Estimated reading time: 4 minutes

ICC Trade Register confirms that credit risk in trade, supply chain, and export finance fall back to pre-pandemic levels.

The International Chamber of Commerce (ICC)—along with their partners Global Credit Data (GCD) and Boston Consulting Group (BCG)—has released its 2022 Trade Register report, confirming that credit risk in trade, supply chain, and export finance have fallen back to pre-pandemic levels for 24 trade and export finance banks, representative of 9% of global trade flows.

Following the impact of the COVID-19 pandemic in 2020 on trade volumes, 2021 reaffirmed the resilience of global trade with a strong and better-than-expected return to growth, with total trade flows reaching nearly 20% above pre-pandemic levels.

While the Trade Register is not necessarily representative of the conditions facing smaller banks, the results of the report remain promising.

Trade flows and growth rate

This recovery in global trade, as well as its consistent growth over the last three decades, has been clearly supported by trade finance products that offer liquidity and risk mitigation solutions for importers and exporters, allowing them to transact with confidence across borders.

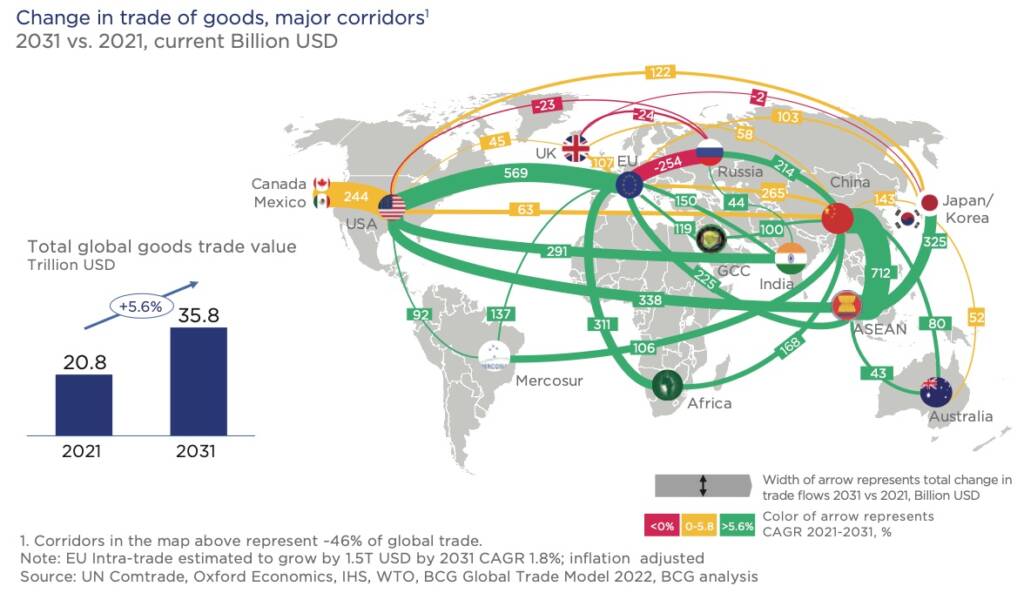

Despite the current macroeconomic uncertainty, BCG expects global goods trade to continue to grow at a further 5.6% compound annual growth rate (CAGR) over the next 10 years on a nominal basis, and 2.3% in real terms (figure 1).

Figure 1. BCG forecast of 2021 vs. 2031 trade volumes and patterns. Source: ICC Trade Register 2022

LGDs across LC, guarantee and SCF products

The ICC Trade Register continues to be the global authoritative source of default rates in trade, supply chain, and export finance using its data set that represents nearly a quarter of all global trade finance transactions.

