Deep-tier supply chain finance can be a powerful tool in the ESG toolkit––but implementing this innovative financing approach will require overcoming some key barriers.

Estimated reading time: 8 minutes

Tragedy struck at 9:00 AM on Wednesday, 24 April 2013.

Rana Plaza, a building complex in Bangladesh housing five garment factories, collapsed, claiming the lives of 1127 workers and injuring a further 2000.

Investigators discovered that the building had been authorised for six stories, yet the owner had built another four stories on top with subpar materials.

Amid the rubble, crews found clothing from major western brands such as Walmart, The Children’s Place, and Mango.

While these major brands did not own or operate the factories in the building, the ensuing backlash made it clear that the court of public opinion found them complicit in the catastrophe.

Major brands and multinational organisations are no longer able to hide behind the shield of a long and opaque supply chain in order to avoid environmental, social, and governance (ESG) concerns.

The imbalance of power in global supply chains

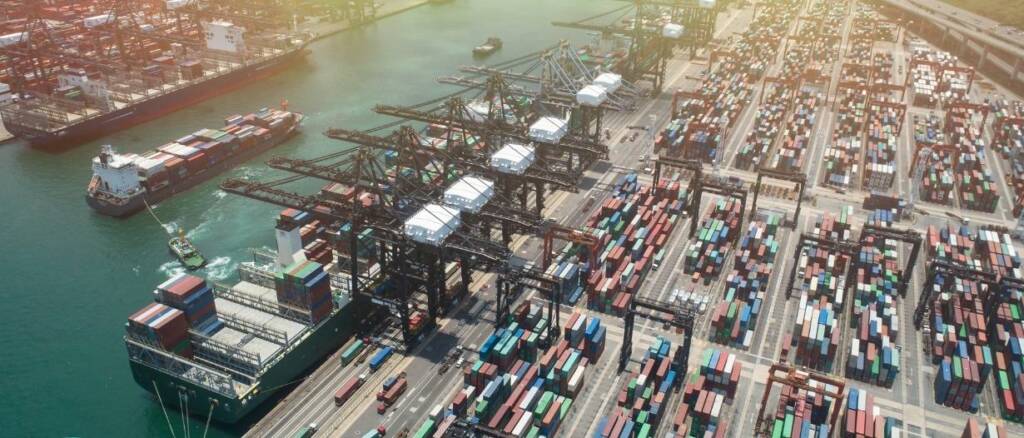

Traditionally, many global supply chains have been characterised by a stark imbalance of power.

Large multinational corporations at the top of the chain have been able to place grand demands on their smaller suppliers to deliver large orders under immense time pressure.

To meet these demands, tier-one suppliers must often make equally grand demands on their own suppliers. Likewise, these tier-two suppliers must procure their inputs from yet more suppliers, and so on, down the chain.

While events like the Rana Plaza disaster have imposed multinationals with an increased duty of care and accountability to their top-tier suppliers, the line becomes increasingly blurred the further down the chain you go.

To what extent, for instance, can electric carmakers—with their large, geographically dispersed, ‘long-tail’ supply chains—be held accountable for the perilous conditions of a small artisanal cobalt mine in the Congo?

The complex practical and ethical implications of such a scenario cannot be understated. One possible solution could be the very phenomenon that has put supply chains in this mindset: money.

The role of finance

The global financial system is constantly changing.

With access to financial support, businesses can ease the working capital constraints that often prevent them from making necessary investments in themselves and their operations.

Access to affordable financing can also help incentivise ESG-aligned activities along the value chain.

If used extensively, this can help promote stability and resilience in supply chains and bring about much-needed social change.

One example of this in practice is the Better Work Program—a collaboration between the United Nation’s International Labour Organization (ILO) and the International Finance Corporation (IFC) that seeks to improve working conditions in the garment industry.

The program covers 1700 factories in nine countries that employ more than 2.4 million workers.

In an impact assessment report highlighting the program’s findings from 2017 to 2022, it is clear that improving working conditions needs to be considered an investment that will improve firm performance and productivity rather than a burdensome cost.

Unfortunately, for the many small businesses around the world that struggle to access finance, making business-improving investments often gets deprioritised behind simply keeping the lights on.

The plight of small businesses

In addition to this, despite playing a major role in most economies, particularly in developing countries, small and medium-sized businesses (SMEs) are often poorly served by existing financial processes.

According to an Asian Development Bank (ADB) brief, they often struggle to access support mechanisms, meaning they tend to suffer global and regional shocks more acutely than larger suppliers.

In instances where an SME does have the resources and know-how to navigate the often convoluted financing application process—something that discourages many from even pursuing the option in the first place—they are often rejected or must accept high financing costs.

