Deep dive into MT 767: Amendment to a demand guarantee/standby letter of creditmessa

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get Started

ADVERTISEMENT

Contents

Deep dive into MT 767: Amendment to a demand guarantee/standby letter of credit

Swift message type (MT) 767 has an important role in trade finance. It simplifies the amendment of demand guarantees or standby letters of credit (SBLCs), allowing global trade transactions to operate smoothly.

To understand MT 767 fully, it is important to examine its structure, present capabilities, and expected enhancements.

Overview of MT 767

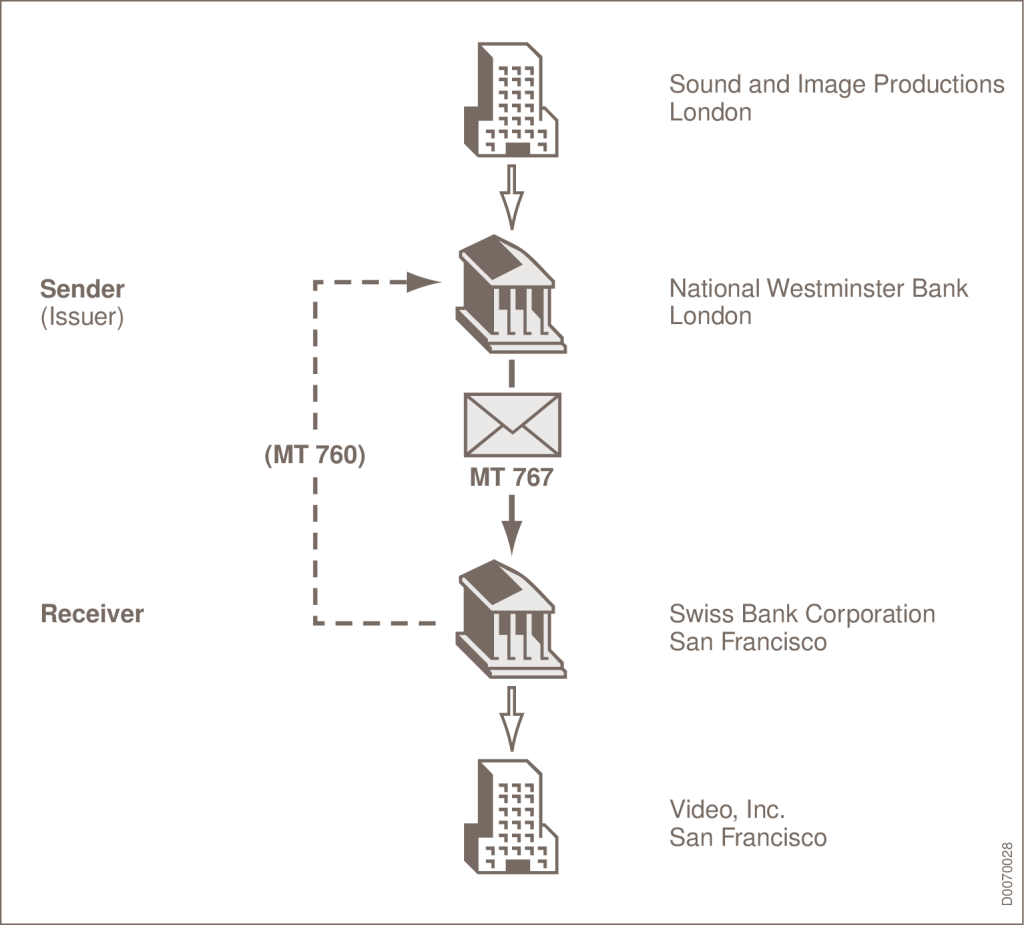

The MT 767 communicates amendments to financial agreements such as demand guarantees or standby letters of credit.

Issuers or advisors use this message to directly inform beneficiaries about changes. This is crucial, especially when the beneficiary is a financial institution or when there’s a designated party responsible for advising the beneficiary on these amendments.

The MT 767 message can communicate a broad range of modifications, including adjustments to the amount guaranteed, changes to expiry dates, and more detailed revisions to the terms and conditions.

SOURCE: SWIFT

Explanation of key fields

MT 767 has several key fields, including:

- Fields 20 (Undertaking Number) and 26E (Number of Amendment): These fields play critical roles in tracking and identifying the specific agreement and its sequence of amendments.

- Field 30 (Date of Amendment): This field captures the official date on which changes were implemented

- Field 52a (Issuer): This field identifies the authority issuing the amendment.

- Fields 32B (Increase of Undertaking Amount) and 33B (Decrease of Undertaking Amount): These fields address adjustments to the amount, clarify whether there is an increase or decrease, and provide detailed information on financial changes.

- Field 77U (Other Amendments to Undertaking): This field allows additional modifications to the agreement not specified in other fields, offering flexibility to cover a wide array of amendment types.

Users and purpose

Banks, financial institutions, and corporations engaged in international trade use MT 767 extensively as it enables the flexible adjustment of guarantees or standby letters of credit.

This adaptability ensures these financial instruments continue to be relevant and effective.

Importance in trade finance

The MT 767 represents the flexibility and adaptability that are crucial for international trade finance.

By enabling amendments to the terms of guarantees or standby letters of credit, the MT 767 is instrumental in risk management, dispute resolution, and ensuring compliance with international trade agreements.

Technological advancements and future outlook

Digital technologies and blockchain integration have the potential to revolutionise the processing of MT 767 messages, promising enhanced security, transparency, and efficiency.

These technological advancements are expected to streamline the amendment process, reduce errors, and foster a more robust trade finance ecosystem.

Such evolution points towards a future where amendments to guarantees or standby letters of credit are executed with greater speed and reliability. This development will facilitate a more agile and responsive framework for international trade finance.

- More articles on SWIFT Messaging Types

- Messaging Types Resources