Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 15

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: Lesley McNamara, Head of Strategy and Product, Global Trade & Supply Chain Finance, Bank of America Merrill Lynch

An interview about the mid-year outlook of the global trade and treasury sector with Lesley McNamara, Head of Strategy and Product, Global Trade & Supply Chain Finance at Bank of America Merrill Lynch.

Deepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global.

The world order is changing rapidly placing pressure on businesses to react, adapt and find efficiencies in order to survive and grow. The last 12 months have seen a surge of geopolitics, market volatility and technological advances. The life of a corporate treasurer is changing, and so is transaction banking. Amidst the current macroeconomic and geopolitical climate, banks, treasurers and corporates must adapt. More than ever before, corporates are demanding more flexibility in working capital solutions and new opportunities for on-going investment in their businesses. This is forcing banks to innovate, both in supply chain finance and trade finance.

We hear the latest from BAML on integrating product offerings, digital banking trends, corporate treasury and trade updates.

Deepesh Patel: Today, I’m joined by Lesley McNamara from Bank of America Merrill Lynch, Head of Strategy and Product for Global Trade & Supply Chain Finance, Global Transaction Services. In this role, she is responsible for managing the trade suite of global products as well as the development and delivery of product client and market strategies to accelerate revenue growth. Normally, based in New York, I had the chance to catch up with Lesley, who joins us today from Bank of America’s offices here in London to discuss the latest transaction banking trends, particularly around the digitization of trade finance. Hi, Lesley, thank you for joining us on Trade Finance Talks.

Lesley McNamara: Thank you so much for having me.

DP: So Lesley, in no more than 30 seconds. Can you introduce yourself and tell us what you do at Bank of America Merrill Lynch?

LM: Of course, my name is Lesley McNamara and I’m the Head of Global Trade & Supply Chain Finance Product and Strategy at Bank of America Merrill Lynch. In this capacity, I manage the trade product management team, the platform and capability team, the Supply Chain Finance programme management team, and the revenue and profitability team.

DP: Thanks Lesley. So, 2019. Trade wars, interest rate changes, geopolitics, FX volatility, what a year. From your perspective at the bank, what have been the biggest trends this year? Has there been anything which has kept you or treasurers up at night?

LM: Given all of what you just said, it’s pretty clear that there’s never a dull day and lots that keeps the industry up at night. For treasurers, I would say uncertainty, and at these uncertain times, some businesses tend to spend less on CAPEX and R&D, which can impede their future performance. However, in such uncertain times, a strong focus on working capital can help unlock trapped cash, and support ongoing business investment, without reducing the cash reserves that those companies wish to maintain as a safeguard. We continue to see this as an area the treasurers which to focus on for the bank. The sheer rate of change in trade finance is enough to keep anyone awake at night.

The sheer rate of change in trade finance is enough to keep anyone awake at night.

Evolving client needs, evolving technology – including blockchain, FinTech, cloud, AI, robotics, big data – all of that feels like we’ve seen more change in the last 18 months than we have in the last 18 years.

And finally, while this doesn’t keep us up at night, it’s another trend of note; ESG (environmental, social, and governance) is definitely a big theme and worthy of discussion. At the same time, externally, we’re seeing an increasing focus from our clients in not only driving sustainability within their own businesses but within their entire value chain.

To learn more about Supply Chain Finance click here.

Developments in the Supply Chain Finance Market

DP: Some good points and thank you. Thanks for mentioning some of the ESG initiatives very, interesting. So, let’s talk about Supply Chain Finance and some of the SCF programmes that BAML run. What big changes, if any, have you seen this year in the market? Are there any changes in liquidity provision, or the length of payment terms from corporate to the end suppliers, and have there been any changes from Bank of America’s perspective?

LM: There’s so much attention on Supply Chain Finance. So this is a great topic. First, we found the treasurers are looking for more. Supply Chain Finance is becoming standardised more than in the past, meaning all banks have similar value propositions. And therefore, we’ve had a number of our more mature clients express to us the need to hear something new and different. This aligns with our broader GTS strategy that has recently rolled out that we refer to as ‘Intelligent Treasury’. In short, it’s the concept of the strategic advisor, and how we best engage to solve our problems or clients’ problems.

Secondly, companies are now looking for solutions that enable them to drive out benefit across their entire supply chain, not just those top 100 suppliers. This is driving demand for new functionality and capabilities that are available on a single platform. So, faster digital supplier onboarding, e-purchase orders and invoicing, supplier management tools, including credit tools and compliance alerts, AI decision and data analysis, and things like dynamic discounting.

And then third, with respect to supply chain, there has been an increasing focus on the balance sheet treatment of supply chains; it’s obviously a topic that’s in the news a lot these days. This is driving treasurers to consider how best to structure their SCF programmes to ensure that they continue to be treated as trade payables, rather than as debt. The impact this may have on payment terms is a great focus for ensuring that these terms stay in line with the industry norms.

