At the ITFA annual conference in Abu Dhabi, TFG’s Mark Abrams spoke with Nishit Kumar, Senior Director, Head of Loan Syndications and Distribution at Mashreq Bank, and Kamola Burikhodjaeva, Executive Director, Head of Americas Distribution at J.P. Morgan.

“None in particular” is the phrase most frequently heard from enterprises ranked in the top 100 for revenue across eight major global markets when asked which provider leads in digital… read more →

Visa has announced a partnership with PayPal and Venmo to trial their new program, Visa+. This new service looks to help individuals transfer money rapidly and safely between different person-to-person… read more →

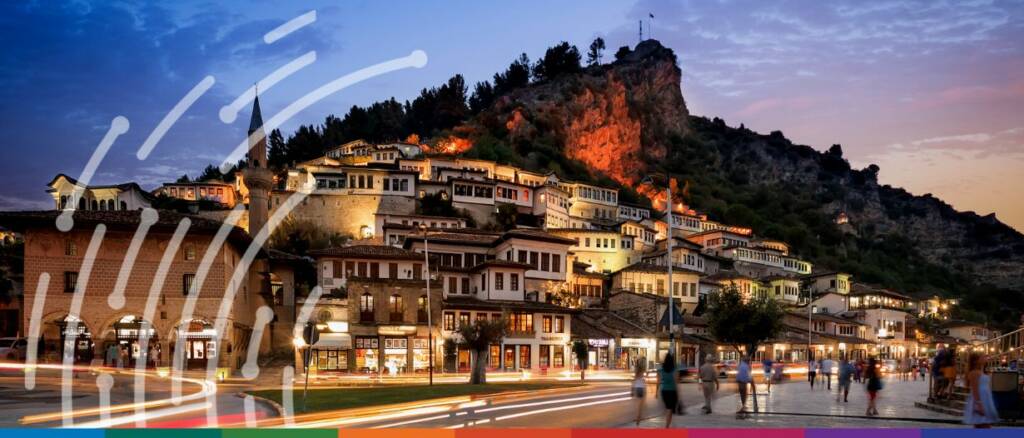

Looking to further international trade, Tim Reid, CEO of UK Export Finance (UKEF) met with Albanian Prime Minister Edi Rama, and Finance Minister Deline Ibrahimaj to finalise a £4 billion… read more →

Moody’s Investors Service announced the long-term deposit ratings of ten banks in Saudi Arabia, as well as the senior unsecured and subordinated debt ratings of their affiliated entities, where applicable,… read more →

To better understand the larger picture of ‘Embracing Equity’, TFG’s Brian Canup spoke to Natalia Clements, senior trade finance specialist at Swiss Re Corporate Solutions, who shared her experiences as a woman in the insurance industry, the challenges she has faced, and the importance of embracing equity in the workplace.

Over the next 12-24 months corporates in Asia Pacific are looking to move more of their supply chains closer to home. According to HSBC’s latest report ‘Global Supply Chains –… read more →

The International Finance Corporation (IFC), the World Bank’s investment arm, said it will provide Sri Lanka a $400 million cross-currency swap facility to help fund essential imports. Three private banks,… read more →

2022 was a year of seismic and rapid changes for international trade and trade finance. War in Europe, COVID-19, and inflation created unimaginable disruptions in the industry. This dynamic phase is creating opportunities and gives way for new entrants in the ecosystem.

ING announced today that it has spun out Loan Optics to vc trade GmbH, the leading digital platform in the market for private placement and promissory note loans. Loan Optics… read more →