Swift MT 760 – A comprehensive Guide [UPDATED 2025]

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get Started

ADVERTISEMENT

Contents

MT760 is a type of SWIFT Message used by banks to issue Standby Letters of Credit. Banks issue Standby Letters of Credit to guarantee payments for clients in case the business they are trading with defaults.

What is MT760?

MT760 is a way banks provide guarantees, in the form of Standby Letters of Credit (also known as Documentary Credit), through the SWIFT messaging platform. Essentially, the MT760 tells the receiver that the sender guarantees to pay on behalf of a customer in case of his default, acting as a guarantor for the customer.

SWIFT is a messaging system used by banks and financial institutions around the world to send and receive information quickly and securely. Information is sent through codes identifying institutions – the Bank Identifier Code (BIC) – and Message Types – like 760.

What is MT760 used for?

MT760 is used by banks to send, receive, and request Standby Letters of Credit and Documentary Credit.

Because sending an MT760 is equivalent to issuing a guarantee of payment, MT760 messages need to contain a lot of information on the sender, receiver, transaction type, and underlying trade. An MT760 message is used to send the recipient bank this information so they can ring-fence the funds to complete the transaction.

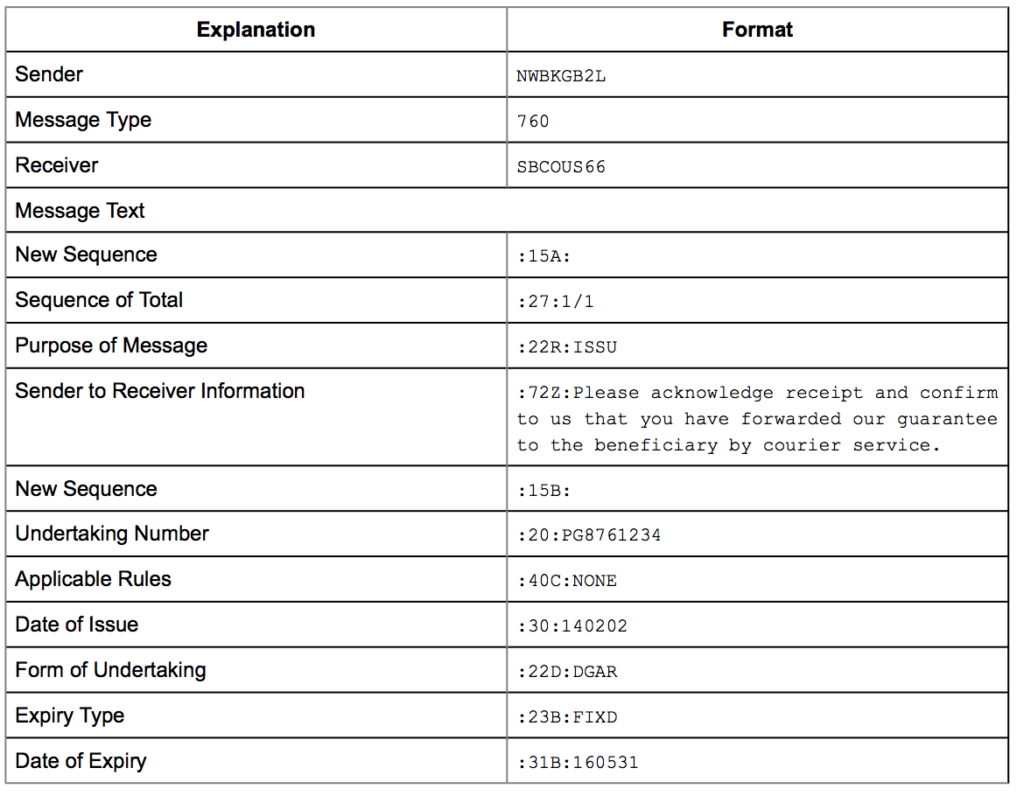

Example of the format of an MT760

An example of an MT760 message could include the following:

- A narrative statement explaining the context (e.g. XX company has signed a contract with YY company to provide equipment)

- Narrative would state all of the details of the transaction (as per the formats above).

- The SWIFT message would include the Sender, Message Type (760), Receiver and Sequence number, before providing information required.

Figure 1: An example of a MT760 (Source: SWIFT)

MT760 vs MT799

MT799 is also a type of SWIFT message sent from an issuing bank to an advising bank, but it is used as proof of funds, not as a transfer of funds or guarantee.

This means that MT799 needs to contain much less information than MT760, and can be much simpler to send. MT799 is also free, while MT760 can sometimes incur a fee of 1-2% of the total value.

To find out more about the difference between MT760 and MT799, read our MT799 and MT760 guide.

What are the rules of the MT 760?

MT760 can be used either by the party issuing a guarantee or Letter of Credit, or by the party issuing a counter-undertaking to the beneficiary.

