As the most authoritative voice in the trade finance industry, ICC Banking Commission, maintains a permanent dialogue with regulators and supervising bodies, helping to develop regulations affecting the industry. The Commission also works towards the development of digital trade – through collaboration and alignment with governments and industry. Their Digital Trade Roadmap provides concrete steps to enable a new era of digital trade.

In this 2020 interview series, TFG spoke to 20 experts in trade, receivables and supply chain finance.

An Interview with ICC Banking Commission

Name: David Bischof

Position: Deputy Director, Finance for Development Hub

Organization: ICC Banking Commission

Interviewed by Nikhil Patel (NP), Analyst, Trade Finance Global

2019 – ICC Trade Register report, the Roadmap of Digital Trade and the Wolfsberg, ICC and BAFT Trade Finance Principles

Nikhil: In 200 words, what were the key highlights and opportunities of 2019 from an industry perspective in trade, receivables and supply chain finance?

2019 was a year of many milestones for the trade finance industry and in particular for the International Chamber of Commerce (ICC), which celebrated its centenary.

From an ICC point of view, key highlights included the release of the 10th edition of the ICC Trade Register report, a flagship publication which originated from the onset of the global financial crisis to measure global risks in trade and export finance. For the first time, the report analysed supply chain finance (SCF) and payables finance in particular, revealing the low-risk nature of payables finance assets.

As the trade finance industry moves towards a new digital era – characterised by lower costs and increased market access for small and medium-sized enterprises (SMEs), digital trade-related rules are becoming increasingly important. Thus, as part of its mandate in setting rules and standards, ICC evaluated all existing ICC rules to make sure that they enable banks to accept electronic documents and data, instead of paper documents only. As a result, ICC released eUCP version 2.0 and eURC version 1.0.

In this context, ICC also released a Roadmap for Digital Trade, which includes four primary objectives to advance digital trade in Financial Services. Those objectives include the automation of paper-based processes, as well as encouraging greater financial inclusion, revised legal frameworks and interoperability between systems.

Meanwhile, following the release of their Standard Definitions for Techniques of Supply Chain Finance in 2016, the Global Supply Chain Finance Forum – comprised of BAFT, the EBA, FCI, ICC and ITFA – issued the first in a series of papers examining the various supply chain finance techniques in further detail, titled “Receivables Discounting Technique”.

Another significant development from this year was the release of the updated Wolfsberg, ICC and BAFT Trade Finance Principles, which expand on various key questions for the industry regarding risk mitigation and financial crime compliance.

NP: What are your top predictions for trade, supply chain and receivables in 2020?