In a nebulous self-fulfilling cycle, the greater exposure to risks that they experience causes traditional lenders to deem them as riskier investments, increasing their cost of capital.

This is often the case because SMEs tend to operate in the lower tiers of supply chains, where they are too far removed from the financial power of their ultimate up-chain end customer.

A small Congolese mining operation can hardly leverage Volkswagen’s €500 billion balance sheet when applying for finance, even though the cobalt they mine may well be among the 3000 tonnes of the metal that the car company purchases each year for its electric vehicle batteries.

But what if they could?

Deep-tier supply chain finance

Multinational supply chains tend to consist of large “anchor” corporations with strong credit ratings and robust borrowing capacity coupled with many deeper-tier SME suppliers operating within their ecosystems.

Traditionally, only upper-tier suppliers have been able to benefit from a relationship with the anchor corporate. While there is no issue with such a relationship, these suppliers already tend to be quite financially strong and could likely acquire financing from any number of sources.

Deep-tier supply chain finance is a financial solution that seeks to leverage business relationships with this ‘corporate anchor’ deeper into the supply chain.

The aim is to unlock working capital to make financing accessible for suppliers throughout the ecosystem, not just for those in the top tier.

The idea is born out of reverse factoring, a financing technique where a supplier can sell their receivables and receive payment early—albeit at a discount. The discount rate applied in this technique is aligned with the credit risk of the buyer, which will generally have a more favourable risk profile than the supplier itself.

In the past, it has simply not been feasible to translate this into lower tiers of the supply chain; however, advancements in digital technologies are making this degree of transparency and data sharing possible.

To ESG and beyond

Deep-tier supply chain financing can provide a major financing boon to smaller suppliers deep within long-tail multinational supply chains, providing them with easier access to finance.

By putting this financing to use in a benevolent manner, SME executives down the chain will have the working capital needed to make investments into bolstering their processes and improving working conditions.

These paramount ESG improvements will reflect positively on the consumer-facing anchor corporates, renewing their social license to operate. But there are many more potential benefits that deep-tier supply chain finance can bring, most notably added supply chain resilience.

The COVID-19 pandemic showed the world how vulnerable hyper-efficient supply chains could be during economic shock.

By creating systems and programs that allow their deeper-tier suppliers to have easier access to finance, large corporations can help build resiliency in their supply chains by mitigating the risk of a highly specialised supplier going insolvent.

Such programs also provide the corporate anchor with increased visibility over the entire supply chain, giving it a host of data that it can analyse and leverage to make better business decisions.

Financiers also benefit from an outsized opportunity to expand their client base by becoming a strategic partner in the entire global value chain, expanding their reach and revenue in the process.

The benefits are numerous but do not come without a few roadblocks to overtake.

Challenges for deep-tier supply chain finance adoption

The ADB brief on deep-tier supply chain finance outlines several major inhibitors to adoption across the various stakeholder groups.

Fintechs creating the software that can be used to facilitate such programs must contend with a lack of market awareness, difficulty engaging buyers, and integration challenges.

Banks and financiers exploring the program must overcome unclear revenue incentives and integration challenges.

The anchor corporations are faced with potential resource constraints and a lack of government incentives.

Suppliers that could join these programs need to be comfortable disclosing their business information and working with technology in addition to overcoming their own resource constraints.

On top of this, all of the stakeholders must contend with an ambiguous legal structure and lack of clarity around the regulations and legal precedent for these models and their related technological functions.

Despite the challenges, there is a path forward.

Accelerating adoption

In its brief, the ADB has also established a clear set of actions that each deep-tier supply chain finance stakeholder must take to help overcome these challenges and accelerate its adoption.

Suppliers must encourage their anchor corporates to implement programs of their own and engage with fintechs to improve their technology offerings by voicing their concerns.

Anchor corporates must engage with their suppliers to understand their demand for financing, and they must begin to run trials using existing fintech programs.

Banks and financiers must raise awareness around successful implementations and work with fintech providers to trial new solutions.

Fintechs must engage with a range of stakeholders to raise awareness and work on clarifying the legal basis of such programs, particularly in a cross-border context.

Governments and policymakers need to raise awareness of the programs, and set key performance indicators (KPIs) around SME lending volumes and ESG reporting. They must additionally encourage the adoption of legislation enabling trade digitalisation and develop the legal infrastructure that will supply deep-tier financing programs.

Lastly, multilateral development banks must advocate for digital trade legislation, raise awareness, and extend targeted financing programs to include deep-tier options.

By following these calls to action, the industry can grow awareness and devise better technology solutions that will be able to reach a broader audience than ever before.

In due time, this nascent financing tool will be a key enabler of supply chain resiliency and a major proponent of the ESG agenda.

Perhaps it may even save lives by helping to mitigate the risk of another Rana Plaza.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.