TradeTech Research

Download our Tradetech Whitepaper

Accelerating trade digitalization to support MSME financing

Content

To investigate the state of the Tradetech industry, Trade Finance Global (TFG) and the World Trade Organization (WTO) collaborated on issuing a quantitative survey to practitioners from banks, FinTechs, multi-laterals, industry associations, trade governance bodies, consultancies, and trade policy experts. In total, 105 responses were received.

Respondents were asked to provide a score between 1 and 10 for what they believe the impact of each technology will be on the industry and how difficult it will be to implement the technology in the industry. Additionally, demographic-type questions were asked in order to determine if there are any differences in the perceptions held by each of the groups. These questions included organization type, geographic presence, and whether they are actively using any of the technologies to facilitate MSME financing.

Survey Results

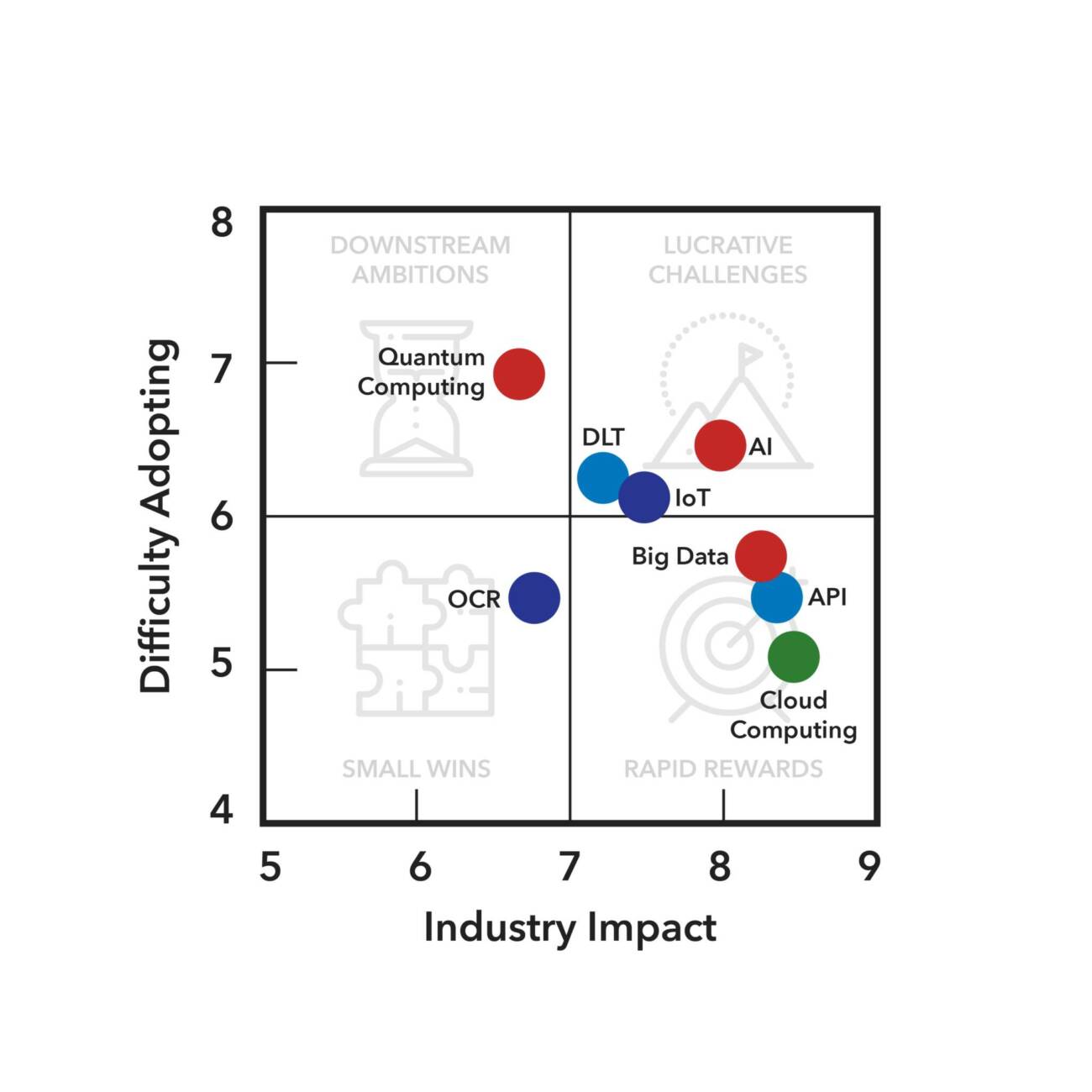

The quantitative results of the administered survey can be seen in the figure below, which positions each technology based on its perceived adoption difficulty and industry impact. The plot has then been divided into four quadrants, titled: rapid rewards, lucrative challenges, small wins, and downstream ambitions. The positioning of each technology within these quadrants helps to visually depict where developmental effort should be focused.

The technologies sitting at the intersection of high industry impact and low difficulty adopting are seen as rapid rewards. Dedicating resources to implement these technologies should be a priority.

