Europe is a large and attractive market for commodities, heavily dominated by Russian exporters, or at least it was, until Donald Trump stepped into power. His promise to supply Eastern European countries such as Poland with American gas, oil and coal puts the US against Russia and threatens the latter to lose some of the valuable supply contracts.

What lies beneath the “energy dominance” agenda?

For many years US presidents strived to make America energy independent, however, with Donald Trump in power there is a different goal: “energy dominance”. The two policies are not so different in general, however, the energy dominance implies being free from this ideology of energy being used as a weapon, increasing the global leadership and presence of American commodities through expanded trade. In the new re-branded policy all the effort is being put into exports of liquefied natural gas (LNG) to countries in Eastern Europe and Asia. Only six months ago President Trump met his Polish counterpart Andrzej Duda in Warsaw with offerings of American gas contracts to help Poland off Russian energy imports.

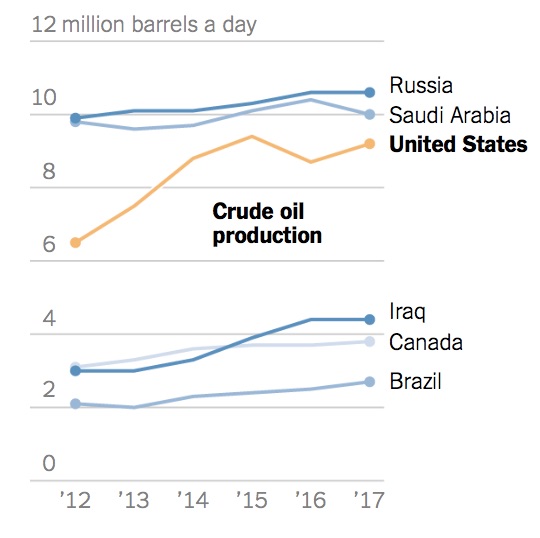

Innovations in technology have allowed US drillers to effectively extract oil and gas from shale rock formations, which America is full of, leading to a boom in fossil fuel production and exports. The doors for exports of american commodities around the world were finally opened. Seeing that they can be self sustained and still have a bit on the side to trade, brought out the necessary confidence in the US to proclaim itself a “big oil producer” and start trading effectively. The future forecasts promise a steady climb upward for the US exports, perhaps surpassing the UAE and getting very close to Russia.

Washington vs. Kremlin.

Russia has been one of a kind, exclusive supplier of LNG to many eastern European countries for years, some long before the Soviet Union. Being the only supplier gave the country unlimited power to manipulate the shipments and occasionally use the gas to deal with disputes by shutting it off for a time period as a punishment. However, with the new competitor – the US – it can no longer do that, as Europe is eager to switch to a new, more reliable source.

The primary targets of American liquified gas deals at the moment are those eastern European countries (Poland and Lithuania among some of them) that used to be tied to Russian contracts for a long time. Focusing on those suffering nations makes kickstarting American trade easier as they were more than delighted to switch to American commodities. Poland and Lithuania have already signed the contracts for American liquified natural gas and received first shipments, proclaiming that they will not be renewing their agreements with Russia and stepping away. This is a huge step that will not only affect Russia, Lithuania and Poland but the gas market as a whole. There is going to be a lot of negotiating and contract signing in the next few years as the nations figure out who to sell to or buy from.

The situation essentially puts Washington and Kremlin against each other, kicking off a race for new buyers. Both governments have said that they are not phased by the competition from the other, Russia making the point that they will fight the “unfair competition” created by the US. Gazprom, one of the Russian gas giants, reassured they are ready to take on the rivals.

Long-term impact

Over the last 10 years there has been a significant boom in production of oil, energy and gas in the US, which brought huge economic benefits to the country, allowing it to finally participate in global trade alongside Russia, UAE and others. However, all of this is the premise of “energy independence” and not dominance, which is the ultimate goal of the Trump government. Achieving said agenda will require a lot more than just upping the production, there needs to more careful thinking put into how the new markets will operate and what effect such agenda brings on friendly relations of the US and other countries.

Initial plan to target eastern Europe could work as a starting point of American exports being more widely used and accepted as an alternative, but considering Russia’s long term trading activity it will definitely be a challenge to wrestle it out of Europe completely. Perhaps a smaller consequence, but by no means less significant, would be the increased competition Russia will now have to face, which ultimately makes using gas supply to correct political judgement almost impossible. It is notably harder to do that in the world with more competition.

Another challenge is that for the US energy sector to thrive and be able to support high volume of trade, the government needs to invest in new technologies, meanwhile Trump’s proposed budget cuts Department of Energy Research & Development department’s budget substantially. Few years down the line and present day technology will not be able to withstand the forecasted increasing trade volumes, putting the whole agenda to shame. In order to operate effectively in the future and become the confident oil exporter the US proclaims to be, it needs to invest largely in research in order to keep up with the competition.

“Energy dominance” sounds like a great opportunity for the US to show the world its’ power, but in practice there is more than just increased production and a couple of contracts to it. The government needs to have a bigger conversation on how the nation is going to keep up with the pace of the market and continue to grow and evolve in order to outlast the competition, since the other rivals have been in this industry for years.

There is so much yet to be done in order for the US to just get on the same level as others, let alone overcome the competition, but it has all the resources to do so if they are handled responsibly.

Exporting to the US?

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.