See our interview with Baris Kalay, Head of Trade Finance for Global Transaction Services, EMEA, Bank of America Merrill Lynch here. Baris explores what it takes to implement a successful supply chain finance program. Read more here.

DP: Thanks, Lesley. Very interesting that a lot of the innovation is being driven by the customer and from the end client. So, let’s go into a bit more detail on that and talk about the changing roles of the corporate treasurer. We think that over the past few years, the treasury function at corporates has changed largely with ever-increasing pressure to optimise the balance sheet, in order to increase operational efficiency and to manage volatility. Do you think the role of the treasury team is becoming broader?

LM: I would guess that this varies by client. But, the concept has helped inform our strategic framework, that of ‘Intelligent Treasury’, to ensure that we’re adequately prepared.

One such example is the development of the Accounts Payable Optimization initiative. This was developed in 2018 with partners across Global Transaction Services, and it brings together supply chain, virtual payables and Paymode-X and traditional payments, such as the ACH and wires, to offer our clients end-to-end payment solutions no matter what their needs. It streamlines their payment solution package. So what does it deliver to them? It delivers deeper data analytics, the client receives one targeted analysis for all of their payments.

So from a trade perspective, a constant client challenge is finding an accounts payable solution that spans from their largest to their smallest suppliers. To solve for this, instead of originating a card deal, a trade deal and an ACH deal separately, we look across the client’s holistic accounts payables file and provide recommendations agnostic of the product. This allows us to simplify the procurement process for our clients as we deliver the strength of Bank of America.

Instead of originating a card deal, a trade deal and an ACH deal separately, we look across the clients holistic accounts payables file and provide recommendations agnostic of the product. This allows us to simplify the procurement process for our clients as we deliver the strength of Bank of America.

The second, in addition to the data analytics, is simplified onboarding. We provide one streamlined implementation across all of those payment products. Clients save time, they save resources and they save money by consolidating multiple implementation projects into one.

Finally, it’s a single file integration. So we can receive and process one secure file for all treasury payables for all of our card solutions and traditional payments. So instead of having the client have to break out their existing spend file into multiple product files, they send one through our online platform CashPro®, and the rest is done by the bank. The goal of the initiative: we improve efficiency, we increase our DPO and we enhance the cash flow.

AI, DLT & Sector Optimisation

DP: And actually, we talked quite a lot about interoperability i.e., the ability for banks to talk to other banks, when it comes to syndicated finance. What I find very interesting is that even internally, integrating products is still a challenge.

DP: So let’s talk a little bit more about the actual technology both internally and externally. So we’ve seen and we report on the huge spike in FinTech and DLT enabled platforms and various initiatives and attempts to digitalize both Trade & Supply Chain Finance. Can you talk to me about any of the new initiatives that the bank is implementing to help potentially streamline some of the SCF programmes, optimise AP, or even enhance the trade finance offering for businesses?

LM: So we just talked a little bit about the optimised AP. I’ll move away from that and towards some of our third-party partnerships and how we’re approaching that because obviously, technology is a hot topic in trade finance these days. So we’re looking to third parties to enhance our existing offering with new capabilities – with whom can we partner to embed best of breed capabilities into our existing solution suite? We have three objectives:

- Extend the client value through accessing new geographies, new product offerings and new flows – this serves to make us more relevant and adaptable to client needs

- Digitise while managing risk

- As we know, trade is so heavily paper-based and capacity-driven, that every day we’re processing thousands and thousands of pages of documents. So we’re looking to leverage AI and robotics to reduce that risk and ideally also reduce the cost.

Digitalisation of Trade

LM: Whilst our supply chain offering is nearly 100% digital, digitization may prove to be more relevant and beneficial to our traditional trade offering.

And then finally, to optimise the organisation. What this means is creating the ability to proactively partner with third parties as opposed to reactively partnering when the client insists. The reactive nature can be slow as we need to onboard the vendor, which is not an easy task at the bank given the rigour around security approvals and risk and enable technology connectivity, which often can be quite pricey.

One such example of a third party partnership would look at a holistic solution to encompass that tail spend from a buyers payment file that we talked about earlier, clients have always been focused on providing that holistic solution to meet the needs of their entire supplier base.

In the past, we haven’t been able to service the smallest suppliers based on cost and capacity. This has become a focus of ours, and we’re looking to partner not only across our existing products but additionally with a third party to deliver that capability quickly and efficiently to market.

And then finally, the hot topic, digital ledger. So well the value of DLT in trade is still in debate. We spent a considerable amount of time exploring the opportunity, and how banks best integrate.

From our proof-of-concept with Microsoft rolled out in 2016, to our more recent alignment to the Universal Trade Network, the landscape has evolved considerably, and we’re actively engaged to remain on top of the most relevant trends and Consortia. We can talk about what success looks like with respect to DLT, but I think that would be an entirely separate podcast.

