Estimated reading time: 7 minutes

This month, the British Business Bank (BBB) released its 2022 Small Business Finance Markets Report.

The report offers a health check on UK small businesses using a range of metrics, from uptake of finance and types of lenders used, to the issuing of equity and the growth of investment in sustainability activities.

For those who are unfamiliar, the BBB is a UK government economic development bank. Its mandate is to build sustainable growth and prosperity in the UK; to enable the transition to a net-zero economy; and to improve access to finance for small and medium-sized enterprises (SMEs).

The issue: SMEs face challenging finance landscape

Historically, SMEs are underserved by the finance sector, and often don’t have the same characteristics that banks and other lenders like about large corporations.

This includes lengthy credit histories, detailed audits and financial accounts, and a large portfolio of assets for collateral on debts.

For start-ups, whose business models are unproven and yet to be deemed creditworthy, these problems are even more pronounced.

2021: Lending levels moving back to normal

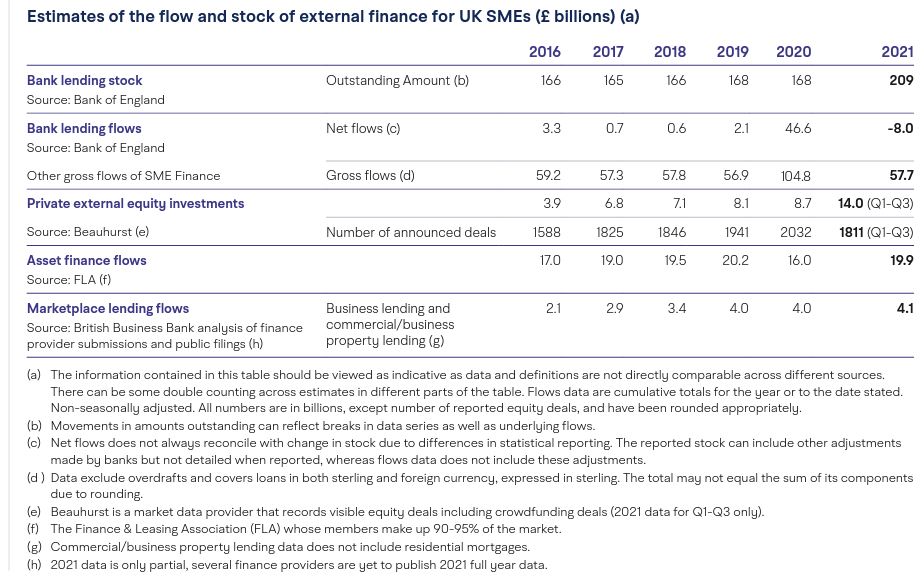

In 2021, lending to SMEs in the UK returned to pre-pandemic levels. A total of £57.7 billion was lent to UK SMEs in 2021, which is 1% higher than in 2019.

Interestingly, however, the 2021 total was 45% lower than in 2020, when £104.8 billion was loaned to UK SMEs.

As you may have guessed, the total during 2020 was unusually high, due to small businesses making use of the UK’s state-backed, coronavirus loan facilities.

After the end of the coronavirus loans facility in March 2021, an interesting trend to emerge was that SMEs began to move away from large banks for their finance needs.

Instead, challenger and specialist banks made up 51% of lending in 2021, compared with 32% in 2020.

Healthier balance sheets

According to the BBB’s report, the balance sheets of small businesses in the UK are mostly recovering from the debt-load acquired from new loans originated during the pandemic.

This finding is further supported by the Bank of England’s (BoE) strong economic growth forecast for 2022.

Another promising piece of news is that debt repayments covered a smaller proportion of SME turnover as 2021 went on.

However, it’s also important to note that in March 2021, small business debt stock was 30% higher than pre-pandemic levels, highlighting a huge obstacle to overcome. Interestingly, small business deposits were at record highs in 2021.

BBB’s survey also found that less than half of small businesses used their full coronavirus loan facilities – this suggests that a large number of businesses are financially robust, and equipped to invest in future operations.

