In light of the current global energy crisis characterised by rising fuel prices and geopolitical tensions, support for the energy sector – especially in the clean energy space – is critical.

BII, the UK’s development finance institution and impact investor, has partnered with Citi to launch a $100 million risk-sharing facility.

Quor and ClearDox announce a partnership to enhance digitalisation and automation in commodity trading solutions.

Trade Finance Global and CommodityThursday are happy to announce a partnership to further connectivity within the industry.

Learn how IFC and DBS Bank are bridging the global trade finance gap and supporting trade financing in emerging markets.

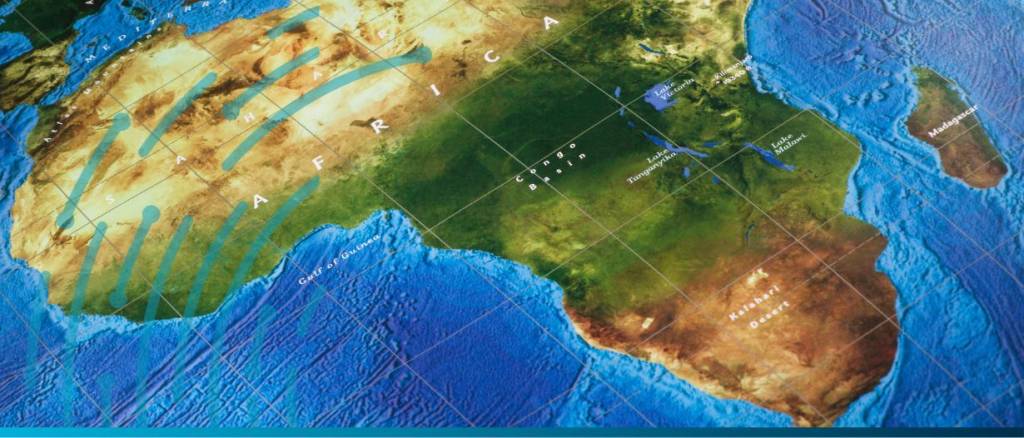

Get insights into BII’s $100M facility with TDB, advancing trade finance and tackling economic difficulties in Eastern and Southern Africa.

Trafigura secures $1.9B multi-currency facility, extends $3.7B credit line. Learn about their sustainability-linked loans.

According to officials, the UAE’s non-oil trade reached $952 billion in 2023, breaking previous record highs. Read more about the news here.

Explore the modern concept of commodity finance. Learn about trades, costs, and the power of commodities in today’s markets!

Navigate today’s economic landscape with the knowledge of commodities & trade finance. Learn how to make a bankable proposal.