Director, Head of Americas Distribution at J.P. Morgan.  Dani Cotti: 6 lessons from the tradetech industry – 2022 was a year of seismic and rapid changes for international trade and trade finance. War in Europe, COVID-19, and inflation created unimaginable disruptions in the industry. This dynamic phase is creating opportunities and gives way for new entrants in the ecosystem.

Dani Cotti: 6 lessons from the tradetech industry – 2022 was a year of seismic and rapid changes for international trade and trade finance. War in Europe, COVID-19, and inflation created unimaginable disruptions in the industry. This dynamic phase is creating opportunities and gives way for new entrants in the ecosystem.  DCW unveils its latest insights on letter of credit use in the USA – Following the latest Q3 2022 edition of its quarterly letter of credit (LC) statistics for US banks, Documentary Credit World (DCW) has released its analysis of LC issuance from banks in the country.

DCW unveils its latest insights on letter of credit use in the USA – Following the latest Q3 2022 edition of its quarterly letter of credit (LC) statistics for US banks, Documentary Credit World (DCW) has released its analysis of LC issuance from banks in the country. Videos – trade finance

Trade finance podcasts

Strategic Partners:

Download our free trade finance guide

Contents

1 | Introduction and the benefits

2 | Types of trade financing

3 | Methods of payment

4 | Pre and post-shipment finance

5 | Risks and challenges

6 | Trade and export finance providers

7 | The credit process and securing finance

8 | SME Trade Finance Guide

Get in touch with our trade team

Speak to our trade finance team

Latest News

BII, Citi launch $100m facility to boost trade finance in Africa

0 Comments

Atradius reports 18% drop in UK trade credit claims amid consumer confidence boost

0 Comments

Standard Chartered launches open banking marketplace to enhance API integration

0 Comments

Quor and ClearDox partner to grow commodity trading solutions

0 Comments

Updates from ITFA’s ITFIE, paving the way for institutional investors

0 Comments

Demystifying payment modernisation: Separating fact from fiction

0 Comments

Cleareye.ai and Surecomp partner to enhance AI powered trade finance automation

0 Comments

PODCAST | Unlocking Mexico’s trade potential: Banorte and ICC Mexico’s Gerardo Gutierrez-Olvera discusses strategies for the future

0 Comments

Lloyds Bank completes its first WaveBL electronic Bill of Lading transaction

0 Comments

Afreximbank to provide $1b crude oil prepayment facility to Nigeria

0 Comments

WTO’s “Global Trade Outlook and Statistics” report indicates positive movement amid challenges

0 Comments

Trade Finance Global and CommodityThursdays partner to enhance collaboration in the commodity industry

0 Comments

Lloyds Bank trade insights: the new era of working capital management, a treasurer’s view

0 Comments

Enigio’s trace:original eBL approved by IG P&I

0 Comments

Kyriba launches AI features to enhance liquidity management solutions for CFOs

0 Comments

Visit our Global Hubs

Australia 🇦🇺

France 🇫🇷

Germany 🇩🇪

Hong Kong 🇭🇰

India 🇮🇳

Ireland 🇮🇪

Japan 🇯🇵

Netherlands 🇳🇱

Singapore 🇸🇬

United Arab Emirates 🇦🇪

United States of America 🇺🇸

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom