Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 12

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: Olivier Paul, Director, Finance for Development, ICC Banking Commission

ICC, On Banking Regulation And The Campaign To Mitigate The Unintended Consequences For Trade Finance

Deepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global.

The trade finance gap lies at around $1.5tn USD. Regulation and compliance, whilst set in best interests, may however be leading to the exacerbation of this trade finance gap. So, how do we ensure that regulation does not hinder the provision of trade finance and promote its fair regulatory treatment? The International Chamber of Commerce Banking Commission recently released a whitepaper urging the trade finance industry to work together, ensuring that regulation doesn’t hinder the availability of trade finance. Here to discuss their recent report, Banking Regulation And The Campaign To Mitigate The Unintended Consequences For Trade Finance: is Olivier Paul, Director of Finance for Development at the ICC, joining us from Paris.

Deepesh Patel: Olivier, in no more than 30 seconds, tell us your elevator pitch; who are you, and what do you do at the ICC?

Olivier Paul: Yes, thank you, Deepesh, yes, my career started quite a long time ago now, more than 30 years in the banking industry. I was with a large international bank, and I had several positions, mainly all relating to international business. So I was running the export finance business line for a significant period of 10 years. Then I moved to trade finance, where I was in charge of developing new products and ensuring a correct level of exchange with our partners – especially with the regulating bodies as well.

I joined ICC two years and a half ago, where I am in charge of the Banking Commission. As you know, this Banking Commission has three main missions: first of all, the most well-known one, is to provide the market with rules on trade finance products. Then there is ensuring a dialogue with the regulators to make sure that the voice of the industry is taken into account. And then of course, the last one is the financial inclusion – all the initiatives that we can take to ensure large access for all players to trade finance businesses.

Basel III & Implications on Trade

DP: Thank you Olivier. So international trade really is an engine for economic growth and the ICC plays a huge role in facilitating this as an organisation and as the only private sector Observer to the UN General Assembly.

So, Basel III is a set of banking recommendations, for the prudential regulation of banks. Where do we stand with Basel III today and how does this impact trade?

OP: Well, we are now entering into the phase of implementation of Basel III. So as you know, we had a long discussion, together with different authorities, including the Basel committee, of course, but not only them – also with European authorities and others, to make sure of the correct interpretation of guidelines provided by the Basel committee, because as you know, the Basel committee is issuing some guidance that then go to the different regional levels – the Americas, Europe, Asia, and then when it goes from this regional level, it goes to the national level. So, we have to make sure that those different layers of decision processes, the interpretation and the implementation will be made in a sustainable way. And more importantly, in a commercial way. What is very important in the regulation today is that we make sure that the potential differentiation of regulation applying into one region compared to another will not create a competitive differentiation amongst the different players that could create hurdles in a particular region. So, we are in the phases of implementing the recommendation of Basel III. We have done a lot of work and have already obtained some good results in that respect. But we still have some discussions to have in the coming month to make sure that that this implementation will be achieved in a proper way.

Anti-Money Laundering and Counter-Terrorist Financing

DP: Great, thank you very much. So now let’s move onto another key topic within trade and trade finance.

Anti-money laundering and countering the financing of terrorism are key priorities, particularly for the trade finance industry. Your recent survey, the 10th Global Survey on Trade Finance indicated that some 93% of banks see regulation and compliance as an obstacle to growth and the provision of trade finance. Do you think we’ve gone too far with compliance, and what’s the implication for providing liquidity to businesses?

OP: Well, I would say the first element of that answer is to say that we need regulation amongst the various regions, among the various players, among the various partners; not only at the banking industry level, but also on the corporate side. And we have to make sure that the transactions we are dealing with are organised, monitored and managed in a proper way.

So we need regulation, more specifically on the compliance side, I think it is exactly the same thing; we absolutely need to have common standards, we need to have common guidelines, and a common way to approach the compliance issues. Anti-money laundering and combating the terrorism is one of the key issues that all players within international trade will have to deal with in the coming months and years. So I don’t think we have gone too far in that respect. What we need now is cooperation among the various countries, we need to have a common way to approach AML issues; the setup of a level of controls and reporting. That has to be done in a homogeneous way among the various countries. The second aspect is that we need stability. We need stability in the guidelines that are, let’s say, released in the different countries and the different regions – at the banking level, at a corporate level, to make sure that we are all talking the same language.

I think that what is felt today by the players, is that there is a hurdle created by those requirements in terms of compliance. It is not because of the level of requirements, it’s more because of the instability of those requirements.

But it is true that as long as you increase the level of control it creates additional costs in the implementation of one transaction. These additional costs have to be absorbed by someone, which is where there might be difficulties in the future. Because the implementation of new transactions will need to have the correct familiarisation for the different players.

The $1.5tn USD Trade Finance Gap and SMEs

DP: I think talking about the business models with respect to operational cost is very important here for the banks, and we’ll definitely talk about some of the progress made a little bit later on in this podcast. So, let’s talk about SME’s now – some 80% of international trade flows involve the recourse to a financial instrument, according to the WTO; be that a Letter of Credit, guarantee, or export credit. So, the rules and regulations mentioned earlier are affecting the banks, their corporates, and larger importers and exporters. But how is this affecting those that are in most need of trade finance instruments, such as SMEs, and those in emerging markets, which we hear so often from the ICC, from the ADB etc.?

OP: Well, you have mentioned that there is a $1.5 trillion USD financing gap that exists today. This is a very difficult figure and, of course, we have to take some initiatives, we have to take some disposition to ensure that there will one day, be a significant reduction / decrease of this level. If we analyse this $1.5 trillion a little more, what we see is that the large majority of transactions which are rejected by the banking industry today are coming from SMEs.

I think the proportion is something around two thirds. So two thirds of the projected transactions are coming from SMEs – this does not mean that two thirds of the transactions proposed by SMEs are rejected, I’m talking about two thirds of the rejected confessions, not two thirds of the transactions proposed by SMEs! I want to be precise on this point, because from time to time, I read that there is a confusion around this figure. However, it is certain that SMEs are the categories of players in this industry, which is the most impacted by the level of requirements attached to compliance, regulation and everything. Of course, what we have to do is to define some specific features that will apply to SMEs in order to help them have better access to financial services and the banking industry on a global basis.

Let’s imagine, for instance, that there will be no regulation in the future, no compliance requirements. OK, even with that, I’m not sure that the banking industry alone would be able to fill in this financing gap of $1.5 trillion USD. So the solution, or maybe one of the solutions, will be new technologies, the appearance of new players and new commerce in this industry. So maybe in the future, a portion of this gap will be filled not by the banking industry, but by newcomers, such as insurance companies, pension funds and treasury funds – entities that would have the clear capacity in terms of funding and the capacity to take some risk on the transaction, with the correct level of remuneration. This is why I come back to my previous point, I think the remuneration of those transactions is also an important point to make sure that this gap will be reduced in the future.

Standardisation of Trade Finance Terminology – A Case for Interoperability

DP: Yes, I’m completely with you there. And perhaps we do need to take a look at the role of non-bank financial institutions, other technology providers and new players. And actually, we released our second issue of Trade Finance Talks, our magazine today with a spotlight on some of the NBFIs, some of the insurance players and the role of securitization perhaps, and other instruments to help facilitate trade.

But with tech comes the need for different financiers and providers to actually talk to each other across different platforms. And standardisation, I think, is another key issue and concern for the trade finance industry, across many jurisdictions. It leads to ambiguity, inconsistencies and variance amongst different banks in different countries as you know and bring up frequently. What is the view from the Banking Commission, and what is being done to standardise trade terminology?

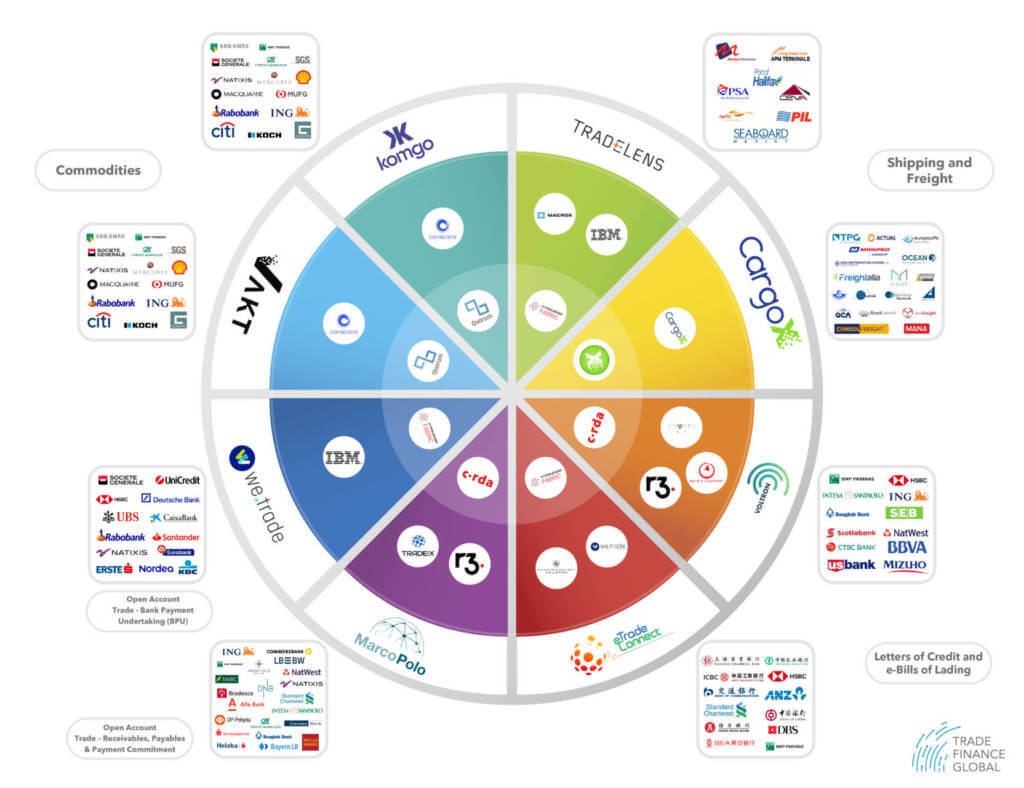

OP: Well, this is something which we’ve been working on for a few months now. I think this is exactly the point you mentioned, I think what is important is to create the interoperability amongst the largest platforms. We will not create one single technology for everywhere and everyone; we can ensure that there will be different DLT technologies, blockchain technologies, that will be developed by different countries and different FinTechs, which is absolutely encouraging. As long as we have many people involved in this research, a good solution will emerge one day – I’m absolutely convinced of that.

See the interactive diagram

What is not taken into account by one single FinTech or one single bank, is to make sure of the interoperability amongst the various trade platforms, which is to say that we have to create the standards across those different platforms so that they have the capacity to connect and the capacity to speak to each other.

We are working on that and have set up an important task force gathering dozens of the largest players in the banking industry. The people in this group are representing those different banks, which makes up a significant portion of the market of trade finance. In the coming months, we will probably announce the preliminary results of the creation of these products. But it will take some time – this is not an easy task – it is not something that would produce before September 2019. It will take much longer than that but it will be successful because we have been around the table with the key players and the key actors of this industry in the future.

Waiving Article 55 of the BRRD?

DP: Yes, interoperability and the idea of a network of networks is so important. We were at Consortia 2019, BCR’s conference last week, talking about this and theorising some ideas for how the different networks and Consortia here can work together and whether a body like ICC should be leading and paving the way for this – I’m very glad that you guys are considering e-bills of lading versus bills of lading and the shipping and logistics space, not just pure trade, letters of credit, open accounts, etc. It’s very important to take a holistic helicopter view of trade.

Let’s get technical and talk a little on the progress that has been made as you mentioned earlier. Tell us about any amends in Article 55 of the BRRD (the Bank Recovery and Resolution Directive), and why we can’t waive this text completely for the trade finance sector?

OP: Ah, it would have been the best solution of course. But unfortunately, this was not possible. Don’t ask me why, maybe we should raise the question at the European Level? But no, as you see, I guess once the concept this described in Article 55 was put on the table and applied to the many aspects of difference financing products out of trade finance, it was maybe a little bit complicated to totally waive the application of this Article for an entire sector.

That being said, you know the article 55 aims to ensure that banks will not be destroyed somehow by commitments that these banks could have with external parties, preventing people having deposits in these banks to recover their money on their demands.

So basically, the concepts of, let’s say, putting together some regulation, with the aim of protecting private people and ensuring that they could recover their deposit in the bank – I think it was a good idea. So I have no problem with the philosophy around Article 55.

The difficulty is that we have to make sure that the regulation is implemented in the different regions. If we apply Article 55 as it was designed at the beginning, to all banks that are located in Europe, we are creating a differentiation in terms of competition between the businesses in Europe and the businesses out of Europe. The introduction of the bail-in clause, which is the essence of Article 55, saying that the bank will, for instance, pay or fulfil its obligation, as though a Letter of Credit, only if the bank has a good financial stability and financial health, is creating a differentiation, compared to the banks out of Europe, which will not have this kind of if and when clause in the obligation of payments relating to the Letter of Credit. And this is where we started to discuss with our European authorities, to explain that even if the philosophy of Article 55 is good, if we apply it like this, it is creating large hurdles for European exporters and importers compared to other regions of the world.