The technologies sitting at the intersection of high industry impact and high difficulty adopting are seen as lucrative challenges. They will require considerable work on behalf of all stakeholders, but this work will have immense benefit in the future.

The technologies sitting at the intersection of low industry impact and low difficulty adopting are seen as small wins. Technologies in this quadrant can often be used as interim solutions, particularly by smaller local banks, until the more robust lucrative challenges can be effectively implemented

The technologies sitting at the intersection of low industry impact and high difficulty adopting are seen as downstream ambitions. These are technologies that may not be mature enough to demonstrate meaningful impact for the industry. The outcome of dedicating resources to implement these technologies is highly uncertain.

After plotting the aggregate data points in the above matrix, further analysis was conducted to determine if there is any significant variation in these perceptions of impact and difficulty between the different self-identified stakeholder groups represented in the survey responses. Specifically, this analysis focussed on differences between:

- firms using each technology to facilitate financing and firms that are not,

- firms with a global presence and those with only a regional or local presence,

- firms identifying as banks and those not identifying as banks, and

- firms identifying as financiers and firms not identifying as financiers.

Most of the analyses did not unveil statistically significant differences amongst the groups (i.e. firms using cloud to facilitate financing and firms not using cloud to facilitate financing perceive cloud as having, on average, an equal impact on the industry). There were, however, four instances where statistically significant differences were found:

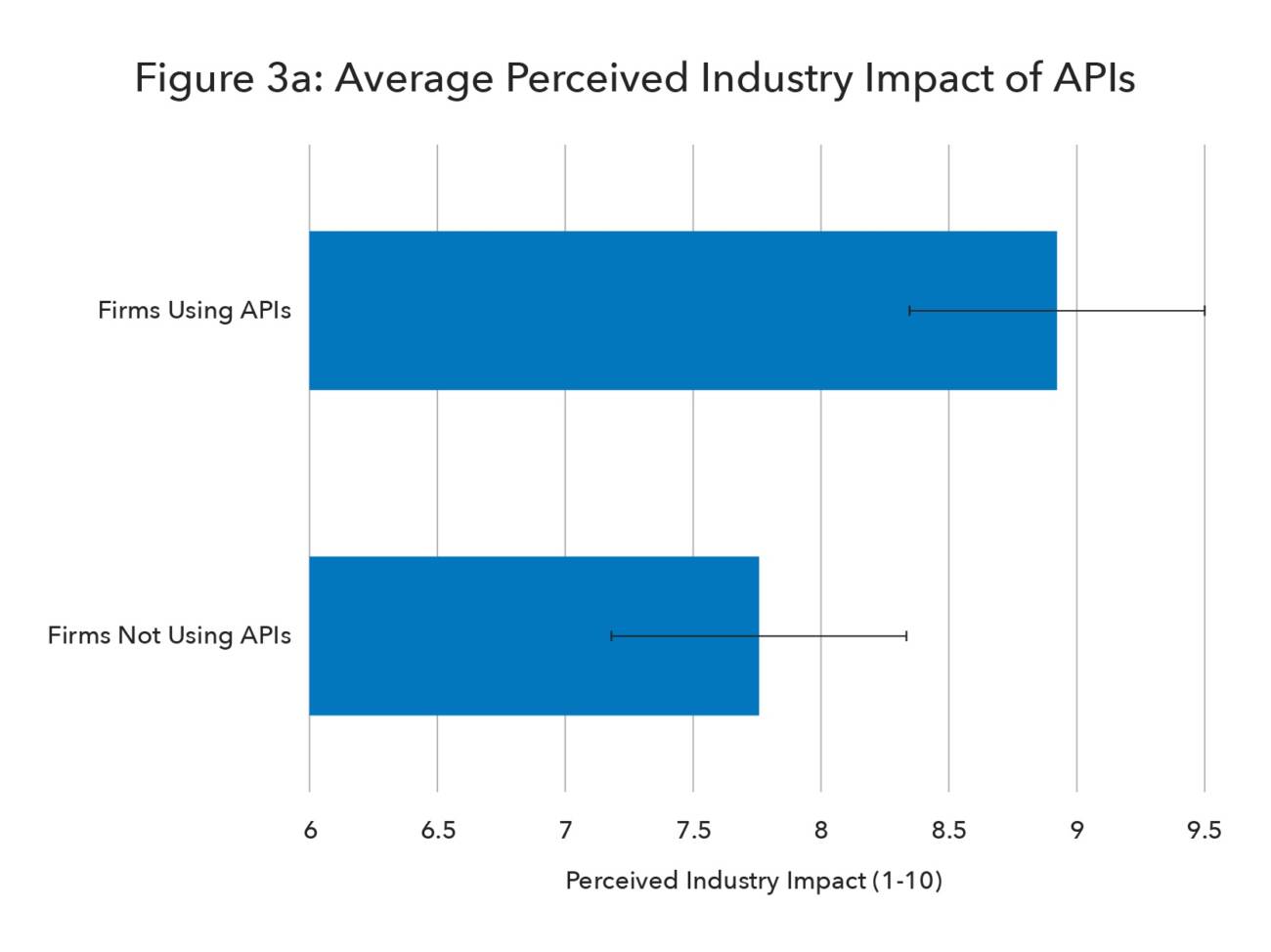

1 API Impact

Firms using application programming interface (API) technology (n=54) view APIs as having a greater impact (p=0.0011) than firms not using APIs (n=51). Firms using APIs may have more insights into the power and excess capabilities that the connections provide, skewing their perception in a positive manner. It is also possible that firms with a preconceived positive sentiment towards APIs are also the firms most likely to be using them.