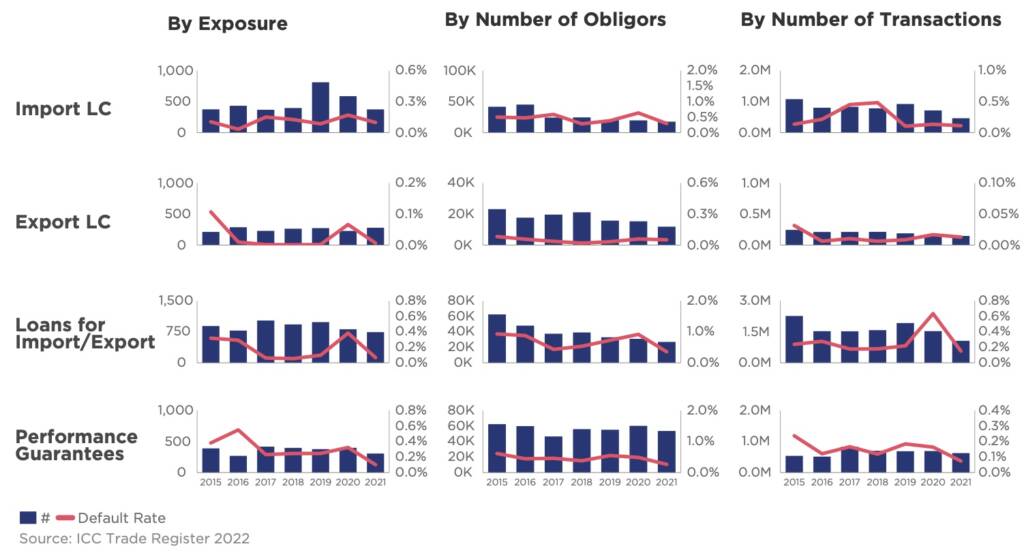

For 2021, the report confirms decreases in default rates across all asset classes versus the prior year (figure 2):

- Import letters of credit (LCs): obligor-weighted default rate decreased from 0.64% in 2020 to 0.29% in 2021 (-0.35 ppts.)

- Export LCs: obligor-weighted default rate increased from 0.06% in 2020 to 0.05% in 2021 (-0.01 ppts.)

- Loans for import/export: obligor-weighted default rate increased from 0.92% in 2020 to 0.36% in 2021 (-0.56 ppts.)

- Performance guarantees: obligor-weighted default rate decreased from 0.49% in 2020 to 0.26% in 2021 (-0.23 ppts.)

- Supply chain finance: obligor-weighted default rate decreased from 0.93% in 2020 to 0.06% in 2021 (-0.87 ppts.)

- Export finance: obligor-weighted default rate decreased from 1.01% for 2007-20 to 0.97% for 2007-21 (-0.04 ppts.)

Figure 2. Summary of default rate trends for trade finance, 2015–2021. Source: ICC Trade Register 2022

While a fall in default rates versus 2020 would be expected, it is even more reassuring that in many cases 2021 default rates are below pre-pandemic averages; this is likely driven by rapid economic recovery following the deployment of effective COVID-19 vaccinations combined with continued government stimuli across many markets.

ICC Secretary General John W.H. Denton AO said, “These findings reinforce the findings of previous iterations of the Trade Register: trade finance products continue to be resilient and represent banks with low levels of credit risk, even during times of macroeconomic uncertainty.

“It is important for banks, investors, and regulators to recognise this and show continued support for this valuable asset class.”

As part of ICC’s ongoing ambition to improve the value the Trade Register brings to its member banks and the trade finance community, in this year’s iteration the Trade Register introduces an improved data set for the calculation of loss given default (LGD), allowing for improved estimates of these values and, for the first time, LGD and expected loss estimates for supply chain finance.

Supply chain finance on the rise… and so were LGDs

For the first time, the ICC Trade Register was able to report on the Loss Given Default rate for payables finance. Representing an estimates 16% of global supply chain finance exposures, LGDs increased from 0.09% to 0.13% in 2020 versus 2021, “potentially driven by the default of a corporate with a high-volume, low-value SCF programme”.

Questionable data

ICC introduced a new commercial model for the Trade Register, for paying member banks in 2021, which continues this year. The value proposition is aimed at member banks, therefore, it is important to note that this is not representative of the entire trade banking ecosystem.

As this report extends to just 21 banks, it does not illustrate or reflect 91% of global trade flow data from other banks, who have not shared their data.

Despite the narrow scope of this project, the Trade Registry indicates a positive step towards post-pandemic trade recovery and risk appetite in the current macroeconomic and geopolitical environment.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.