- Topics

- Themes

-

Trade

Do you want to know how access to trade finance can increase your cross-border imports and exports? Explore our Trade Finance hub for practical tools.

Treasury

Are you a treasury or operations manager looking to mitigate the risks and efficiently manage your business’ cash flow? If so, check out our Treasury Management hub.

Payments

Whether you want updates from infrastructure support to cross-border transactions or clearing house operations to processing techniques, you can find all on our Payments hub.

Letters of Credit

Ready to to increase your imports / exports to guarantee the payment and delivery of goods? Find out more about LCs here.

Shipping & Logistics

Whether you’re transporting goods, or learning about supply chains, warehousing, transportation and packaging, we’ve got you covered.

Incoterms

Need to know which International Commerce Term is right for your needs? Explore our curated guides from shipping expert Bob Ronai.

Sustainability

Prioritising sustainable supply chains? Building inclusive trade? Working towards the UN’s 2030 SDGs? Read the latest on global sustainable standards vs green-washing here.

Customs

Heading into international markets? From the correct documentation to standardisation, here’s what you need to know for a streamlined customs clearance process.

TradeTech

TradeTech is rapidly evolving to help reduce some of the biggest challenges when it comes to trade. Keep up with these innovations here.

-

- News & Insights

-

News

The latest in Trade, Treasury & Payments - stay up to date on all the changes across the globe.

Magazines

The issues feature experts across the industry on the latest developments with specific themed and regional editions.

Articles

Insights by the industry, for the industry. These include thought leadership pieces, interview write ups and Q&As.

Guides

Working closely with industry experts and trade practitioners we provide inclusive educational guides to improve your technical knowledge and expertise in global trade.

Research & Data

We undertake qualitative and quantitative research across various verticals in trade, as well as create reports with industry association partners to provide in-depth analysis.

Trade Finance Talks

Subscribe to our market-leading updates on trade, treasury & payments. Join the TFG community of 160k+ monthly readers for unrivalled access in your inbox.

-

- Media

- Events

-

Partner Conferences

We partner with industry conferences around the world to ensure that you don’t miss out on any event; in person or online, add to your calendar now.

Women in Trade, Treasury & Payments

Get involved in our most important campaign of the year, celebrating the achievements of women in our industry and promoting gender equity and equality.

TFG Geneva

Trade Finance Global is excited to announce our first international conference: ‘TFG Geneva: Challenges and Opportunities within Trade & Commodities’, which will take place on 6 November 2025!

Awards

Our excellence awards in trade, treasury, and payments are like no other. You can't sponsor them, and they're independently judged. They are the most sought-after industry accolades.

Online Events

Join our virtual webinars and community events. Catch up on-demand, right here on TFG.

-

- Editions

- Themes

- Access Finance

- Finance Products

-

Trade Finance

Trade finance is a tool that can be used to unlock capital from a company’s existing stock, receivables, or purchase orders. Explore our hub for more.

Invoice Finance

A common form of business finance where funds are advanced against unpaid invoices prior to customer payment

Supply Chain Finance

Also known as SCF, this is a cash flow solution which helps businesses free up working capital trapped in global supply chains.

Bills of Lading

BoL, BL or B/L, is a legal document that provides multiple functions to make shipping more secure.

Letters of Credit

A payment instrument where the issuing bank guarantees payment to the seller on behalf of the buyer, provided the seller meets the specified terms and conditions.

Stock Finance

The release of working capital from stock, through lenders purchasing stock from a seller on behalf of the buyer.

Factoring

This allows a business to grow and unlock cash that is tied up in future income

Receivables Finance

A tool that businesses can use to free up working capital which is tied up in unpaid invoices.

Purchase Order Finance

This is commonly used for trading businesses that buy and sell; having suppliers and end buyers

-

- Sectors

-

Machinery & Equipment

Technology, construction, telecommunications, PPE, and electronics

Commodities & Materials

Raw materials, agricultural products, minerals, metals, and textiles

Chemical & Energy

Pharmaceuticals, chemicals, and energy products

Autos, Aerospace & Marine

Automotive, aviation, and marine industries

Pharma & Healthcare

Pharmaceuticals, healthcare equipment, and related sectors

Metals & Mining

Ores, minerals, metals, and concentrates

Finished Goods

Retail stock, e-commerce, textiles, clothing, and consumer goods

Construction & Projects

Construction, infrastructure, project finance, and green finance

Tech, Media & Telecom

Construction, infrastructure, project finance, and green finance

Food & Beverages

Food, drink, dairy, confectionery, and alcohol

Professional Services

E-commerce, recruitment, legal services, and hospitality

-

- Case Studies

-

Informing today's market

Financing tomorrow's trade

Soft Commodities Trader

Due to increased sales, a soft commodity trader required a receivables purchase facility for one of their large customers - purchased from Africa and sold to the US.