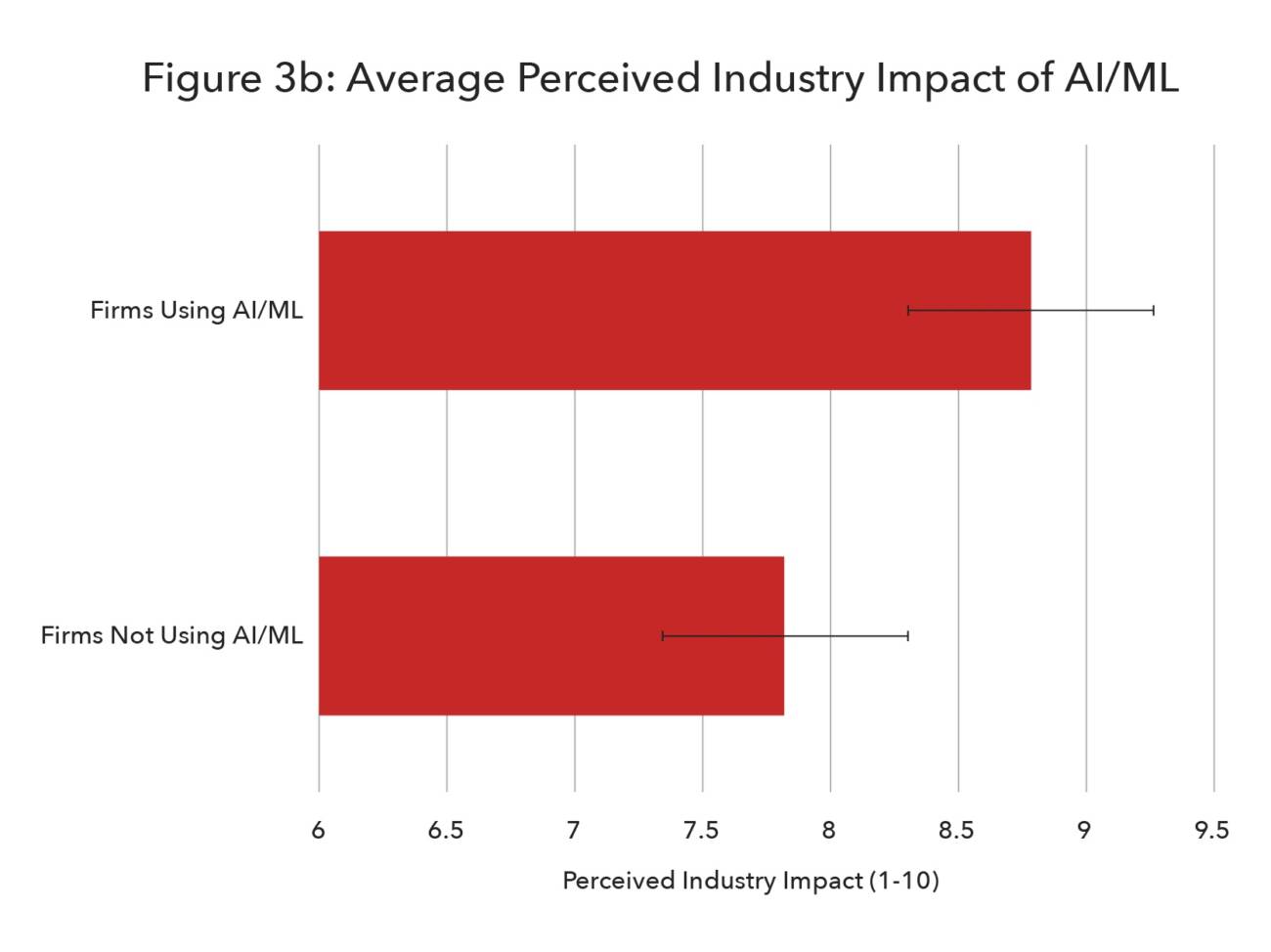

2 AI Impact

Firms using artificial intelligence and machine learning (AI/ML) (n=23) view AI/ML as having a greater impact (p=0.0407) than firms not using AI/ML (n=82). This difference could be attributed to several possibilities. One is that firms using AI/ML have an inside understanding of the true capabilities of the technology for the industry and are thus more optimistic. Another possibility is that the correlation runs in the opposing direction and that firms viewing AI/ML as having a strong impact are the firms most likely to have implemented the technology in their workflows.