Often MT760s reach their maximum size limit, so one or more extra messages can be used to extend the total size. MT761s are messages used to extend the total MT760 message size; up to 7 MT761 messages can be sent in addition to the MT760, for a total of 8 messages.

The information on MT761 messages must not contradict any of the information in any of the preceding MT761s or in the MT760 they are linked to. It is also important to ensure no duplicate information is sent in any of the messages.

Sequence C (Optional Information) can only be used when Sequence B is for a counter-undertaking for a Guarantee or Letter of Credit.

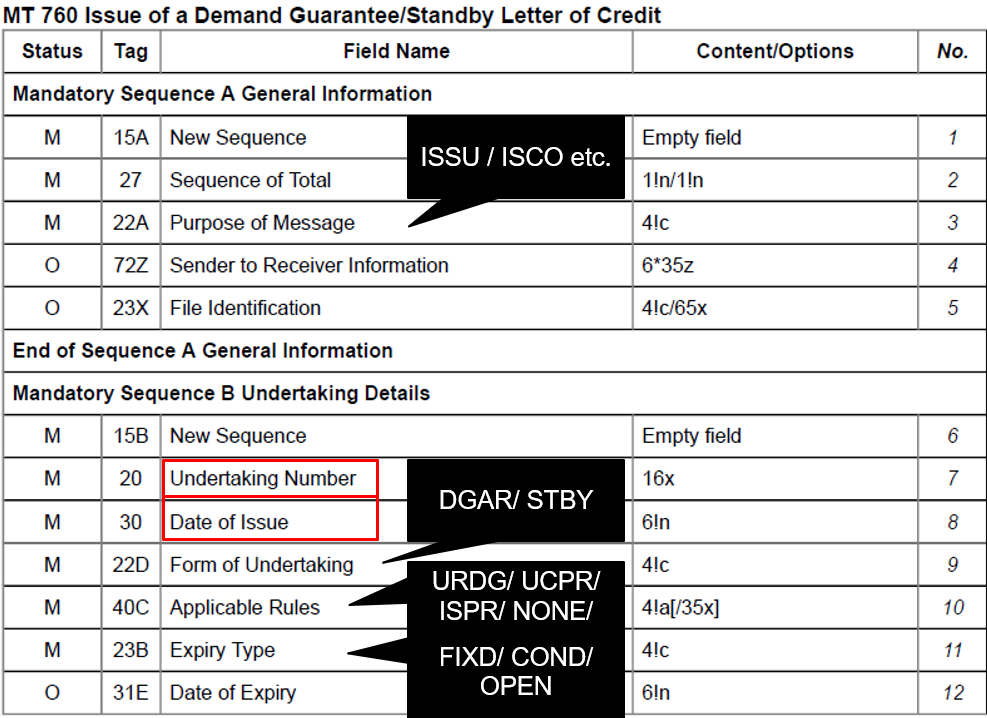

MT 760 Criteria

Unlike the MT 799, the MT760 requires a lot of information on the transaction and the parties involved. This information can include:

- Parties involved (Issuer, Beneficiary, Applicant, Obligor, Advising Bank)

- Transaction Details

- Transport details and presentation of goods

- Dates and timings

Source: Bank On School

What is SWIFT used for?

When it first went live in 1977, SWIFT was used by 518 members in 22 countries; now, the platform is used by over 11,000 institutions in more than 200 countries.

Originally, the founders of SWIFT aimed the network at treasury communications. However, its popularity grew and with it SWIFT’s customer base. The platform’s format allowed for great expansion and led to SWIFT to now be used by:

- Banks

- Exchanges

- Asset Management Companies

- Brokerages/ Trading companies

- Normal Businesses

- The treasury market

What happened before SWIFT?

Before SWIFT was used to guarantee Letters of Credit and send information, a system called Telex was used. This system was however characterised by low speeds, multiple security concerns and also no coding system

.

Transactions had to be described by the senders and interpreted by the receiver, a process which could be slow, burdensome, and inaccurate.

Potential issues and advancements for SWIFT

In late 2017, SWIFT worked on a proof-of-concept with six major banks w to discover whether blockchain technology could be used to reconcile their Nostro accounts in real time. Nostro accounts are accounts held by banks in countries other than their own, in the foreign country’s local currency.

The way in which blockchain constantly updates the logbook owned by every member of the chain provides transparency which SWIFT may look to utilise to increase efficiency in the messaging process.

It is thought that blockchain could help update information in real-time more securely, increasing transparency and reducing wait times. As many of SWIFT’s clients have astronomical transaction volumes, they are difficult to keep up with; blockchain could be a way to simplify and speed up some core processes.

However, blockchain integration has never gone beyond experimentation or proofs-of-concept in any aspect of SWIFT yet, so it is unclear whether it will have an impact at scale in the near future.

More information

- More articles on SWIFT Messaging Types

- Messaging Types Resources