Estimated reading time: 4 minutes

At the European Bank for Reconstruction and Development’s (EBRD) Trade Facilitation Program Forum in Istanbul, Turkey, TFG spoke with Peter Mulroy, secretary general of FCI.

FCI is a global association of companies, financial institutions, and non-financial institutions engaged in open account receivable finance.

The association, active in over 90 countries, has 400 members that collectively comprise around 60% of the global volume and 90% of cross-border factoring activity of the $3.5 trillion global factoring industry.

This broad global access allows Mulroy to travel the world and speak on the successes in the factoring and receivables industry, often using Turkey as a role model.

The success of Turkey’s factoring industry

Since the first invoice was financed in the country in 1989, the industry has increased.

“There were just a few players back in the early 90s,” Mulroy said.

“Today, over 60 financial institutions are engaged in some capacity relating to domestic and international receivables finance.”

One factor for this growth has been the foresight of past Turkish leaders to develop a robust legal and regulatory environment around receivables finance to ensure that financiers are confident that the courts will protect their investments.

Another factor for Turkey’s success is the nature of the business conducted within its borders.

“Turkey is a consumer product country, meaning there is a significant amount of consumer products manufactured here, especially in some core factored industries like textiles and apparel,” Mulroy said.

“Hence (small- and medium-sized enterprises) SMEs have been very successful in capturing that business in open account with manufacturers in Turkey.”

A third critical success factor is that the country developed a successful factoring association with widespread participation across various stakeholder groups.

This has created closer relationships with regulators, better industry education, increased government cooperation, and better access to international markets.

“Turkey is one of the most successful international factoring markets in the world, and they have done that by developing a very strong relationship with global financial institutions around the world to support the cross-border element,” Mulroy said.

The impact of macroeconomic shocks on factoring in Turkey

Nearly every industry in the world has been impacted by current macroeconomic events like the Russia-Ukraine conflict, soaring inflation, food shortages, or the energy crisis.

While it has felt these events, the factoring industry in Turkey may not be as negatively impacted as some others.

“Factoring always does well in crisis times,” Mulroy said.

“That’s a given and has been supported by evidence of past economic upheavals over the past century.”

Turkey has also experienced a significant influx of immigration since the crisis, from countries like Ukraine, Russia, and Belarus.

Experts attribute this influx to Turkey acting as a welcoming hub and crossroads for travellers unable to secure visas to enter the European Union (EU).

Similarly, many manufacturers established in Ukraine, Russia, or Belarus have shifted their operations to Turkey to help mitigate the supply chain disruptions that ensued following the invasion.

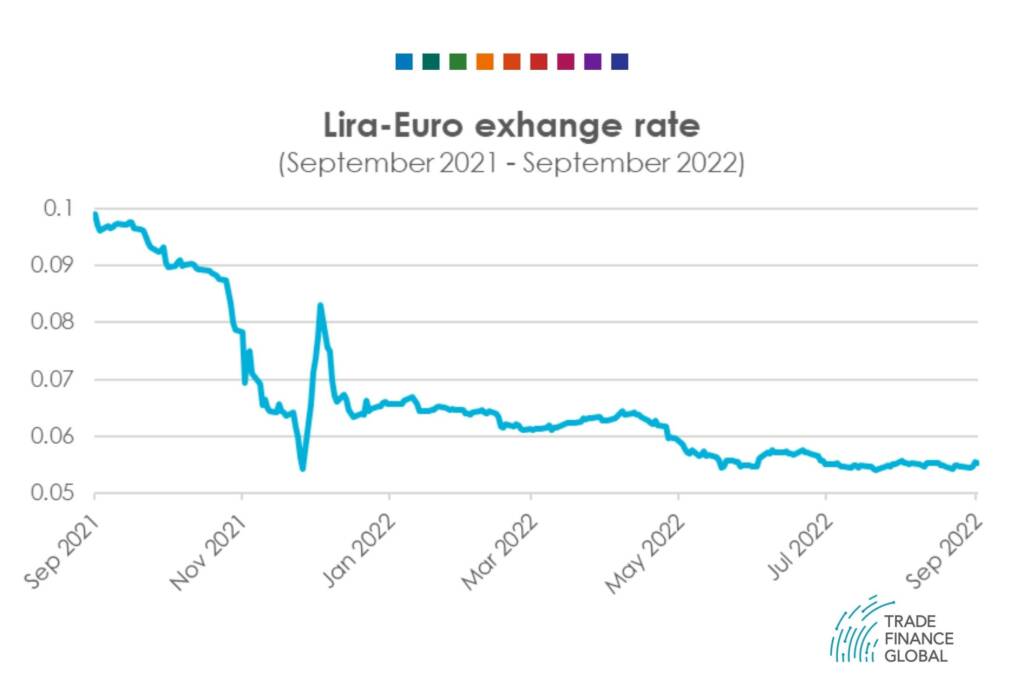

These manufacturers exporting to the EU have also benefited from the decline in the value of the Turkish lira relative to the euro, leading to significant order increases.

The result of this is a thriving Turkish export market.

“Turkish exports are booming––it’s one of the strongest markets in the world in terms of trade,” Mulroy said.

“But risk is a different matter––the political risk environment here is pretty high.”

In some instances, local banks that do not have a strong presence in other currency markets struggle to access dollar or euro capital.

“But overall, the strengths still outweigh the weaknesses,” Mulroy said.

“Even though you see the inflation and rising interest rates, the factoring industry is doing pretty darn well here in Turkey.”

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.