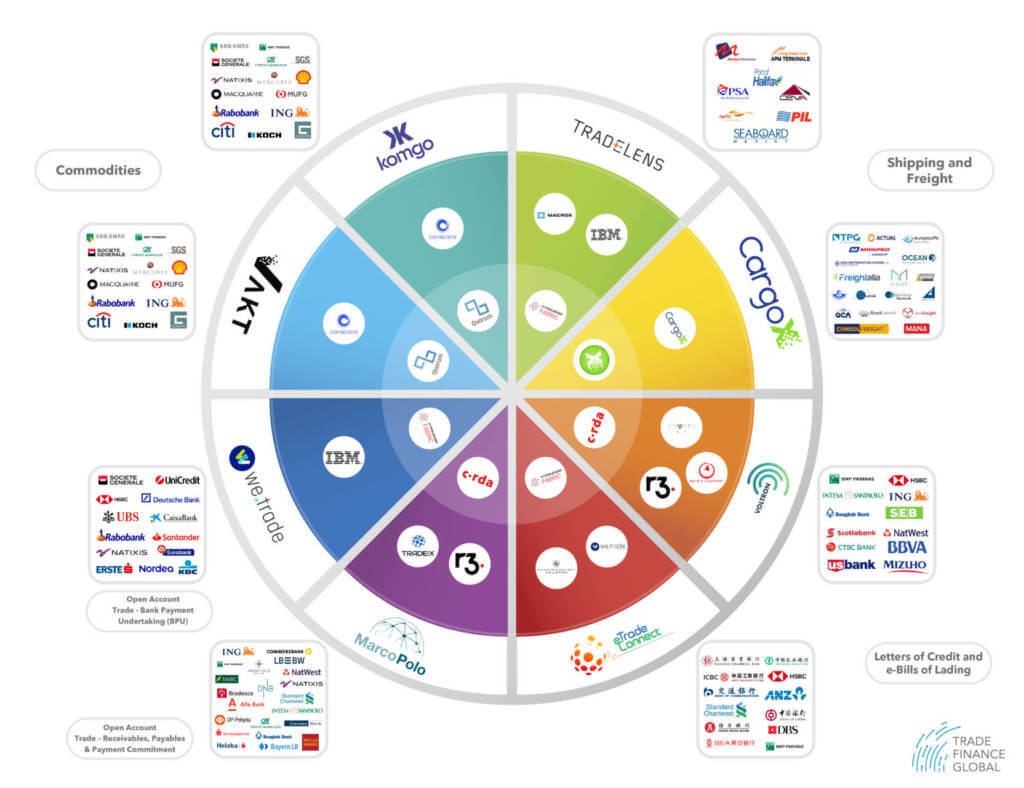

Who’s Who in the Consortia?

See the interactive diagram

DP: Thank you, yes, we’ve done lots of podcast on that. And we should definitely talk more about that at a later stage. It’s very interesting to hear about the bank’s perspective of adoption of DLT.

So just taking a more of a forward-looking view now on what’s in stock for the rest of 2019 and beyond. And I’d like you to give me three pieces of advice for a corporate treasurer, What should they be watching out for? And how can they be prepared for what’s in stock for the rest of the year, I didn’t bring my wishball with me.

3 Pieces of Advice for a Corporate Treasurer

LM: So I’ll try to boil it down.

The three pieces of advice that are top of mind right now are (1) innovation. There are a number of digital solutions being developed in trade finance, where banks can help treasurers as trusted advisors in navigating this space. Treasurers should make a point of asking those key banking relationships for their view on these technologies and the platforms that are available.

At Bank of America, we see this is a fundamental part of the value that we bring to any client relationship.

The second is working capital. Keep the focus on working capital. It may be obvious but having access to flexible sources of cash can be really important in these ongoing times of uncertainty.

And then finally, balance sheet treatment. Keep balance sheet treatment in mind when structuring SCF programmes with your banks. SCF is a powerful tool but companies need to avoid pushing payment terms well outside of industry norms. And careful consultation with auditors and accountants is key.

DP: Great, thank you. Thank you very much for joining us today. And that was very, very insightful and lots of interesting learnings from the bank’s perspective.

I think there were three themes which I picked up, first of all, the idea that corporates are demanding more flexibility, which is forcing innovation; I think is a good thing. And if we take a step back, these are the kind of initiatives that are closing the $1.5 trillion trade finance gap, which is so often talked about because it forces the banks to look at some of the smaller suppliers and the smaller ticket deals, which are suddenly a little bit more manageable, thanks to technology.

The second theme, which I think you talked about today, which is all-around connectivity between different products at the bank office and how technology can be an enabler of that.

And finally, as you mentioned, Supply Chain Finance, which is relatively newer to market than trade, has been digitalized. And actually, the focus on the more traditional paper-based trade finance is what is more of a priority and also an opportunity from a digitalisation perspective. So Lesley, thank you very much for joining us here today from London on Trade Finance Talks!

LM: Thank you. It’s a pleasure.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.