Exporting to the United Kingdom

UK Country Profile

Official Name (Local Language) United Kingdom of Great Britain and Northern Ireland

Capital London

Population 64,430,428

Currency British Pound

GDP $2,650 billion

Languages English

Phone Dial In 44

UK Imports Profile

Imports ($m USD) 641,332

Number of Import Products 4,512

Number of Import Partners 227

Finland Economic Statistics

Government Website | https://www.gov.uk/ |

| Sovereign Ratings | https://countryeconomy.com/ratings/uk |

| Central Bank | Bank of England |

| Currency USD Exchange Rate | 0.7391 |

| Unemployment Rate | 4.8% |

| Population below poverty line | 15% |

| Inflation Rate | 0.25% |

| Prime Lending Rate | 4.6% |

| GDP | $2,650 billion |

| GDP Pro Capita (PPP) | $42,500 |

| Currency Name | British Pound |

| Currency Code | GBP |

| World Bank Classification | High Income |

| Competitive Industrial Performance | 7/138 |

| Corruption Perceptions Index | 8/180 |

| Ease of Doing Business | 9/190 |

| Enabling Trade Index | 8/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedExporting to the UK

The United Kingdom is a sovereign country in Europe that comprises England, Wales, Scotland and Northern Ireland.

The capital and financial centre of the UK is London, with a metropolitan area population of over 14 million.

The UK’s 2016 decision to leave the European Union (EU) gave it the freedom to pursue its own trade deals with countries around the globe.

At the time the UK left, the EU had about 40 trade deals covering more than 70 countries. Since leaving, the UK has signed trade agreements and agreements in principle with 69 countries, including one with the EU.

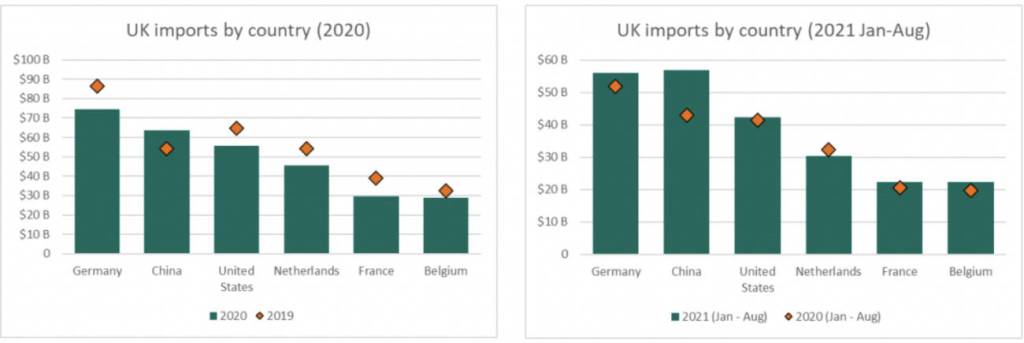

Its 2019 import flows were nearly $692 billion, with imports primarily coming from Germany, the USA, China, the Netherlands, and France.

In general, individuals in the UK seem open to digitalisation, even for financial products.

Online banking penetration in the UK has grown steadily over the past decade, reaching 76% in 2020.

Exporting to the UK: What is trade finance?

In order for a company to export goods to another market, it may need export finance, which is a commercial agreement between the exporter and the foreign importer.

A non-bank lender will advance the cost of producing the goods before they are manufactured, or after they have been shipped.

Once the foreign importer has received the stock supplies and pays for the import, the company will repay the advance loan from the lender over an agreed period of time.

Chart Showing GDP Growth Compared to rest of world

GDP Composition for UK

Agriculture

0.6%

Cereals, oilseed, potatoes, vegetables; cattle, sheep, poultry; fish

Industry

19.2%

Machine tools, electric power equipment, automation equipment, railroad equipment, shipbuilding, aircraft, motor vehicles and parts, electronics and communications equipment, metals, chemicals, coal, petroleum, paper and paper products, food processing, t

Services

80.2%

Other business services Financial services Travel Transportation Computer and information services Insurance services Royalties and license fees Cultural and recreational services Government services Construction services

Map

Top 5 Import Partners

| Country | Trade | % Partner Share |

| Germany | 89,695 | 13.99 |

| China | 59,863 | 9.33 |

| United States | 58,829 | 9.17 |

| Netherlands | 51,411 | 8.02 |

| France | 36,502 | 5.69 |

Top 5 Import Products

| Export Product | Number |

| Motor cars and other motor vehicles principally… | 6.9 |

| Gold, incl. gold plated with platinum, unwrought | 5.4 |

| Petroleum oils and oils obtained from bituminous | 3.2 |

| Turbo-jets, turbo-propellers and other gas… | 3.2 |

| Transmission apparatus for radio-telephony,… | 2.9 |

Strategic Partners

More- All Topics

- United Kingdom Trade Resources

- Export Finance & ECA Topics

- Local Conferences