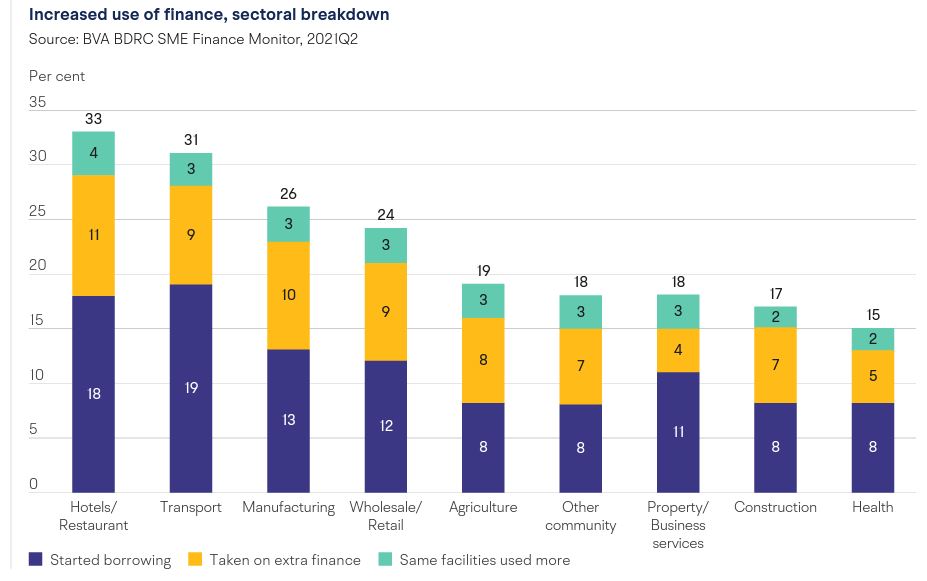

But SMEs in different sectors are under different levels of financial stress, and unfortunately, some sectors will find it more difficult to obtain future financing now the coronavirus loan facilities have been phased out.

Those that will suffer most are the hospitality and transport sectors, which were also the hardest hit by the pandemic.

For example, the BBB survey found that the hospitality and transport sectors self-reported the highest level of concern for loan repayments. In addition, BoE agents have reported that lenders are cautious about investing in these sectors.

