TFG interviewed Robert Meters (RM), Head of Marketing and Sales, Global Business & Financial Services at SCHUMANN to discuss how the trade credit insurance has changed as a result of the covid-19 pandemic.

The Department for International Trade has recently published its Global Trade Outlook report. TFG summarised of the key points from the report, outlining what could be in store for global trade between now and 2050.

Your morning coffee briefing from TFG. Korea contributes CHF 290,000 to help developing countries participate in global trade, commodity dependence increased over the last decade, supply chains crisis will leave lasting change on globalisation, food price inflation increases pressure on poorer countries and Brexit trade barriers added £600m in costs to UK importers this year.

SINGAPORE & NEW YORK – September 13, 2021 – MonetaGo, a financial technology solutions provider, today announced a new platform to combat financing fraud in trade finance on a global… read more →

The TFG / Finastra’s tradecast will explore how corporates are reacting to new levels of volatility, and ultimately, how technology and innovation can help build inclusive, resilient global value chains.

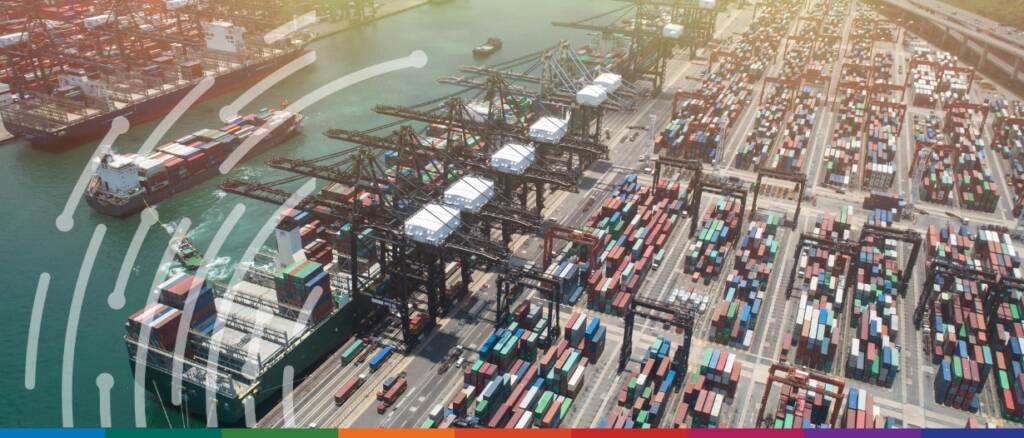

Global supply chains have been and continue to be deeply impacted by the changes that have taken place in the last 12 months. From the Suez canal debacle to the current shortage of HGV drivers in the UK, it is fair to say that the industry is, currently, facing significant challenges.

Our editor, Deepesh Patel sat down with Zencargo’s Sales Director, Sam Greenhalgh to discuss what changes need to take place to make the shipping industry more attractive to young professionals.

The need for trade digitization has never been more prevalent than it is today, especially with pandemic-induced restrictions emphasizing the inefficiency of paper-based trade. Our Editor, Deepesh Patel sat down with Contour’s CEO and Chief Product Officer, as well as TradeLens’ Head of Strategy and Operations, to discuss how fintech can come together to partner to solve these problems.

Global exports of intermediate goods such as parts and components rose 20% year on year, latest World Trade Organization (WTO) report finds. Asia recorded the highest growth in exports of… read more →

Open account business drives economic activity worldwide, and during times of volatility, uncertainty and of course, the pandemic, the need for solutions when it comes to receivables finance has never been more pronounced.