To the untrained eye, trade finance can seem like an intimidating assortment of industry terms and acronyms that were designed to be confusing.

Those in the industry know that confusion was not a design intention, but rather an unpleasant side effect of a siloed industry that has been adapting to shifting needs for hundreds of years.

Today, things are changing for the better.

The International Trade and Forfaiting Association (ITFA), together with Komgo SA, has released a visual trade finance taxonomy, building on the previous trade finance guide launched in conjunction with Trade Finance Global (TFG) in 2020.

To the extent possible in this ever-changing environment, the taxonomy lays out the whole ecosystem of trade finance within a diagram. It shows the industry’s different areas, techniques, and instruments involved in trade finance.

Izabela Czepirska, lead of the Komgo Secondary Market Workstream, said, “I wanted to make sure that the complex world of trade finance is understandable to anyone new to the industry.

“When I first started working on the Taxonomy, my aim was to help software developers translate between the industry and the code that they had to write.”

One of the benefits of this visualisation is the identification of connections between different areas of trade finance.

This taxonomy, therefore, provides a menu of options that bankers and financiers can make available to their clients once they know what instruments exist and how they work.

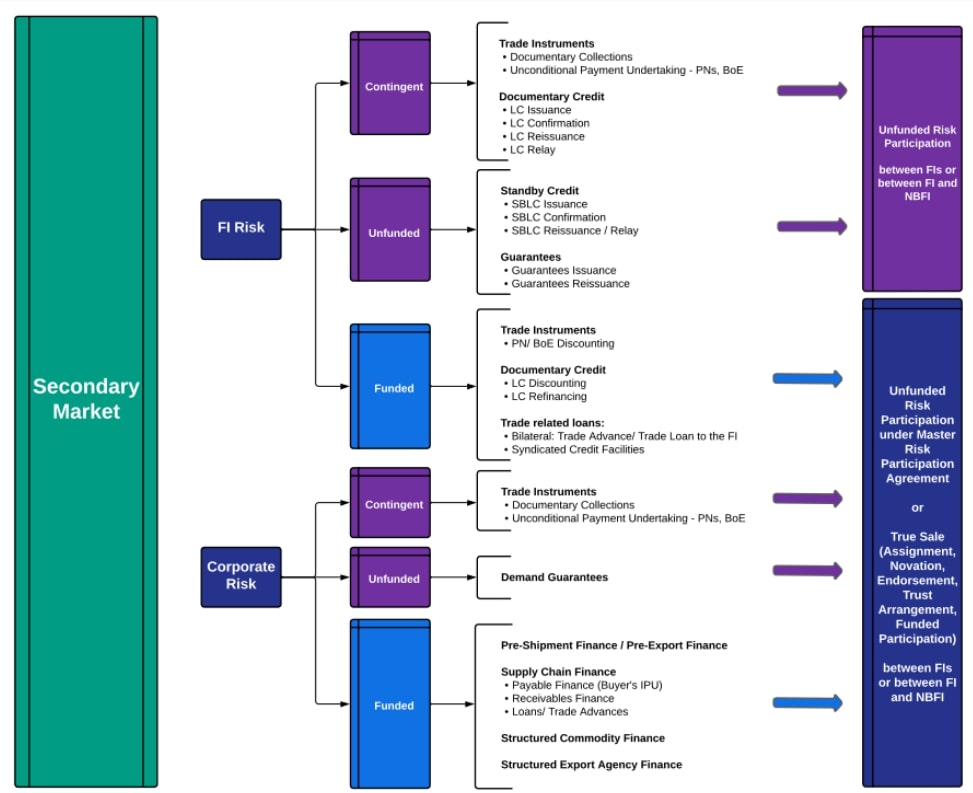

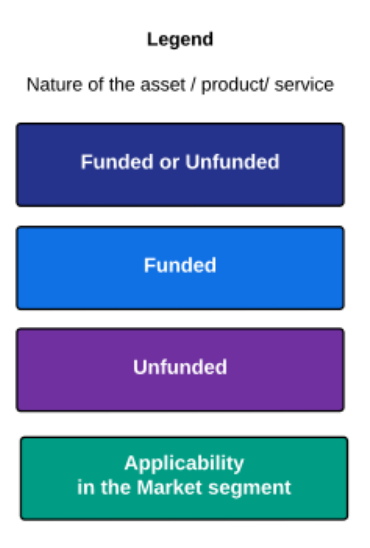

The colour-coded classification categorises each technique or practice by its primary or secondary market affiliation and then categorises them into either funded or unfunded. Further to this, where relevant, the taxonomy breaks down these groups into instruments or sub-categories.