Equity finance

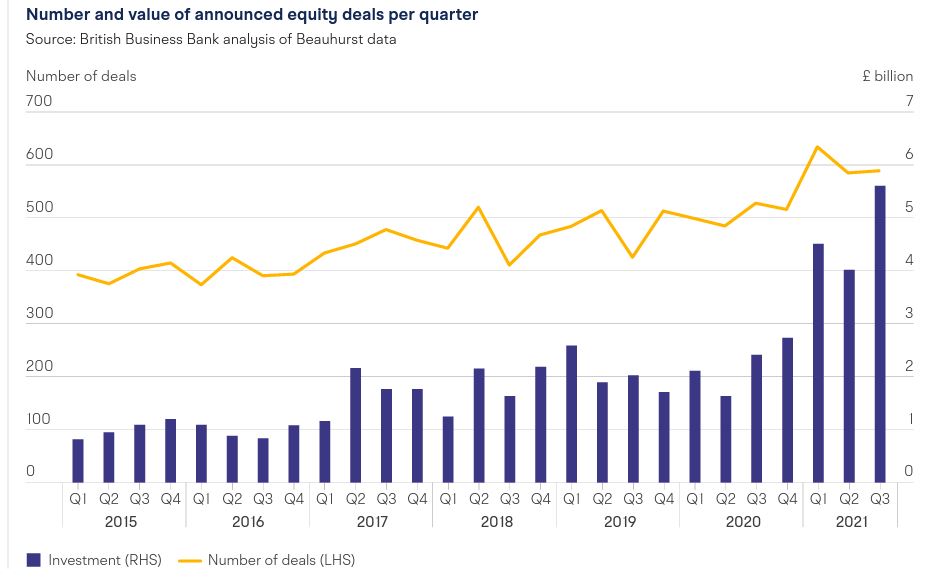

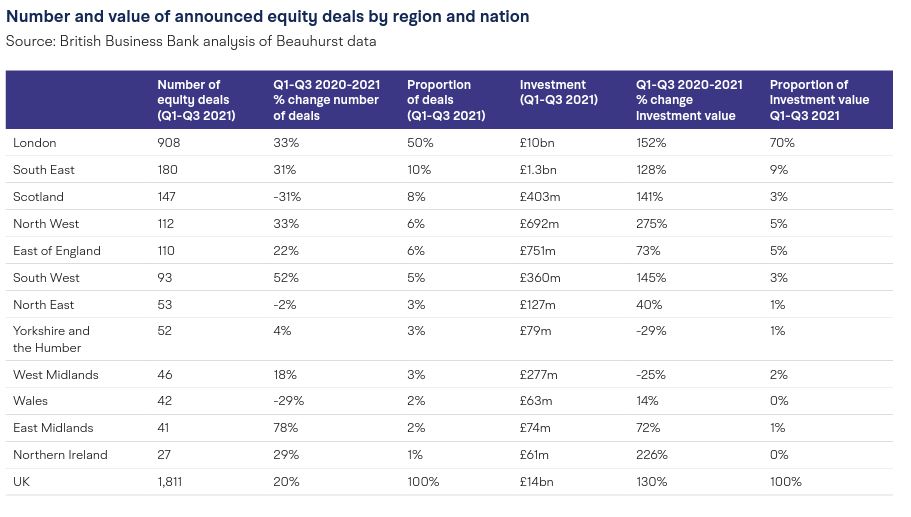

Equity investment is an alternative way for SMEs to access finance. In the first three quarters of 2021, £14 billion was invested in equity finance, a 130% increase on the £6.1 billion invested in equity over the same period in 2020.

Although the overall increase in equity investments is good news, a closer look at the figures also highlights the regional inequalities in access to finance in the UK.

London companies received 70% of the total value of equity investments in the UK, while the rest of the country received only 30%.

Regional access to finance

Looking at access to finance from a supply and demand perspective, both were lower outside of London in 2021.

Supply is lower in regions outside London, with fewer private debt and equity investors. This is influenced by the geographical location of the investor and businesses.

The BBB Regions and Nations Tracker found that 82% of equity investment deals were made by investors located within two hours of the receiving business.

The lower demand for finance outside of London is also due to attitude towards finance. SMEs outside of London are less likely to want to use financing; they have a lower awareness of the variety of options available; and they are less likely to employ financial experts within teams.

Given this backdrop, the UK government is attempting to improve access to finance in regions outside of London.

The BBB has specific regional funds available to SMEs. The Northern Powerhouse Fund recorded £300 million in direct investment in 2021, and the Midlands Engine Investment Fund recorded £150 million in direct investment in 2021.

This year, the government will increase its funding for BBB programmes, following the Autumn Budget and Spending Review at the end of 2021.

Sustainability

2021 was a year marked by talk of sustainable finance, driven not least by COP26 in November, around which many banks and businesses announced net-zero pledges and sustainable finance plans.

This year, Barclays announced that it is developing products offering social and environmental financing, and is hoping to issue at least £150 billion in social and environmental financing by 2025.

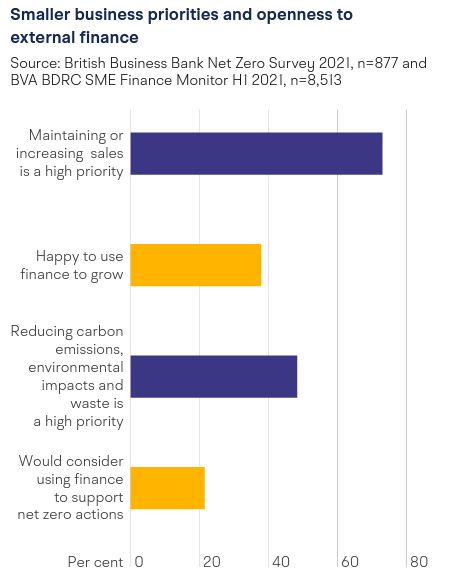

Among SMEs, 47% see reducing carbon emissions and environmental impact as a priority, and 22% say they would access finance for this. This compares with 71% who see increasing sales as a high priority.

There is a gap between words and action, however, with only 11% of small businesses actually having accessed external finance to build sustainability into their business.