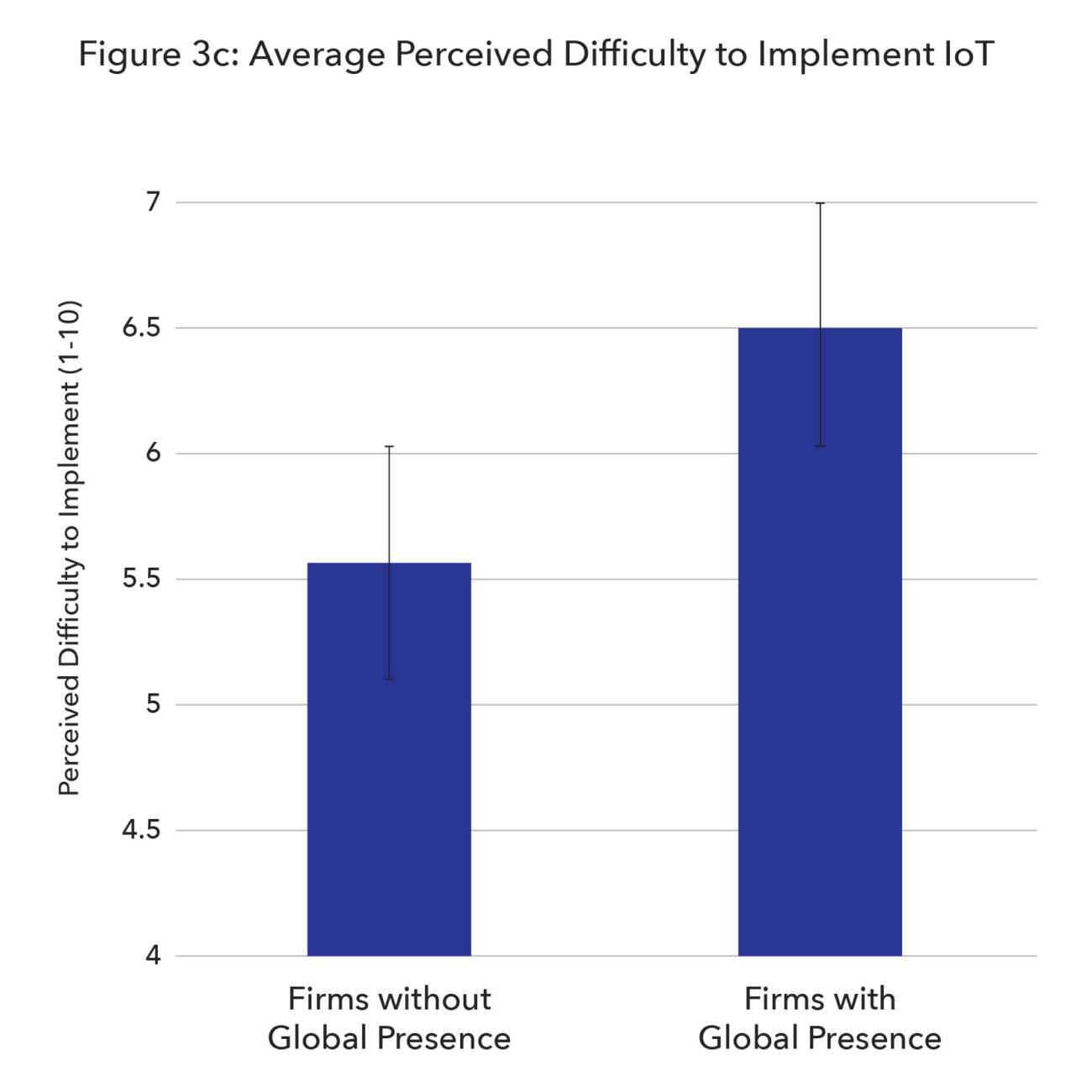

3 IoT Difficulty

Firms with a global presence (n=51) view internet of things (IoT) as more difficult to implement (p=0.0227) than firms without a global presence (n=54). This difference could be attributed to the notion that global firms have a larger scale perception of what will be required to interconnect the entire ecosystem, making the task seem more monumental. Firms with a global presence were no more or less likely to be using IoT, and firms using IoT did not view it as more difficult to implement than those not using it.