Metals Trader

Purchasing commodities from Africa, the US, and Europe and selling to Europe, a metals trader required a receivables finance facility for a book of their receivables/customers.

Energy Trading Group

An energy group, selling mainly into Europe, desired a receivables purchase facility to discount names, where they had increased sales and concentration.

Clothing company

Rather than waiting 90 days until payment was made, the company wanted to pay suppliers on the day that the title to goods transferred to them, meaning it could expand its range of suppliers and receive supplier discounts.

-

- Search

- Get Trade Finance

- Finance Products

- About Us

- Talk To Us

TradeTech

TradeTech Overview

Developing Technologies

Resources & Guides

Download our Tradetech Whitepaper

Accelerating trade digitalization to support MSME financing

Content

Welcome to the TFG TradeTech hub. International trade and trade finance is going through rapid innovation, thanks to the advancement of both developed and brand new technologies. In the TFG TradeTech hub, we focus on how technologies affect the digitalisation of freight and transport, trade and customs and access to finance. TradeTech can help reduce some of the biggest challenges when it comes to paper documents, access to MSME finance and getting goods from A to B would be easier.

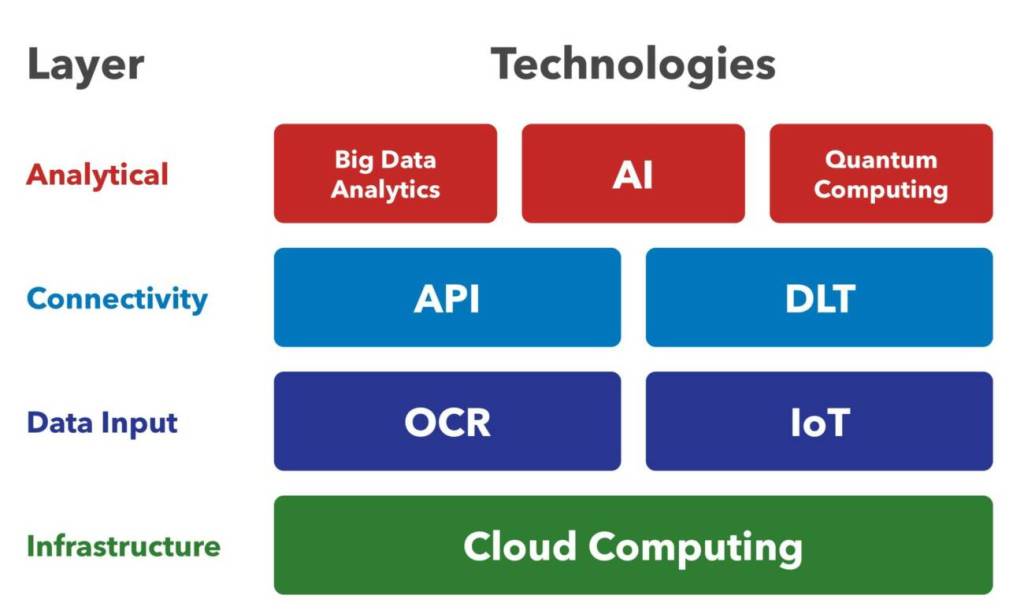

TradeTech – Layers

TradeTech – Frequently Asked Questions

What is the definition of TradeTech?

Trade finance technology, often abbreviated as TradeTech, refers to the use of technology, innovation, and software to support and digitally transform the trade finance industry. It is often considered to be a subcategory of the more widely used term, FinTech. TradeTech, which can include several technologies, puts a particular emphasis on the application of technology and software to modernise trade finance.

These technologies include but are not exclusively limited to cloud computing, optical character recognition (OCR), internet of things (IoT), big data analytics, artificial intelligence (AI), quantum computing, distributed ledger technology (DLT) and application programming interface (API).

Who uses TradeTech and what is its role in global trade?

TradeTech can be used by any firm in the international trade ecosystem. While TradeTech applications are often developed by large banks or innovative technology companies, the applications themselves are not limited to this demographic.

