Understanding MT 720: transfer of a documentary credit

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get Started

ADVERTISEMENT

Contents

Understanding MT 720: transfer of a documentary credit

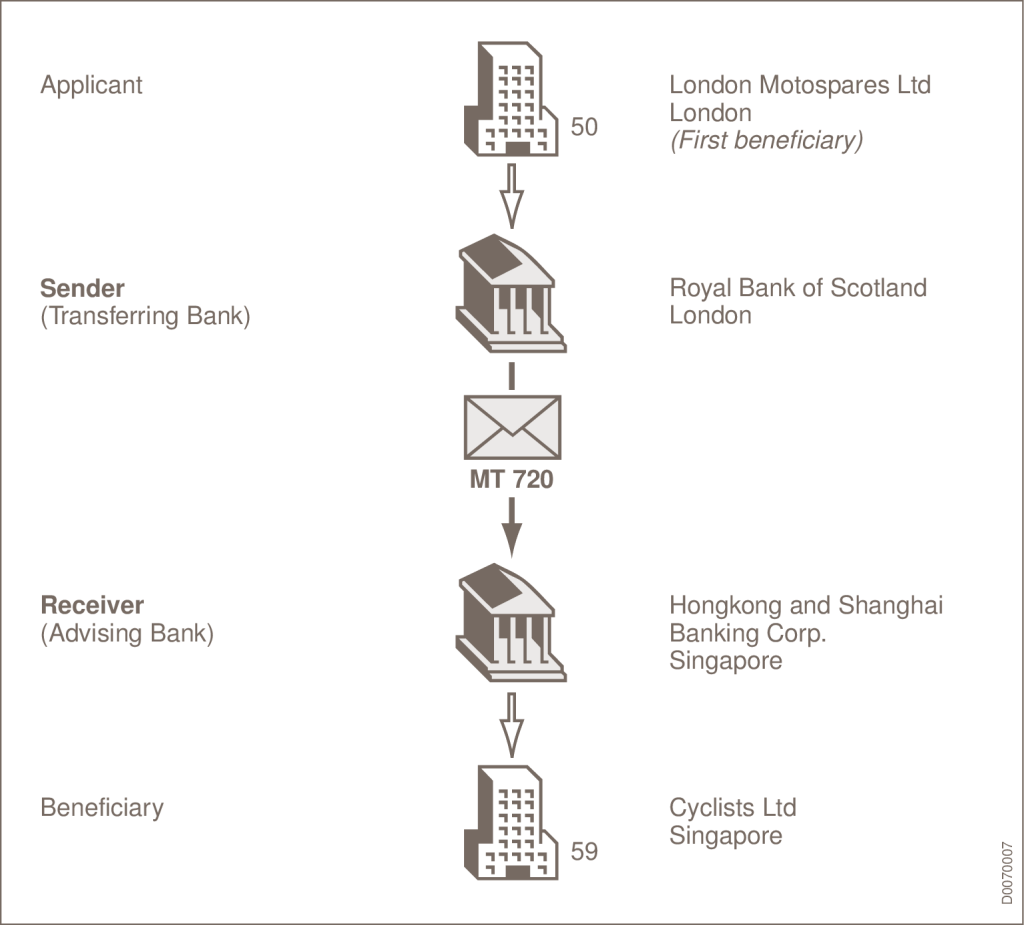

The MT 720 message is crucial in international trade finance. It is designed for when a beneficiary requests a documentary credit to be transferred to a second beneficiary. This SWIFT message is dispatched by the bank authorised to manage the transfer and directed towards the bank advising the second beneficiary.

It outlines the terms and conditions of the transferred documentary credit, in full or part, ensuring that all involved parties understand the credit terms underpinning their transactions.

MT 720 format specifications

The MT 720 is used when a beneficiary requests the transfer of a documentary credit to a second beneficiary. The bank authorised to advise the transfer sends this message, ensuring that all parties involved are informed of the terms and conditions of the transferred credit.

- SOURCE: SWIFT

MT 720 key fields:

The MT 720 message has several key fields, including:

- Fields 27 (Sequence of Total) and 20 (Transferring Bank’s Reference): These fields provide a framework for sequencing and identifying the transfer process, establishing a clear audit trail.

