We caught up with the President of the Bankers Association for Finance and Trade (BAFT), Tod Burwell. We talked about the balance of human capital and technology in the international transaction banking, about the amendments of the funded master risk participation agreement and how trade-based money laundering can be eradicated.

Featuring: Tod Burwell, CEO and President of BAFT

Host: Deepesh Patel, Editor, Trade Finance Global

I’m Tod Burwell, the President and CEO of BAFT. We’re an International Industry Association specifically focused on transaction banking. We’re headquartered in Washington, DC, but our members are located around the world and about 61 countries right now.

Here we are in SIBOS in London, 2019. As a representative of the International Transaction Banking Community, what has been keeping transaction bankers up at night?

So it’s interesting, so depends on who I’m talking to and where they’re from. There are slightly different things that are taking a higher priority. I think we have consistently heard regulation was something that kept seeing leaders up at night. But there are some growing headwinds, concerns about negative interest rates and a lot of positive energy about how to re-engineer their business particularly in the context of technological transformation. You know, their old business models may not really work in a new technology world. So you’re trying to think through business models, you’re trying to think through the balance of human capital versus technology.

Great. So let’s talk about some of the key milestones of BAFT. Can you talk to us about the new amends to the Funded Master Risk Participation Agreement for trade finance this year?

Sure. I’ve been at BAFT about eight and a half years. This was easily the most productive year from the standpoint of work product that the industry has been able to take advantage of; advocacy work that we’ve done; best practice guidance is and so forth. So most people when they think about BAFT, they think about the Risk Participation Agreement that we developed for secondary sales of trade assets. That was done about 10 years ago. There was a New York law version and English law version. And those have both gone through revisions this year, primarily because organisations that had been using them found that the way the business has evolved, the agreements needed to evolve with it. So we spent some time working with practitioners in the industry. We got together with the ITFA because they also have a membership base that are active users of trade risk participations. And we put together some revisions that reflect the current business environment. We took a look at one of the agreements to specifically try to achieve true sale on the secondary sales. And so there were some provisions that allowed for that. Now, both the old agreements and the new agreements are still in effect in the market. So it’s up to clients to decide. The other thing that was interesting for us this year is we worked with the IIFM, which is based in Bahrain. And they are really experts in Islamic finance. Some of our members, particularly in the Middle East, had noted to us that about 25% of the trade in the Middle East was being done as Islamic trade. And they were interested to see if they could leverage a similar type of agreement as to the Risk Participation Agreement for Islamic trade, but obviously it had to be modified. So we worked with the IIFM to come up with is now called Islamic Risk Participation Agreement. So that was launched in early 2019. And we have both funded and unfunded version of that. And we’re trying to get the market comfortable with that, so they can use it.

Great. So let’s talk about digitization. Why is the digitization of trade and Supply Chain Finance so important? And what is the industry doing about this?

If you walk around SIBOS, you can’t help but notice that technology is on par with banking, in the way that it’s displayed in the vendors and providers that are here. In all the topics of discussion. Trade is still very much a paper-based manual business. It’s very, very costly. It’s labour intensive. It’s difficult to do seamlessly, which is what we think about what technology has done for us in our daily lives. So much of what we do as humans is done in a touchless contactless, frictionless way. And when you think about how trade is done, it’s everything but frictionless and that creates a lot of obstacles. So the significance of digitising trade is to increase the ability of parties anywhere to do trade with others, to increase the cost-efficiency of doing trade with others, to increase the speed efficiency of being able to settle trade and transact trade, and really getting people used to doing trade and the way that they do everything else in their life. So there’s a lot of challenges with it because it’s a very fragmented process. So you have to get not only banks on board, you have to get their clients on board. You have to get SMEs on board. Ultimately, you have to get freight companies, customs organisations, and a lot of parties so it’s a very complex ecosystem. Well, one that obviously has a tremendous amount of potential if we can collaborate around it and get it done.

Absolutely, I think another issue within trade and supply chain finance is a financial crime, financial crime risks is abundant but very problematic for trade violence activities. And I know that together with the Wolfsburg group and ICC, BAFT continues to work on the standardisation and definition of some of these principles. Why is this important to the community? And can you explain a little bit more about these principles?