Discimination within SME finance

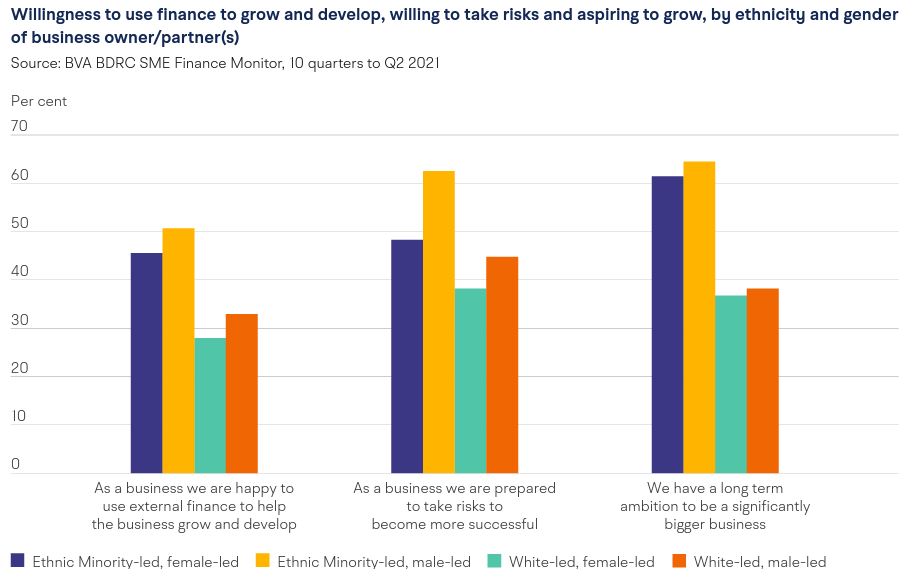

The BBB report found that ethnic minority-led businesses are more open to finance and business growth than white-led businesses. However, ethnic-minority-led businesses have higher rejection rates.

Between Q3 2020 and Q2 2021, for example, 18% of minority-led businesses were rejected finance, compared with 10% of white-led businesses.

Overall, BBB found that both ethnic-minority and women-led businesses are underserved in the finance sectors, while recommending that lenders should look at the reasons behind this and assess the best way to close the financing gap.

Ethnic minority- and female-led businesses’ reasons for not applying for finance include fear of rejection, lack of knowledge of appropriate finance availability and options, length of decision time, and hassle.

Open banking and alternative finance

Open banking and alternative finance can play a role in closing these funding gaps.

The report found that there are 330 regulated firms in open banking, alongside 230 third-party providers (fintech services that can send and receive payments for customers). Meanwhile, 90 payment service providers are a part of open banking services, covering 95% of current accounts.

The BBB reported that half of SMEs use services powered by open banking in some way.

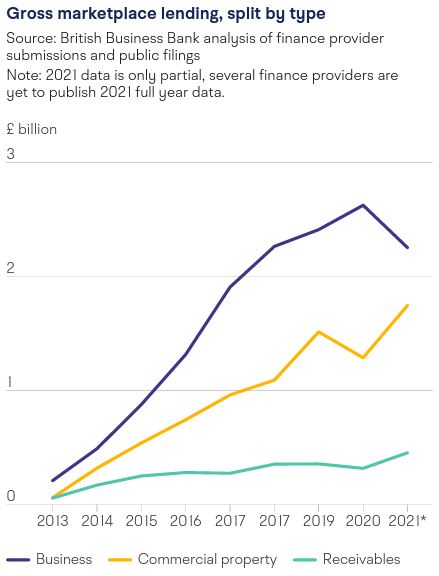

In alternative finance, marketplace lenders and peer-to-peer finance funded £2.6 billion in 2020, up 6.5% from £2.4 billion in 2019.

The sustained lending levels were due to the availability of the Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBLS) through the platforms.

The platforms were yet to release full figures during the writing of the report; however, BBB suggest that their estimates predict similar lending levels to that of 2020. This is even with the CBILS and BBLS having been phased out by March 2021.

The future

The report offers reasons to be optimistic about the future of access to finance for SMEs, but there are nonetheless still many obstacles and barriers to be tackled.

In sum, there are yields to be made in SME finance: the money just needs to reach the right places.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.