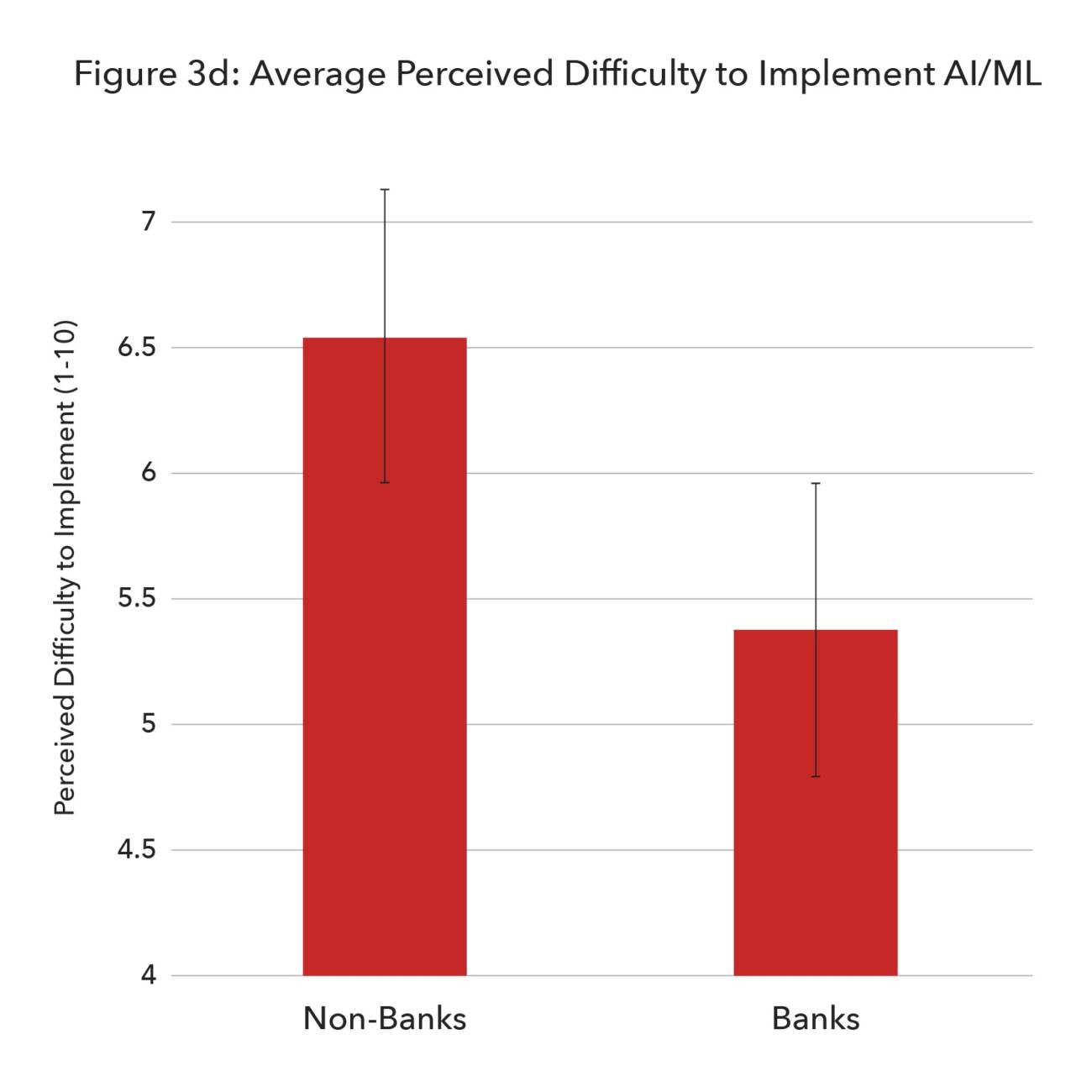

4 AI/ML Difficulty

As can be seen in figure 3d, banks (n=19) view AI/ML as being less difficult to implement (p=0.0090) than non-banks (n=86). Several possible explanations could underpin this difference. Banks already possess immense amounts of data, thus eliminating, from their perspective, the added difficulty of needing data for AI to be useful. Another reason could be that banks are simply more skilled in this area, making implementation appear like a straightforward endeavour.

