Technology platform Chainlink, Microsoft Brazil, the Brazilian digital bank Banco Inter, and IT services company 7COMm are developing it. The pilot programme aims to demonstrate cross-border agricultural commodity transactions using… read more →

Trade negotiated on the Finteum Platform, which uses R3’s Corda, and executed on the TP ICAP UK MTF, with Finteum also acting as the arranger

At MC13, 27 February, a group of leading international organisations forged an agreement to promote a unified goal of developing a neutral, open, non-profit, and inclusive digital platform for sharing trade data.

The International Trade and Forfaiting Association’s (ITFA) Digital Negotiable Instruments (DNI) Initiative Day, hosted in London on 12 July 2023, served as an important platform for the future of trade finance.

The Single Trade Window (STW) is a technology concept proposed within the 2025 UK Border Strategy, published by the Cabinet Office in 2020. It builds upon the recommendation and guidelines proposed by the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT).

Trade is critical in advancing economies, including those in the MENA region. At the same time, trade finance presents unique opportunities for criminal exploitation, also referred to as Trade Based Financial Crime (TBFC).

Tuesday morning, the Institute of Export & International Trade (IoE&IT) and Ernst & Young (EY) released their report, “TradeTech: A pathway for businesses to seize trade opportunities”. Marco Forgione, director… read more →

The evolution of cross-border payments is more exciting than ever. However, for banks, the priority is to use the payment data for compliance and differentiation. So, get your data in order.

On November 15 a group of major banks including Citigroup, HSBC, BNY Mellon, Wells Fargo and the Federal Reserve Bank of New York initiated a 12-week digital dollar pilot. The… read more →

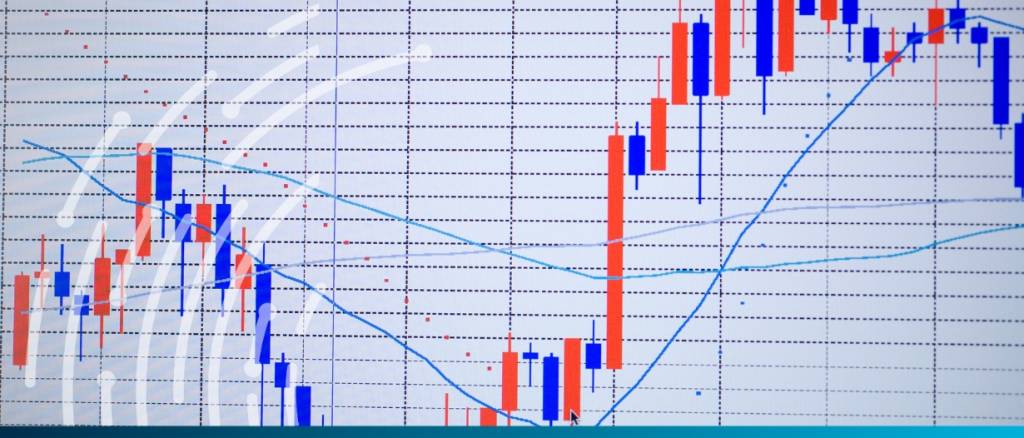

Capgemini’s 2022 World Payments Report finds that 89% of small and medium businesses (SMEs) are considering switching to challenger banks and alternative PayTech providers. Market volatility. It affects everyone, but… read more →