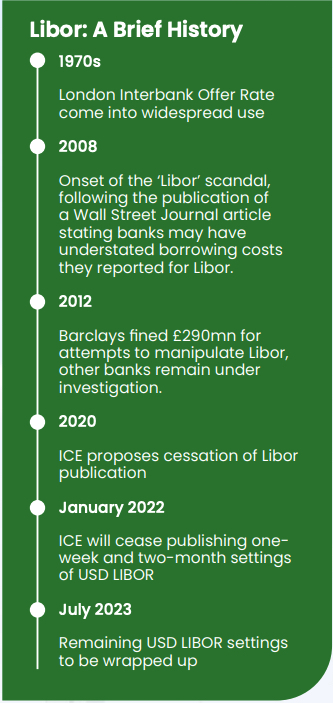

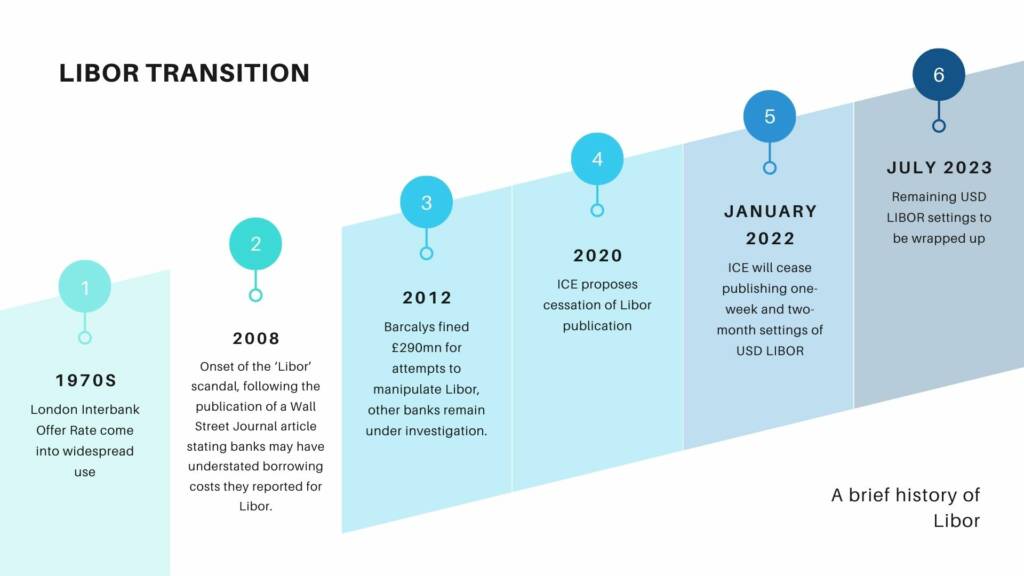

Despite the disruption of the COVID-19 pandemic, progress towards the demise of the London Interbank Offered Rate (LIBOR) has continued, and the cessation endgame has been established. At the end of 2020, Intercontinental Exchange (ICE), which administers Libor, proposed a plan to cease publication. Under the plan, which was confirmed on March 5, ICE would stop publishing the one-week and two-month settings of USD LIBOR immediately after December 31, 2021 and would cease publishing the remaining USD LIBOR settings on June 30, 2023.

The proposed deferral of the more commonly used USD tenors will provide time for more legacy contracts to mature. While this is a welcome development, all other Libor currencies remain on the original 2021 cessation timeline and U.S. regulators have clearly stated that U.S. banks should cease writing new Libor contracts as soon as practicably possible, and that there should be no new USD LIBOR activity after the end of 2021.

With the timeline set to transition away from LIBOR to Risk Free Rates (RFRs), several issues remain. Among the most significant of these facing the trade finance industry is the potential lack of availability of forward-looking term rates. Libor has long been the default benchmark interest rate for trade finance, with USD LIBOR serving as the most widely used benchmark across the industry globally.

“Trade finance professionals need to coordinate internally with bank-wide transition teams to assess the scale of the impact on their portfolios and to plan for the transition.”

Trade finance products broadly reference Libor term rates due to their transparency of pricing and certainty of funding costs. This element is critical, especially for financing offered at a discount, where the value of the discount needs to be determined at the start of the transaction. Additionally, since the transition impacts the banking industry as a whole, it applies changes to a number of products, systems, and processes. Trade finance professionals need to coordinate internally with bank-wide transition teams to assess the scale of the impact on their portfolios and to plan for the transition. The industry also needs to continue, or begin in earnest, to discuss the expected impact of the transition with their customers.

Term-rates in focus

Since the transition away from Libor was announced, national working groups have proposed RFRs to succeed LIBOR. For USD, the preferred rate is SOFR, while for GBP the recommended rate is SONIA. It is important to note that RFRs are overnight rates and a term structure is not guaranteed. Establishment of a term rate and timing of its launch are critical for the trade market to finalise conventions and support the transition away from Libor – a case that BAFT and member institutions have made to U.S. authorities on several occasions, when accounting for the volume of transactions that currently reference USD LIBOR.

The new RFRs in their current overnight form can not be applied appropriately to the discount context. The main affected areas of concern include how prices are established in commercial contracts between buyers and sellers and the legal aspect surrounding the agreements. A forward-looking term rate is required to replace Libor in order to enable these discounted products to maintain the characteristics that differentiate them from other loan-like trade finance products, and to ensure minimal disruption to capital flows that are facilitated by discounting.

Progress toward producing a forward-looking term rate has been made in some currencies. On January 11, 2021 the ICE Benchmark Administration Limited and Refinitiv began live production of forward-looking term SONIA (TSRR). The Sterling Risk Free Rate Working Group has limited the use of TSRR, but use is permitted for trade finance. Meanwhile, for USD, a SOFR forward-looking term rate remains under development.

The Alternative Reference Rate Committee (ARRC) has suggested that a rate could be available by the middle of 2021. Potential benchmark providers have already been identified and are making progress, but ARRC officials have cautioned that insufficient liquidity in the underlying SOFR swaps market could limit their ability to recommend a term rate. The market will have to monitor this development closely and plan for possible alternatives should a SOFR forward-looking term rate not be available before the end of the year. In other Libor currencies, no term rate is expected (CHF) or remains to be determined (JPY). The divergent timelines and approaches across jurisdictions are a challenge we will have to live with.

A path forward

While the path to transition away from Libor is complex, the “wait and see strategy” practiced by many in 2020 is no longer advisable. The industry must now prepare to transition away from Libor by working towards resolving replacement rate issues while communicating with affected customers and third parties throughout the process.

“The ‘wait and see strategy’ practiced by many in 2020 is no longer advisable”

Trade finance practitioners are encouraged to work internally with Libor transitions teams to review documentation carefully to determine what elements of the portfolio and services reference Libor and what fallbacks would apply if Libor becomes unavailable. Banks should review documentation closely to determine the position for each contract in their portfolio, in relation to existing or legacy products, as well as for any new products they are considering entering into. For standard documents produced by BAFT, such as the MPA and the MTLA, we are actively working to provide market guidance.

There will be many new developments over the next nine months as we prepare for the cessation of Libor. It is important to track currency-specific transition deadlines and progress toward the establishment of a SOFR forward-looking term rate. While things come into focus over the coming months, internal preparation and clear communication with clients will help to ease some of the uncertainty and pave a more solid path toward transition.

Read our latest issue of Trade Finance Talks, Spring 2021, here

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.