In early October 2015, the European Parliament voted to pass a directive known as Payment Services Directive, the main aim: increasing competitiveness between payment providers in Europe. This short paper cuts into why 2018 is an exciting and disruptive year for challenger banks, what the implications are for the world of payments.

As with much of the financial services industry, which often seems fairly ‘dark art’, complex and regulated, the Payment Services Directive (or PSD1) was a set of initiatives aimed to bring competitor payments companies (also known as Payment Institutions) to market and compete on the same level as banks, without the need for a high standard expensive banking license.

It all start with the Payment Services Directive (PSD1)…

In 2007, The European Parliament voted for the adoption of PSD1. The legislation simplifies payments and the processing of payments across the European Union, increased competition by allowing new entrants to come to market easily, and provided up a platform for Single Euro Payments (SEPA).

How do payments actually work?

PSD2 has much broader scope for consumers, but to understand this, we’ve got an example:

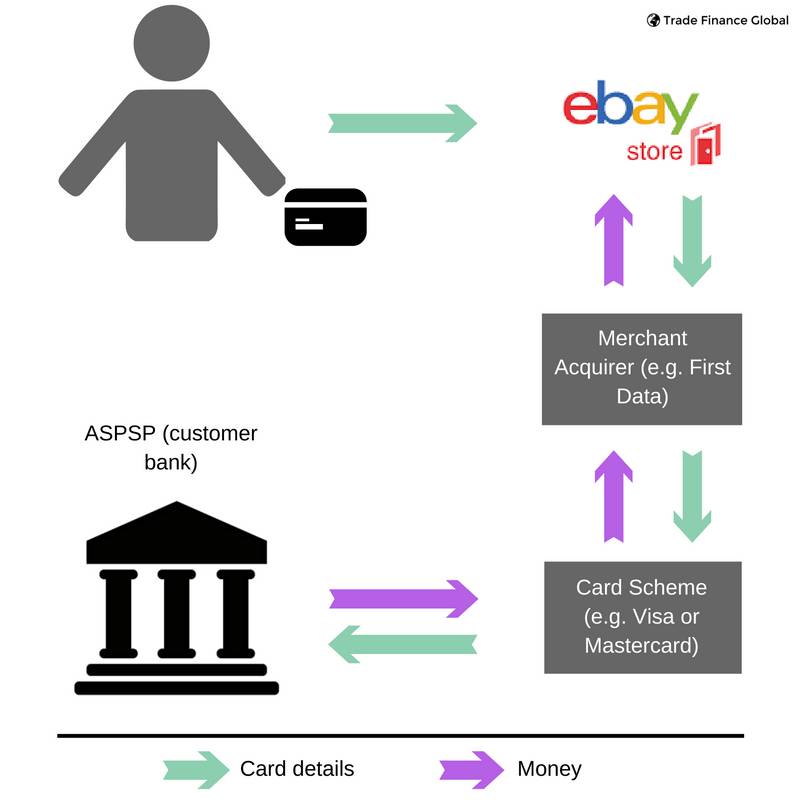

Say you’re a customer shopping on eBay, and you complete your transaction using one of your bank debit cards. eBay are the ‘merchant’ who use a broker such as WorldPay or First Data who would then go onto contacting your card scheme (the most popular being Visa, MasterCard, or Maestro), who pull the payment and take money out of the customer’s bank account (e.g your Natwest Current Account). This is shown in the diagram below:

Diagram 1 – Paying Online with a Debit or Credit Card

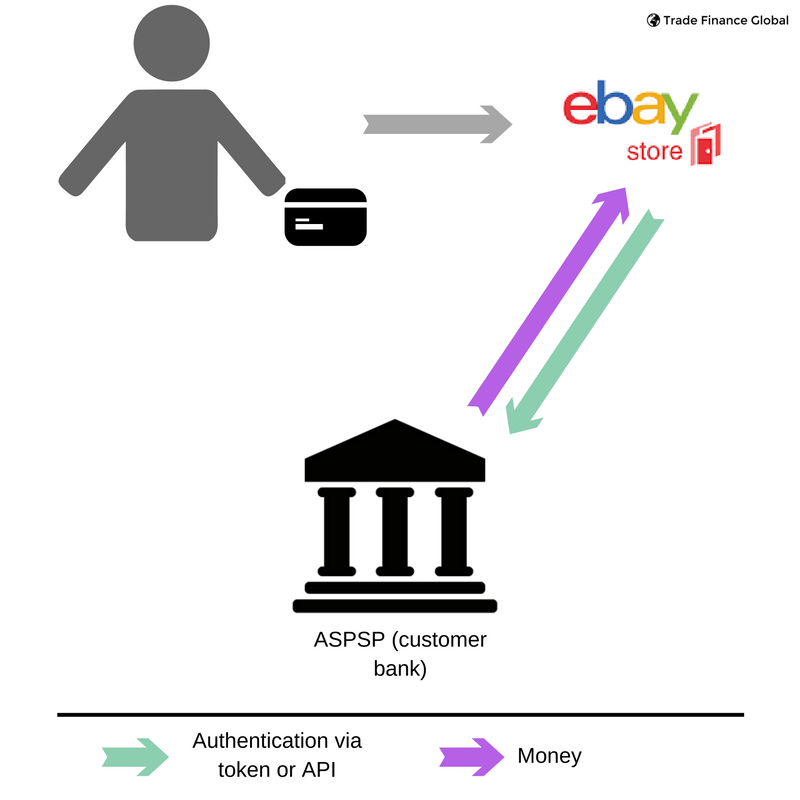

Now let’s revisit this example when PSD2 is active. Rather than entering your Debit card details into eBay, eBay can ask if you want them to contact Natwest Bank on your behalf and execute the payment. You won’t give your account details to eBay, you give them permission to do payments on your behalf (a bit like when you register with websites using Facebook or Twitter credentials; they don’t see your password to the social media sites)…

