The United Kingdom, and in particular London, has been at the helm of entrepreneurship within Europe, even rivalling Silicon Valley. Of Europe’s technology start-ups worth $1bn of more, the UK is home to 40%, even though only 10% of Europe’s population lives in the UK. However, the vote to leave the European Union will undoubtedly have an effect on these start-ups, particularly the fintech (financial technology) sector.

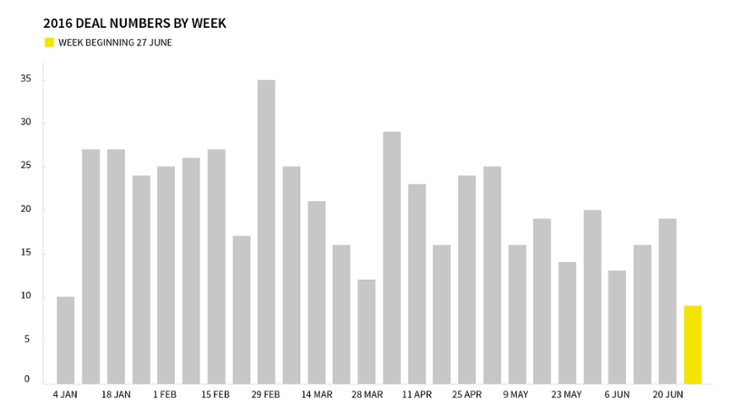

Early indication from Beauhurst shows that equity deal numbers in 2016 have fallen over 20% compared to the second half of 2015, with the EU referendum and its impact on investor confidence likely to have played a significant role in the second quarter of this year.

The effects of Brexit on the industry, much like everything, depends on the result of the negotiations and what sort of deal is negotiated.

For fintechs, access to the single market is very important as this allows for ‘passporting’ rights for UK financial services allowing them sell across Europe, while only having to follow a single set of regulations.

Fintech companies have still been able to bag some £40.6m in equity funding, most notably, Revolut’s £7.75m raise, and MarketInvoice’s £7.2m fundraise.

According to a report jointly carried out by Ernst & Young and the Treasury, leaving the single market could mean that roughly £6.6bn of revenue generated by the UK’s fintech sector become spread across other major cities in Europe.

Furthermore, funding for start-ups could be hit as the EU provides capital for a variety of initiatives designed to help businesses get off the ground and grow. However, there are still ways for post-Brexit start-ups to access EU funding, for example both Israel and Norway both receive money for start-ups through the EU’s Horizon 2020 innovation and funding initiative.

Additionally, the UK is currently a net contributor to the EU, and so a Brexit could mean that more money would become available to be spent on home grown funding initiatives.

Nevertheless, leaving the European Union and its free movement of labour rules could mean that the UK attracts fewer workers to fuel its start-ups. Innovative Finance believe that 30% of the UK’s 61,000 fintech workers come from overseas, with the vast majority originating from within the EU.

Despite the potential issues leaving the EU may cause, Brexit could also create positive opportunities for the fintech industry. These may range from more favourable tax arrangements such as tax breaks for start-ups, a greater focus on attracting the most skilled labour and the ability to negotiate better trade agreements. These benefits, combined with a strong desire from the UK government to help home-grown start-ups could improve entrepreneurship within the UK.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.