Importing from Netherlands

Netherlands Country Profile

Official Name (Local Language) Koninkrijk der Nederlanden

Capital Amsterdam

Population 17,016,967

Currency Euro

GDP $773.9 billion

Languages Dutch, Eastern Frisian

Telephone Dial In 31

Netherlands Exports Profile

Exports ($m USD) 505,941

Number of Export Products 4,461

Number of Export Partners 232

Netherlands Economic Statistics

Government Website | https://www.overheid.nl/ |

| Sovereign Ratings | https://countryeconomy.com/ratings/netherlands |

| Central Bank | De Nederlandsche Bank |

| Currency USD Exchange Rate | 0.9214 |

| Unemployment Rate | 6% |

| Population below poverty line | 8.8% |

| Inflation Rate | 0.3% |

| Prime Lending Rate | 0% |

| GDP | $773.9 billion |

| GDP Pro Capita (PPP) | $50,800 |

| Currency Name | Euro |

| Currency Code | EUR |

| World Bank Classification | High Income |

| Competitive Industrial Performance | 4/138 |

| Corruption Perceptions Index | 8/180 |

| Ease of Doing Business | 36/190 |

| Enabling Trade Index | 2/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedImporting from the Netherlands

The Netherlands stands as the eighth largest export economy in the world and the twentieth most complex economy as ranked by the Economic Complexity Index (ECI).

In addition, the Netherlands is home to the Port of Rotterdam, the largest seaport by container activity outside of East Asia and Amsterdam Schiphol Airport, the fourth largest airport for cargo in Europe.

Lying within 500km of one third of the European Union (EU) population, its advanced transportation infrastructure has contributed to the relatively small nation’s position as 17th largest global economy, with a GDP per capita of $59,300.

In recent years, the Netherlands exported around $535B yearly and imported around $540B, resulting in a small negative trade balance.

In 2013 the GDP of the Netherlands was around $850B and its GDP per capita was around $46k.

The main export destinations are Germany (around $115B), Belgium-Luxembourg ($90B), the United Kingdom ($52B), France ($33B) and Italy ($26B).

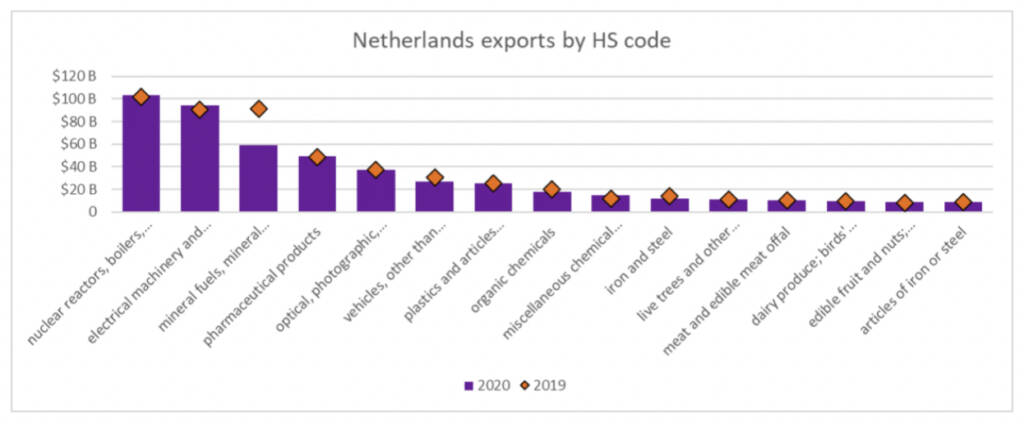

The largest exports of the Netherlands are refined petroleum (at around $76B), petroleum gas ($25B), crude petroleum ($26B), computers ($16B) and packaged medicaments ($12B).

Importing from the Netherlands: What is trade finance?

It is estimated that the value of exports is over 80% of the Netherlands’ GDP a year.

Dutch exports are dominated by a few key categories: machinery and transport equipment (28%), mineral fuels (23%), food (11%), clothing and footwear (10%), and pharmaceuticals (5%)

In order to capitalise and tap into these markets trade finance may be required.

Trade finance is a revolving facility which lenders offer. Through this process firms are able to buy stock and can help ease the pressure from cash flow challenges.

A trade finance facility could additionally help fund the importing of goods through offering a letter of credit or some form of cash advance.

If a business is looking to import inventory from other countries it may require import finance, which is an agreement between the importer and the foreign exporter.

Chart Showing GDP Growth Compared to rest of world

GDP Composition for Netherlands

Agriculture

1.6%

Vegetables, ornamentals, dairy, poultry and livestock products; propagation materials

Industry

17.8%

Agroindustries, metal and engineering products, electrical machinery and equipment, chemicals, petroleum, construction, microelectronics, fishing

Services

70.4%

Map

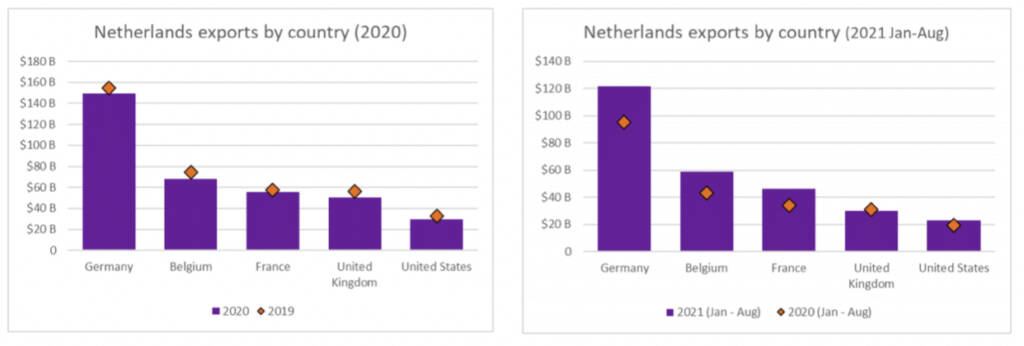

Top 5 Exports Partners

| Country | Trade | % Partner Share |

| Germany | 110,857 | 21.91 |

| Belgium | 51,884 | 10.25 |

| United Kingdom | 43,411 | 8.58 |

| France | 40,625 | 8.03 |

| United States | 22,037 | 4.36 |

Top 5 Exports Products

| Export Product | Number |

| Petroleum oils, etc, (excl. crude); preparation | 8.7% |

| Parts and accessories of automatic data process | 3.5% |

| Transmission apparatus, for radioteleph incorpo | 3.3% |

| Other medicaments of mixed or unmixed products, | 2.8% |

| Human and animal blood; microbial cultures; tox | 1.9% |

Local Authors

Local Partners

- All Topics

- Netherlands Trade Resources

- Export Finance and ECA Topics

- Local Conferences