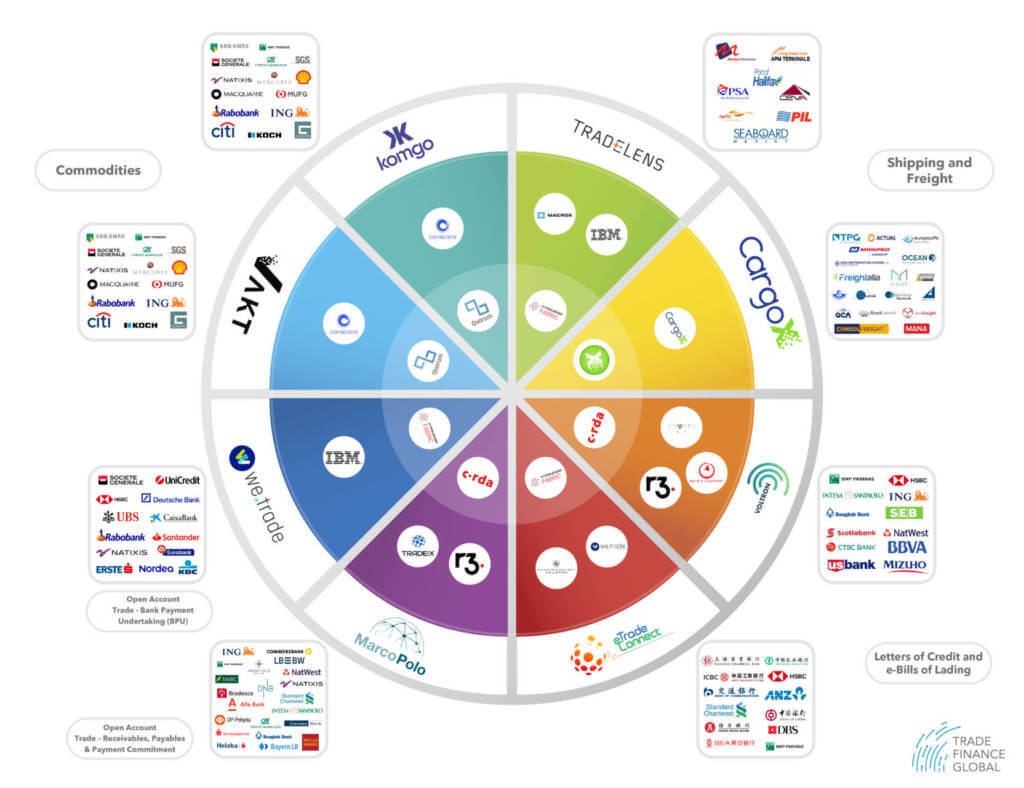

We expect major changes throughout 2020 as the digitalisation of the trade finance industry continues to develop exponentially. The evolution of blockchain will especially be something to look out for as projects and initiatives move beyond the pilot phase. ICC is currently developing a Digital Trade Standards Initiative (DSI) to promote cross-industry digital trade standards to drive technical interoperability among the numerous blockchain-based networks and technology platforms that have entered the trade and trade finance space over the past two years.

See the interactive diagram

- Growth of non-bank finance providers

Other trends to be aware of include the growth of non-bank finance providers in the trade finance market. The industry as a whole recognises the opportunity for alternative financiers – namely institutional investors – to help close the financing gap, which will notably help SMEs access adequate financing.

- Fintech presence

The presence of fintech in the trade finance industry is also shaping client preferences, and collaboration with traditional trade finance providers is expected to continue growing. We have recognised this trend with the first-ever Fintech Showcase set to take place at the Banking Commission Annual Meeting in April.

- Interest in sustainability

Meanwhile, practitioners’ interest in sustainability is growing, with discussions surrounding sustainability-linked financing becoming increasingly important, for example. We expect this to continue into 2020 and beyond, as global momentum for sustainable trade and investment continues to grow.

2020 Predictions in Trade and Supply Chain Finance – An ICC Banking Commission Perspective

NP: In 200 words, what are the biggest challenges in trade, receivables and supply chain finance you predict for 2020?

As the digitalisation of trade finance continues at pace, new and aligned rules, as well as updated laws and regulations, will be required in order to reduce legal uncertainties.

ICC work is now in progress to draft a new set of rules under the working title Uniform Rules for Digital Trade (URDT). The objective of the URDT is to develop a high-level framework outlining obligations, rules and standards for the digitalisation of trade finance.

As mentioned earlier, ICC is actively developing cross-industry digital trade standards through the DSI. These will build on existing work that had been done in the industry by the Universal Trade Network, as well as other initiatives and organisations.

Over the past few years, many initiatives and projects have been established to encourage this standardisation of digital trade. There is now a need to encourage and streamline these efforts at a global level. This will be a critical task going forward and one we expect to be at the heart of our, and the wider industry’s work next year.

Key Priorities for 2020

NP: What are the key priorities for ICC in 2020?

Sustainability, digital trade and advocacy will be at the heart of our mandate in 2020.

Achieving the United Nations’ Sustainable Development Goals (SDGs) will require enormous investment. But with the current macroeconomic and geopolitical volatility, most investors continue to seek liquidity and short-term gain. We must encourage a shift in market incentives to spur investment into areas supporting the SDGs and promote alignment between global financial regulation and the imperative of long-term sustainability.

As the most authoritative voice in the trade finance industry, we also need to maintain a strong, permanent dialogue with regulators and supervising bodies, helping to develop regulations affecting the industry. Our advocacy regarding Basel III implementation has already led to several amendments. With implementation into national legislation nearing, additional areas will need to be examined in further detail. Finally, work towards the development of digital trade – through collaboration and alignment with governments and industry – will be a core objective for 2020 to deliver better access to innovation for all. Our Digital Trade Roadmap provides concrete steps to enable a new era of digital trade. We encourage our members and partners to use it as they strive to understand and resolve the barriers to digital trade finance.

The technology that will kick off the success of 2020

NP: What’s your top prediction for a technology that you think will truly kick off / have the most success in 2020?

Distributed ledger technology (DLT) has vast potential – and we can expect further progress next year. Indeed, in the ICC 2018 Global Survey, DLT was highlighted as a priority area of development over the following three to five years for banks.

And in November 2019, ICC partnered with Perlin, DBS Bank, Trafigura, Infocomm Media Development Authority and Enterprise Singapore to pilot ICC TradeFlow, a blockchain platform aimed at simplifying the trade documentation process for all parties, enabling them to visually map out trade flows, issue instructions to partners, and analyse trade actions in real time.

Automation through DLT will help enable wider market access to SMEs, often locked out of the trade finance market due to the high-cost, paper-heavy processes and requirements. DLT could also help improve sustainability tracing in trade finance transactions.

Read our trade finance 2020 predictions here

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.