Many micro, small and medium enterprises (MSMEs), however, are often under the impression that technology is simply not for them and view it as complex and costly. This may be due to the idea that some digital trade technology solutions focus more on trying to explain the technology itself rather than simplifying the explanation and service offering to MSMEs, leading to a lack of audience engagement. Continual efforts to make MSMEs aware of the plethora of opportunities available to them are important. Governments may have a role to play in this respect to raise awareness and provide education for MSMEs.

How has the COVID-19 pandemic impacted TradeTech?

The COVID-19 pandemic has rapidly accelerated the development and adoption of many TradeTech applications. Largely, these have come about as a result of a lack of physical employee presence at the usual places of business, coupled with the inability to print and transport documents. Operating under “normal” processes has not been an option. To cope, banks have been forced to create or scale up ad hoc digital processes.

Despite this firm-level acceleration, there have also been indications that many banks have not received significant meaningful support from government authorities to facilitate trade on digital terms. Nevertheless, the desperate necessity for paperless workarounds has set the industry on a digital course.

Does TradeTech include data security?

Absolutely. Given the vast amounts of data that exist today, data security must be treated as a top priority and subsequently exists at the heart of nearly every TradeTech application. For some, like distributed ledger technology, the security of data is at the core of their reason for being.

For many firms, using TradeTech applications will go a long way towards boosting their data security. This is because TradeTech providers generally operate internationally. In order to do so effectively, the data security standards that they use to protect consumer data must meet the stringent requirements of every region they operate within. For most end-users, this means that their data will be protected to a standard greater than that legally required in their own jurisdiction.

What is the most prominent technology in trade?

There is a complex interplay between all of the technologies used in trade. Each technology relies on the capabilities of others to deliver its most powerful benefits. Some of them work to collect and deliver data, others analyse and interpret this data, and still others provide the infrastructure which allows this communication to occur. Take, for example, the role of the internet of things (IoT) in this relationship. IoT devices and sensors on their own provide minimal value. However, when they are combined with the secure transmission capabilities of distributed ledger technology (DLT) and the analytical capabilities of big data analytics tools enabled by artificial intelligence (AI), they are able to deliver meaningful and actionable information.

To name one technology as the most prominent would be like deciding which part of a car is the most important. One could argue the engine, or the brakes, or the tires – but it is safe to agree that the car is just better when it has all of these combined together.

Why is technology in trade so underdeveloped relative to other industries?

Many of the cumbersome processes that exist in trade today have been developed to allow parties to a transaction to trust the outcome of the transaction even if they do not trust their counterparties. Considering that the counterparties are often on opposite sides of the globe and operating in vastly different legal systems, it has been critical to thoroughly develop robust instruments that both parties trust to facilitate these transactions.

Until recently, the technological tools that could be used simply did not suffice in facilitating this trust – meaning that they were just not good enough to replace the paper processes that were already in place. This led to several decades of technological progress in other industries that effectively bypassed international trade.

Today, however, with advancements in technology such as distributed ledger technology (DLT), it is finally possible to trust digital mechanisms in lieu of their paper counterparts that have been in use for so long.

How can TradeTech help inform trade policy?

Most current national regulations do not allow most TradeTech solutions to be widely adopted. This stems from legal concerns, such as the ambiguity of Uniform Customs and Practice for Documentary Credits (UCP) rules, which do not specify whether digital tools such as artificial intelligence (AI) can be used in lieu of humans. As increased developments and proofs of concept demonstrate the efficiencies and power of TradeTech, policymakers around the globe will be forced to modernise their nation’s policy or sit idly by as the global economy moves on without them.

The United Nations Commission on International Trade Law (UNCITRAL) has already developed a model law that would create an enabling regulatory framework recognizing e-signatures and e-documents – the Model Law on Electronic Transferable Records (MLETR). The UNCITRAL MLETR has already been adopted by 2 countries – the Kingdom of Bahrain and Singapore. Its adoption by the broader global community is critical to the continual development of TradeTech solutions.

What is the definition of TradeTech?

Trade finance technology, often abbreviated as TradeTech, refers to the use of technology, innovation, and software to support and digitally transform the trade finance industry. It is often considered to be a subcategory of the more widely used term, FinTech. TradeTech, which can include several technologies, puts a particular emphasis on the application of technology and software to modernise trade finance.

These technologies include but are not exclusively limited to cloud computing, optical character recognition (OCR), internet of things (IoT), big data analytics, artificial intelligence (AI), quantum computing, distributed ledger technology (DLT) and application programming interface (API).