TFG heard from Joel Schrevens Global Solutions Director of China Systems about the state of the trade and supply chain finance ecosystem. Established in 1983, China Systems is a leading trade services solutions vendor. The company is fully focused on providing an integrated front-end and back-office platform catering for internal and external deployment at a domestic, regional or global level.

Featuring: Joel Schrevens, Global Solutions Director, China Systems

Host: Deepesh Patel, Editor, Trade Finance Global

Joel, welcome to Trade Finance Talks. Good to be here at Sibos 2019. So introduction – Who are you? Where are you from? What do you do?

First of all, thank you Deepesh for having me. So my name is Joel Schrevens, I’m Global Solutions Director of China Systems. I’m responsible for product strategy at China Systems. At China Systems, we’re focused on trade finance and supply chain finance, we provide traditionally trade back office and also portal solutions, and also we’re very active in the digital transformation space.

Great. So you’ll be an expert in explaining what the trade finance ecosystem looks like right now.

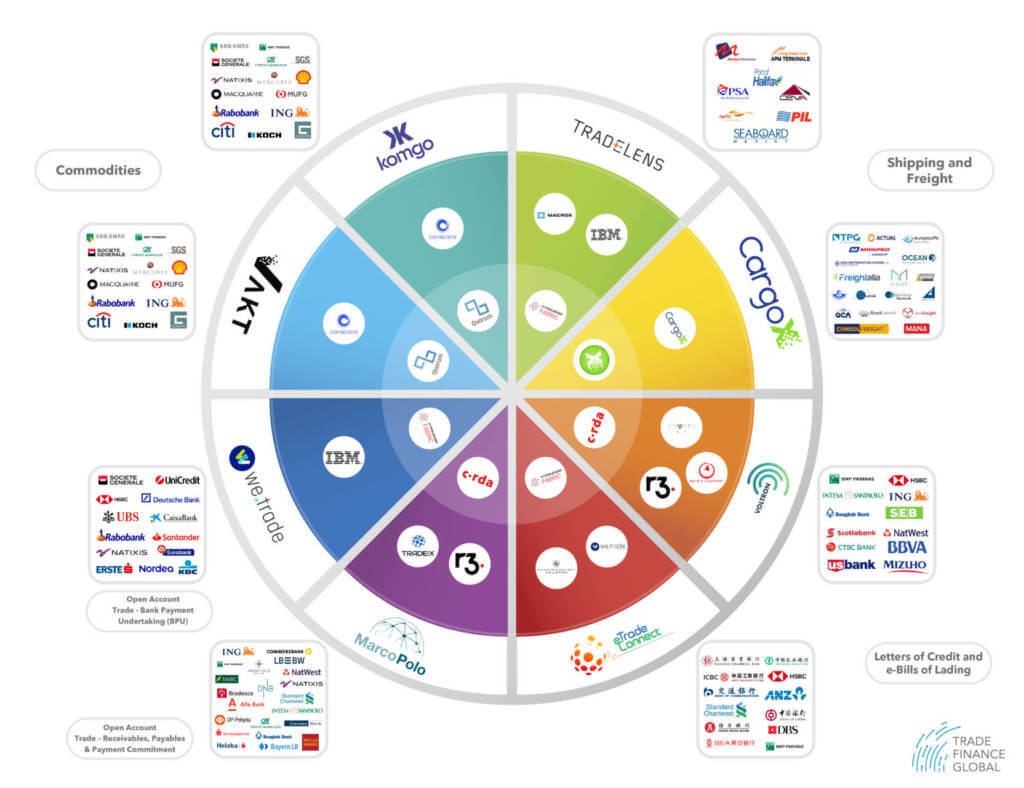

Okay, what it looks like right now, it’s a very good question because it’s changing heavily. So typically all trade finance processing is heavily SWIFT based. There’s a number of new ecosystems appearing like Voltron, Marco Polo, which I believe have a lot of potential. Of course, they don’t have the bandwidth of SWIFT yet, but they have the potential to become very important players. Especially in the supply chain finance space, there is a lot of room to come up with more efficient solutions. So it’s a very volatile world. And I think it’s very important for us as a solution provider to keep our systems, to keep them flexible, to allow our customers actually, to be on-boarded on new platforms very easily without having to change the underlying technology.

See the interactive diagram

Okay, so how is China systems addressing the pain points from the bank as well as the bank to corporates?

Okay. So one of the big pain points is obviously that trade is traditionally known as a heavy paper-based business. That is a challenge, which is still going to be there for a long time. We at China Systems, we will obviously cooperate on all source to settle digitization efforts, that is definitely the future. The reality today is that it will still be a long path, there is still a lot of paper, and it will still be around for a long time. So we have to make sure, as is demonstrated on of our wall pictures here, that we have to be able to deal with the digital world, in the future, and also with the paper world today… and in a hybrid processing environment. So it is quite challenging from a processing point of view to do that. But it’s why we’ve heavily focused on our solutions, that, actually, regardless of the channel we communicate with, whether that’s paper, whether it’s a portal solution, whether it’s SWIFT, whether it’s MT798, whether it’s Voltron, whether it’s host to host connectivity, it is actually not really that relevant for our solution. It’s based on party profile settings. So our solution will interact with other trade ecosystem partners, based on the intelligence predefined on the system.

Great. So I guess whilst we’re here at Sibos which is really about the forefront of machine learning AI, big data. What is China Systems doing to future-proofing systems?

Yeah, OCR and AI are currently one of the most effective ways of dealing with today’s challenges. As I’ve said, the paper is there. Distributed ledger technology, we don’t doubt the technology. But in fact, we are very much focussed also today on how do we help our customers dealing with the paper today. And OCR and AI, are, of course, very important tools to do that. What we’ve done is, we’ve integrated our back-office engine with an OCR/AI engine, which we are actually interacting within real-time. So, we’re pushing LC data into that system, we can also scan documents, and those documents are uploaded into the software, where they will be checked. So the data will be extracted and documents are classified. And that’s where the machine learning comes in, it will perform the rules, the engine will do all the document checking. We will actually incorporate the results of that information into our system and also integrate it fully into our processing flows. Because ultimately, the objective is to improve customer service.

So where we used to have manual processes for registration of documents, checking documents, processing of documents, pay, accept, refuse, we’ve now fully automated those steps. So we’re using API’s to interact with the system, our system gets updated automatically with the activity taking place in the document checking engine, and we can push those results straight to the customer, for the presenter of the documents, if he wants to say, send the documents as is to the issuing bank or please modify them. So, actually the ultimate goal of using this technology is to leverage technology to optimise business processes and to improve customer service.

Great. And it was a very, very recently this year, you announced your partnership with Voltron. Yep. Can you tell me a bit more about the partnership?

Exactly. We became a partner, I think about end of April. We were actually one of the latest probably, trade finance vendors to join. We were first watching the activity – we wanted to see the progress, we wanted to understand the roadmap. And the key thing for us is that we wanted to prove actually how easy it is for us to interact with the blockchain platform. And it’s all based on API connectivity. With the tools we have in place, I think it took us about one week, for us to add a Voltron adapter to actually establish the API connectivity. Two weeks, I think for the business configuration, we took the LC process, an import LC process as a prototype. And it total, it took us three weeks to actually configure this and have an entire LC flow for the issuance of the LC supported – with exactly the same application as the one that we’re using to do SWIFT based Letters of Credit. So for our customers, if Voltron takes off, if the customer wants to be working with Voltron, our solutions are ready to support that, and they can keep using their existing infrastructure to process it on a SWIFT basis.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.