- Fields 31C (Date of Issue) and 31D (Date and Place of Expiry): These fields define the operational timeline of the credit, specifying its validity period and timing.

- Fields 50 (First Beneficiary) and 59 (Second Beneficiary): These fields identify the original and the new beneficiaries. This is crucial for acknowledging the transfer’s intent and confirming the parties’ rights and obligations under the new credit terms.

- Field 32B (Currency Code, Amount): This field specifies the amount and currency being transferred.

- Fields 41a, 42C, 42a, and more: Additional fields detailing instructions from the transferring bank (78D) and specifications on handling partial shipments and deferred payment details (42P, 43P) provide further information to the corresponding parties.

Network-validated rules and usage

The MT 720 message adheres to network-validated rules designed to ensure clarity, prevent errors, and facilitate the smooth processing of documentary credit transfers. These include:

- Fields presence and combination: Specific fields, such as 42C and 42a, must be present for a valid message. Furthermore, the message must accommodate the fields 42C and 42a together, field 42M alone, or field 42P alone, preventing any other combinations to avoid ambiguities.

- Operational instrument status: Unless specified otherwise, the MT 720 message, along with any supplementary MT 721 messages, constitutes an operative credit instrument. This underscores the message’s legal and procedural weight in the documentary credit transfer process.

- Consistency and non-repetition: Information conveyed must be consistent across related messages, with no repetition in any related MT 721 messages. This ensures that the transfer is precisely documented, upholding the integrity of the transaction.

Why is MT 720 an important messaging term for global trade transactions?

The MT 720 is important for global transactions as it:

- Enables flexibility in trade transactions: The MT 720 allows the original beneficiary of a documentary credit to transfer all or part of the credit to a second beneficiary. This flexibility is crucial in trade transactions involving intermediaries or when goods are sourced from third parties.

- Ensures accurate communication of terms: By providing a structured format for advising the transfer of a documentary credit, the MT 720 ensures that the terms and conditions of the original credit are accurately communicated to the second beneficiary. This accuracy is vital for maintaining trust and clarity between the parties.

- Facilitates risk management: Extending the security and assurance provided by a documentary credit to secondary parties supports the financial stability of the trade transaction, ensuring that suppliers and subcontractors are also protected under the terms of the original credit.

- Promotes efficiency in trade finance: The standardised format of the MT 720 message streamlines the process of transferring documentary credits. This standardisation reduces potential errors and misunderstandings, leading to faster processing and more efficient transaction handling.

- Supports smaller businesses: The MT 720 helps smaller businesses in international trade by enabling the transfer of documentary credits to second beneficiaries. This inclusivity promotes the growth and diversification of the global economy, allowing smaller entities to engage in transactions that might otherwise be beyond their reach.

Who uses MT 720 and why?

Users

Banks and financial institutions that handle documentary credits use MT 720 to facilitate the transfer of these credits at the request of the first beneficiary. This process is crucial for businesses engaged in international trade, especially when intermediaries or agents are involved in transactions.

Purpose

The MT 720 is essential for ensuring the terms and conditions of the transferred documentary credit are clearly communicated to the second beneficiary. This clarity is crucial for the smooth execution of trade transactions. It enables the second beneficiary to understand and comply with the terms of the credit, thereby facilitating global trade by extending the credit’s benefits to further parties in the supply chain.

Potential issues and advancements

Challenges

- Complexity of transfer: Transferring a documentary credit can be complex, requiring meticulous attention to detail to ensure accuracy and compliance with international trade laws.

- Operational risks: Errors in the transfer process can lead to disputes, delays, and potential financial losses, highlighting the need for precision and expertise.

Advancements

- Digitalisation and blockchain: Efforts to digitalise trade finance processes and the introduction of blockchain technology promise to streamline the transfer of documentary credits, reduce errors, enhance security, and improve efficiency.

- Electronic documentary credits: The adoption of electronic documentary credits (eUCP) facilitates easier and faster transfers, enabling better tracking and management of credits throughout the trade process.

The MT 720 is a cornerstone in the architecture of international trade finance, providing a structured and secure method for transferring documentary credits.

It provides flexibility, accuracy, risk management, efficiency, and support for smaller businesses in international trade finance.

- More articles on SWIFT Messaging Types

- Messaging Types Resources