This means that moving forwards, customers can give permission for the merchants to stay active and act on your behalf to contact the payment provider (bank) until you revoke access (Diagram 2)

Diagram 2 – Paying Online with a Debit or Credit Card Post PSD2

How does PSD2 work, and who cares?

Here’s the technical bit. PSD2 allows the Payment Initiation Service Provider (PISP), in this case, eBay, to manage the bank, the Account Servicing Payment Provider (ASPSP), i.e., Natwest.

This payment path is known as Access to Accounts, and for completeness sake, it’s also got a sexy acronym; XS2A.

So what? The back end technology enabling this innovation is actually one of the biggest in financial services to date. Why? Because the banks can communicate to each through an API, an open Application Programme Interface. For the majority of customers, online transactions will go largely unnoticed, and it’s unlikely to significantly change a customer journey on ecommerce checkout.

Note for geeks: APIs aren’t new. They’ve been around for years, and most websites will integrate and use APIs of some form to collate information from other sites. It’s essentially a way for things to talk to each other. However, the API that’s being enabled from financial institutions is a very new concept under the new EU Directive.

Businesses however will need to seriously take into consideration PSD2 implementation. PSD2 disintermediates acquirers such as WorldPay and First Data, which means that for banks, they could lose a fairly big revenue stream. For merchants, it means costs can be reduced as they don’t need to pay as significant a fee to connect to banks. For banks, they must go through significant technological changes in their systems to open their financial data and customer account APIs to third party merchants.

For merchants, such as eBay or Notonthehighstreet.com, if they forego changes allowing their customers to communicate to the bank directly trough an API, they need to be compliant with regulatory standards (e.g. securely transferring customer data), but it means that they can save customers money as they save costs.

PSD2 part II: AISP

I’m sorry, what? Another element of the Payment Services Directive is the Account Information Service Provider (AISP). Acronyms aside, these ‘things’ allow companies to consolidate information from many different Account Servicing Payment Providers (ASPSPs). For customers, this is revolutionary, and could change the future of banking.

Customers might at some stage be able to use aggregators such as Moneysavingexpert.com to have a single consolidated view of their bank accounts – cool, hey?

It’s likely that as a result of PSD2, we will see more and more merchants positioning themselves as Account Information Service Providers, and it could force high street banks to also be AISPs (so customers might login to their Natwest bank account and see information from all of their other bank accounts).

The Banks will face the most challenges

All in all, it appears that the banks are the biggest losers out of the implementation of PSD2. Banks will have to invest significantly into their legacy systems as they face squeezed revenue streams (or even no revenue stream at all) from payment service providers, they won’t be able to surcharge for card payments.

It is predicted that up to 9% of revenue for retail payments could be foregone as a result of PSD2 by 2020.

How can merchants and banks prepare for PSD2?

With the addition of AISPs and PISPs, banks have to adopt and become less siloed. One example, is that banks currently do not allow for third parties to access customer information. PSD2 forces banks to develop solutions and create APIs which allow this. An example of this could be through social media – by allowing apps such as Facebook Messenger and Whatsapp to become PISPs, they can essentially send payments.

At Sibos 2016, Mr Cambounet, VP at Axway highlighted the need for banks to look at their current ecosystem and to encourage open banking in order to blueprint their future.

Banks should strategically assess opportunities of the new regulation, rather than seeing it as a way for challengers to ‘eat their lunch’. Banks have a large retail footprint, customer database and trust. Banks could look at developing customer centric applications which monitor spending behaviour, as well as inform customers on what they charge in terms of back end revenues.

Lots of acronyms? See this article, courtesy of Starling Bank.

VIDEO: How the PSD2 will change the European payments landscape: What innovation is needed

Transaction banking editor Joy Macknight speaks with David Ellender, the head of platform innovation, global transaction banking, at Lloyds Bank, about his views on the innovation banks need to be working on for a successful implementation of PSD2.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

They could have waited a few years and we could have had decent CBC implementation…I don’t see Legacy being addressed by this…I just see everyone bolting on an API on a Legacy system, or putting an Intermediary Database (taken from a Legacy system) and adding an API. It’s a bit like saying “If we force everyone to have Double glazing, people will just move house….”… bonkers…

What’s not ‘cool, eh?’ is that third parties will have open access to information I have provided believing that the institution (bank, merchant, etc) had an unbreakable duty to keep that information private. PSD2 will give my personal information to anyone who can log in from, for example, a debt collector (well known as employers of violent criminals) or any other spurious credit checking gang. This will mean that all that information will be available to the criminal fraternity, government agencies (indistinguishable from other criminal organisations, often) and any of their associates, sub-contractors and short-term employees. The advantage is that financial institutions will have more money to roll around in. Ie, nothing in it for me except pain and fear.