So, what we have obtained is not a full waiver of trade finance, unfortunately, but a kind of reverse application of the Article 55. It means that Article 55 is implemented but, depending on the different jurisdictions, i.e., the different countries, if the banks located in a particular country ask the local regulator for a waiver on the transactions relating to trade finance, they will obtain it.

So it’s a reverse procedure, somehow. It means that it is not an obligation coming from Europe and then coming from the local regulator to banks to fully apply Article 55 – it is a recommendation to apply. But if the banks are explaining to their local regulator that they are not in a position to apply Article 55 because it will create large difficulties in the implementation of the transaction, the local regulator will give the bank a specific waiver for that transaction. So, it is not exactly what we considered at the beginning, but we consider that the result is good. Because at the end of the day, it will not negatively impact the European business compared to Asian businesses or America’s businesses. The consistency of implementing regulation will be maintained in that case.

NFSR (Net Stable Funding Ratios) and Trade Finance

DP: Okay. Yeah. So in in a roundabout way, there has been some good progress there. What about the NSFR (net stable funding ratios), and the negative impact of this on trading businesses?

OP: Well, it’s not the same story compared to Article 55. But it is more or less the same story in terms of homogeneity of the application. As you know, the NSFR has to be differentiated, taking into account the maturity of the transaction. So you have a different step of maturity below one month, between one month and six months, and above six months.

And so, in some countries, you have a flat rate of NSFR whatever the majority of the transaction is, and you hope you have different rates, depending on the maturity. At the beginning of our discussion, there’s a different rate, we’re going from 5% to 15%. 15% for longer maturity and 5% for the shorter-term transactions. Take a country like Brazil, for instance, if I remember correctly, they have one single rate, applying to all maturity, which was limited to 3%. And you have other jurisdictions or other countries, where they decided not to apply any NSFR requirements. So, in the world you have several different ways to apply these requirements. So it was difficult, because at the European level, it was maybe one of the highest level of rates that was supposed to be applied.

The question is not over on this field, we still have some discussion to have with Europe, but what we understand is that the scale, or the differentiation among the various level of rates will be reduced. So, perhaps we will not go from 5% to 15%, we’ll go from 5% to 10%, for instance, which is not exactly what we would have liked to obtain but at least it is already progress compared to the initial proposal that we still need to continue discussing.

The Role of Digitalisation in Regulation

DP: Thank you. What are the next steps for ensuring that regulation does not hinder the availability of finance and remains relevant in a digital landscape?

OP: Well, this question is a little bit difficult, because it’s difficult to anticipate the next steps. However, I would say the following: I think we have enhanced our knowledge of all different elements of regulation that are on the table. I do not anticipate a new topic or new set of rules or new ideas of regulation that will come from nowhere, which would create a totally different picture compared to what we have up to now.

The only point is that we have to accompany the businesses and the market in a proper way. So the next step is to continue the dialogue with the regulators, as experience shows that the regulators are listening to ICC. They take into account what we say we have demonstrated – that we are in a position to obtain some good results. So, we have to continue on that.

The next big step is digitisation – what will be the consequences of digitisation, what will be the consequences of the appearance, the emergence of new players, who will regulated in a different way?

Of course, the constraints, the Basel Committee recommendations for instance, do not apply to non-banks today. So how do we tackle this, how do we manage this situation? The idea is not to totally open the game to the non-bank industry and to kill this activity for the banking industry. The idea is to find a proper way to maintain and improve the situation of the banking industry to allow them to continue to develop their business. The idea is to allow also SMEs to have access to financial services. But it has to be done in a commercial way, in the proper way and in a fair way. The idea being not to destroy anything or to prevent anyone to be part of the game. The idea is to find the proper way to accompany this move in the future.

DP: Thanks very much Olivier for your insights and knowledge into the impacts of regulation and compliance on banks, and implications this has on trade financing. I think you’ve bought up some good dialogue about the need for regulation, but the potential for technology, understanding business cases and the models for providing liquidity to businesses, and the role of intergovernmental bodies such. As. ICC in rulemaking and setting the agenda for the future of trade. We look forward to hearing about further progress in terms of Basel Committee regulations, tackling the situation with non-banks, digitalisation, DLT and blockchain working groups and growing global trade which is good and inclusive for all parties. So thank you very much, Olivier, for coming and joining us on today’s podcast of Trade Finance Talks.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.