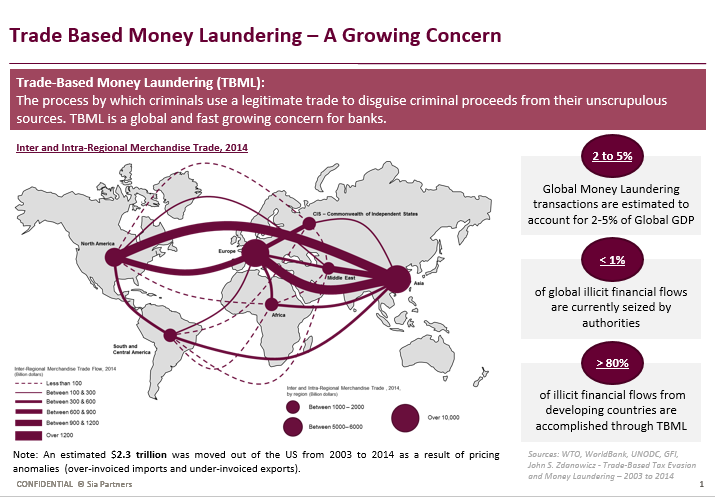

Yeah, so let me approach it from a little bit of historical context. So there’s been increasing concern from regulators around trade-based money laundering. Part of the challenge is that trade-based money laundering as it actually happens does not necessarily happen in the context of traditional trade, finance. So we’ve had to do a lot of work to really try to define what is trade-based money laundering, how does it happen? And what capacity do banks even have to try to identify it and interdicted? So we did a paper on combating trade-based money laundering in 2017. And that’s just one piece of the challenge. Another issue around financial crime is that if you look at trade and I think we all agree that there is about a one and a half $1.6 trillion trade finance gap, mostly with SMEs. What’s happened is a lot of that gap has originated because of compliance concerns, know your customer concerns and limitations that those banks have with doing business with smaller companies. So we have to somehow solve this problem if we’re going to solve the trade finance gap. So if we peel that back, and we look at the regulatory environment Some of the issues that the regulations are typically left with a certain amount of discretion for how its applied. It makes it difficult, from bank to bank, to bank to bank, to apply the regulations in the same way and in the most effective way. So we thought there were a need and an opportunity to try to develop some best practices for how to apply these regulations to gain some clarity about parts of the regulations that were maybe causing banks some issues. So working with the Wolfsburg group and the ICC, we were able to develop trade finance principles, which really look at a variety of issues, including non customer due diligence, looking at due diligence at a transaction level, not just at a client level, and tries to layout in a little bit more consumable fashion, what the expectations are. So we published the original version two years ago. This year, we updated that document to cover open account, as well as bank to bank trade loans. So we’re continuing to work together and I think the next iteration, we’re going to drill down and a little bit more detail on what the risk-based approach really means.

Okay, great. Thank you. And finally, we expect to see more active implementation of Basel III in the next 12 months. It is like Basel IV, Right. What is BAFT doing here?

Yeah, so if we go back five or six years ago, that was our single most important advocacy topic. And working together with the industry. I think collectively, we laid out about eight or so issues that were significantly and negatively going to impact the trade finance, business and the ability of banks to lend. So of those eight issues, and working with the Basel Committee and working with the local and regional regulators, I think we were able to get some agreement on modifications to about six of those issues. In the final framework of Basel III, I think a couple of those settled issues have become a little bit unclear again. So the industry is has coalesced to try to identify in the final framework, what are the issues that are still really going to cause some difficulties for banks to provide real economy lending. What happens is every geography then has to go and implement the Basel framework in local law and into local context. So we’re having conversations on a local jurisdiction level now about how countries are going to implement Basel III. And hopefully they will implement the framework in a way that really considers the low risk nature of trade finance.

29th Annual BAFT Conference on International Trade

Great. Well, Tod, thank you so much for joining us here in SIBOS.

My pleasure.

And we’ll see you in Chicago. Tell us a bit more about the Chicago conference.

So we have our Annual International Trade conference in Chicago. We’re excited about it. We have a variety of important topics. We have the newly appointed president and chair of US EXIM Bank, which is one of the organisations we have been fighting to get reauthorize so we have her joining us in Chicago, will have a variety of sessions that touch on digitization, as well as Supply Chain Finance, evolutions and a whole host of issues. It’ll be a good chance for more thought leadership around hot topics. It’ll be a good chance for people to network.

Great and TFG are media partners there so we will be there and be covering the event.

Looking forward to it.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.