Introduction to Letters of Credit | 2025 Guide

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get Started

ADVERTISEMENT

Contents

Letters of Credit

Welcome to TFG’s Letters of Credit hub. Find out how we can help you access Letters of Credit to increase your imports and exports to guarantee the payment and delivery of goods – or discover the latest research, information and insights here.

What is a Letter of Credit (LC)?

Letters of credit (also known as documentary credits in the US) are a financial facility issued by a bank that effectively functions as a guarantee to the seller that the buyer in a transaction will pay on time.

How do Letters of Credit work?

Letters of Credit (LCs) are used to guarantee payments and facilitate trade, especially in international transactions. When a seller wants a guarantee that they will be paid, the buyer may offer a letter of credit. This acts as a commitment on the part of the buyer’s bank that payment will be received on time, even if the buyer is unable to make the payment themselves.

LCs are regulated by the UCP 600, a set of standards and regulations issued by the International Chamber of Commerce. Information about LCs is transmitted via the Swift messaging platform through one or more MT 700 messages.

There are several critical features of documentary credits/Letters of Credit (LCs):

- Irrevocability: LCs constitute an irrevocable undertaking of the issuer to pay. This means that, once issued, the issuing bank cannot revoke or change the credit. A credit can only be amended or cancelled with the consent of the issuing bank, the beneficiary, and the confirming bank.

- Documentary nature: LCs are documentary in nature, so the payment undertakings they contain are conditional upon receipt of documents as stated in the terms and conditions of the credit. The documentation, often detailed and containing information about the shipment and the transaction, can be submitted physically or in electronic form.

- Compliance: LCs are settled only when the documents presented by the beneficiary comply with the letter’s terms and conditions. If the documents contained do not comply or contain discrepancies, the issuing bank may refuse to honour the letter of credit; the bank is only obligated to pay if the non-complying documents are corrected before the credit expires, or if both the applicant and the issuing bank agree to waive any discrepancies.

- Payment mechanism: LCs are effectively a payment mechanism designed to facilitate the settlement of an underlying trade transaction. They function by placing the bank as an “intermediary” between buyer (applicant) and seller (beneficiary): when the buyer receives the goods or services, the seller obtains payment via the credit, which satisfies the buyer’s payment obligations.

- Independence and autonomy: LCs constitute an independent undertaking of the issuing bank and the confirming bank that is separate from the underlying sale or other contract on which it may be based. The principle of autonomy is articulated within the UCP 600, the ICC’s set of rules governing letters of credit followed by banks all over the world.

Purpose of Letters of Credit

Letters of Credit are crucial to facilitate trade all over the world and build trust between exporters and importers.

LCs are independent of the underlying transaction; banks will often ask the applicant (usually the buyer) to provide collateral before issuing a Letter of Credit. This means that banks will only deal with documents – not with goods, services or transactions to which the documents may relate.

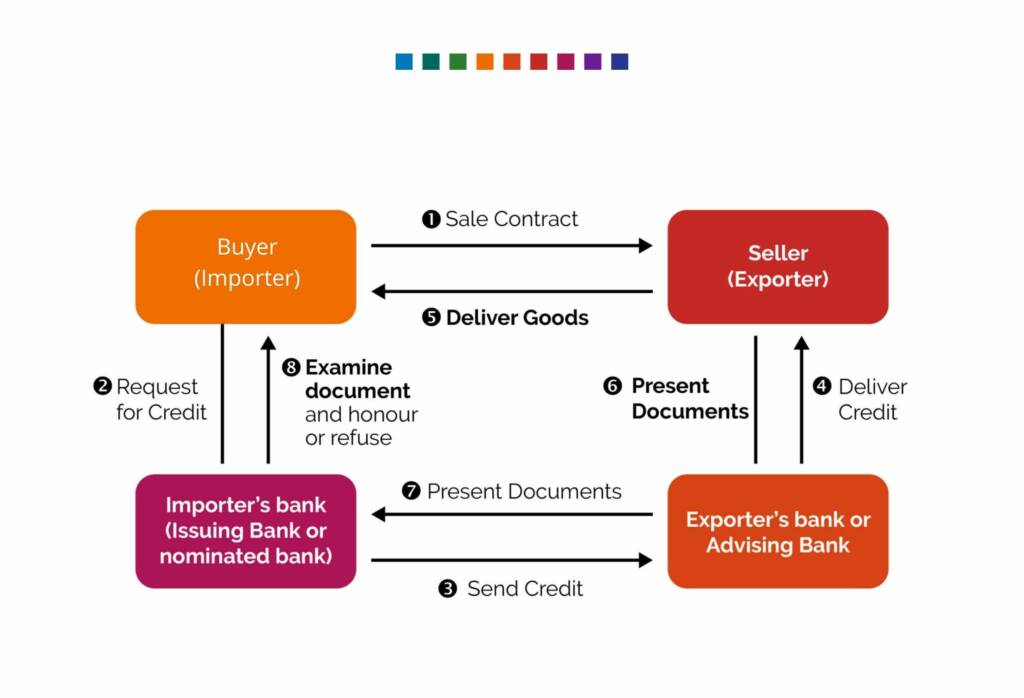

Diagram: How does a Letter of Credit work?

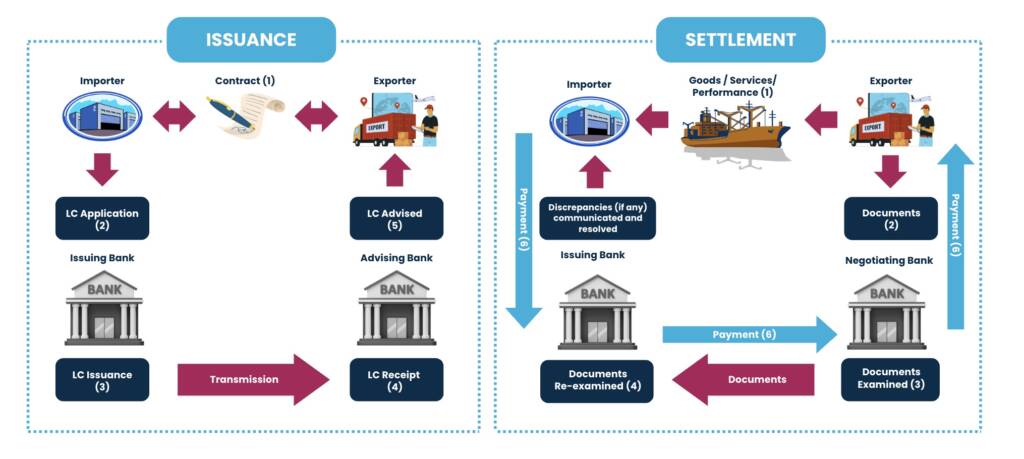

Diagram: LC Issuance & Settlement

Access Letters of Credit and Documentary Credits with TFG

The TFG team works with the key decision-makers at 270+ banks, funds and alternative lenders globally, assisting companies in accessing Letters of Credit.

Our international team are here to help you scale up to take advantage of trade opportunities. We have a team of sector specialists, from fuel experts to automotive gurus.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate trade finance solutions for your business.

Read more about Trade Finance Global, and how we can help you with your Letter of Credit queries, here.

Learn more

Look no further. We’ve put together our feature insights, research and articles: you can catch the latest thought leadership from TFG, listen to podcasts and digest the latest news from the LC community right here.

Frequently Asked Questions

t

Our trade finance partners

- Letters of Credit / Documentary Credit Resources

- All Letters of Credit Topics

- Podcasts

- Videos

- Conferences