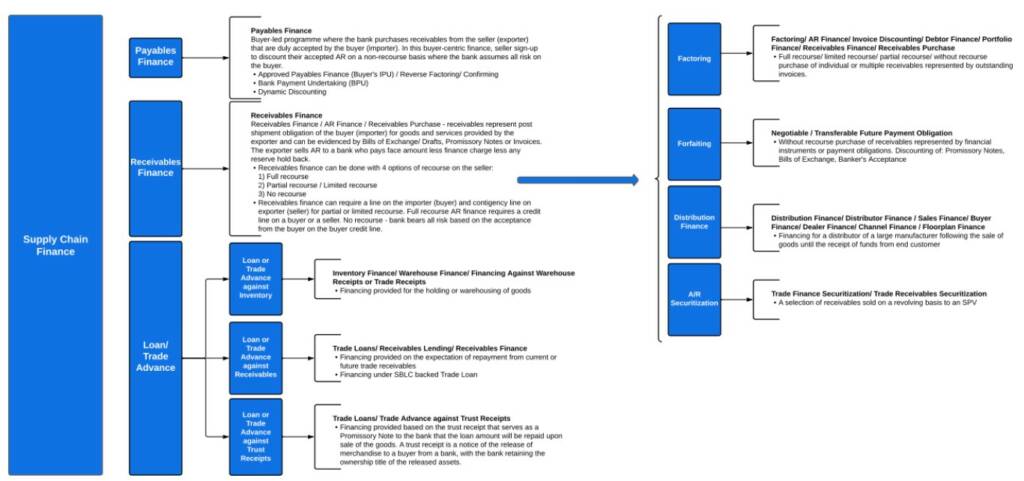

For example, supply chain finance arises in the primary market, is funded and then broken down into payables, receivables, and loan-based sub-categories. The taxonomy additionally divides receivables finance into different instruments that use receivables as their base asset.

A complement to other initiatives

ITFA and Komgo’s Trade Finance Taxonomy is intended to serve as a complement for other related initiatives like the Global Supply Chain Finance Forum’s (GSCFF) Standard Definitions for Supply Chain Finance.

While many of these initiatives focus on creating standards and standardising terminology within specific trade finance industry siloes, the Trade Finance Taxonomy is helping break down these barriers by looking at the industry as a whole.

Sean Edwards, chairman at ITFA, said, “ITFA is a contributor to the GSCFF Standard Definitions for Supply Chain Finance but this new taxonomy goes much further and wider than just supply chain finance, which is covered of course.

“Trade finance is a big world and opening everyone’s eyes to all the possibilities is a major aim of this project.”

Categorisations in the taxonomy

As is the norm for most trade finance classifications, this taxonomy categorises the array of products as either funded or unfunded.

Funded trade finance products focus on the provision of liquidity from a financial institution to the parties in a trade transaction.

Unfunded trade finance products are focused on credit enhancement or support, such that the trade finance provider does not offer direct liquidity to the parties in a trade transaction, but supports the transaction by guaranteeing the performance of the parties in their different roles.

The struggle for consistent trade finance terminology

Historically, practitioners have had a difficult time devising consistent terminology for the many techniques and instruments available for international trade finance.

This largely stems from the sector’s long history and vast geographic disparities.

While the industry, as we know it today, may date back a few hundred years, the financing of international trade has existed alongside international trade for millennia.

Many of the tools, terms, and techniques in use today have seen their fair share of tweaks and transformations.

In addition to this, international trade finance is an inherently global endeavour, meaning that practitioners must adhere to the nuanced differences that exist between the many legal jurisdictions of the world.

An instrument that works splendidly in one country, may need to be marginally modified to meet the legal requirements of another.

Often, these slightly revised documents end up taking on different names in different places.

This creates confusion for practitioners and policymakers alike.

The benefits of trade policy reform and closing the trade finance gap

Many industry experts believe that the complexity and confusion in the trade finance industry is a significant hurdle for much-needed legislative reform.

Particularly when it comes to trade digitalisation, industry proponents have been calling for legal reform for many years to help catalyse an environment of innovative development.

One of the visions for this new Trade Finance Taxonomy is to provide policymakers in jurisdictions around the world with an at-a-glance view of how these assorted tools relate to one another, making trade happen.

Aided by this additional bit of understanding, policymakers and legislators will be better equipped to address the needed reforms.

Paul Coles, ITFA board member and chair of the Market Practice Committee, said, “The taxonomy will be a single reference point covering the entire spectrum of trade finance.

“In turn, we expect this increased clarity to attract new funding and bridge the $1.7 trillion trade finance gap.”

Trade Finance Global are a proud partner with ITFA.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.