Survey on Distributed Ledger Technology in Trade

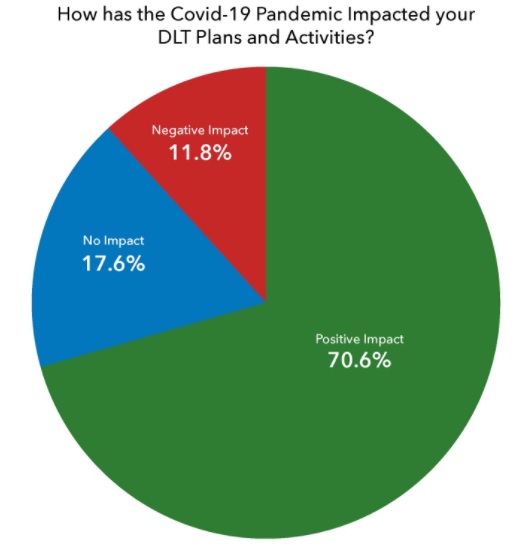

The WTO and TFG have also conducted a survey of firms specifically operating in the Distributed Ledger Technology (DLT) space. The results of this research, which sought to gain a detailed understanding of the impact that the global pandemic has had on DLT projects in trade, is depicted below.

As part of the survey, respondents were first asked how the Covid-19 Pandemic has impacted their DLT plans and activities. In congruence with the ICC Global Survey on Trade Finance, the WTO-TFG survey indicates that the vast majority of firms have experienced a positive benefit to their DLT plans and activities as a result of the pandemic. Without the physical presence of staff, due to work from home orders in many nations around the world, banks and corporates have been forced to produce rapid digital solutions in order to remain operational. In many instances, according to the ICC Digitalisation Working Group’s report Digital Rapid Response Taken by Banks Under Covid-19, this was best done by scaling up existing digital solutions. While many DLT solutions may not have been directly implemented as a result of Covid-19, the progress made on the implementations of supporting technologies have had clear positive implications.

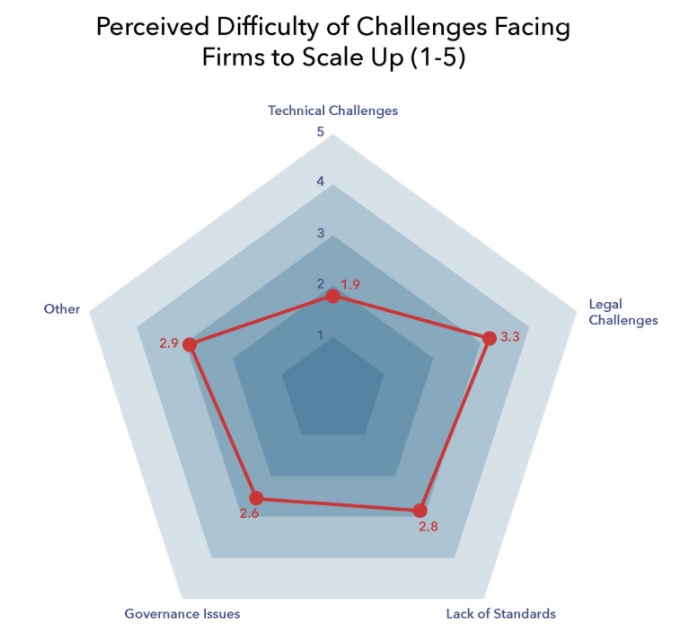

The WTO-TFG survey regarding the impact of Covid-19 on DLT and Trade also sought to understand the various challenges facing DLT firms as they try to scale up their solutions.

It is interesting to note that legal challenges were rated as posing a more pressing challenge than any of the other challenges. This suggests that the largest current challenge facing the deployment of DLT solutions across the industry relates heavily to lack of legal clarity and enabling regulatory framework that firms face. This idea is further supported by the results of the ICC Global Survey on Trade Finance. In the ensuing report, the ICC noted that when fighting to overcome the challenges of the Covid-19 Pandemic, “most banks have not yet seen meaningful support from authorities to facilitate trade on digital terms”. If the industry is to successfully transition into a digitalized world powered, in part, by DLT, regulatory development needs to keep pace with technological advancement. Governmental authorities and policymakers around the world need to begin addressing the historic, and often-times wildly outdated, laws that are burdening those seeking to guide the industry into the future.

Publishing Partners

- Tradetech Resources

- All Tradetech Topics

- Podcasts

- Videos

- Conferences