Electronic Payment Undertaking (ePU)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

An ePU requires the ability to create and sign an electronic document that has all the properties associated with a NI in English law. Therefore, an effective ePU must have the following characteristics.

3.2.1 Critical Characteristics of an ePU

- be identifiable as an original (i.e. distinguishable from a copy);

- be an irrevocable, unconditional promise to pay;

- to a holder in due course;

- who can freely transfer it;

- with no defence to non-payment; and,

- be evidenced in an immutable electronic original document solely controlled by the holder.

3.2.2 ePU Requirements

The requirements for an ePU, outlined below, closely mirror the dDOC requirements discussed in 2.4.2.

The underlying technology solution used for the ePU must be a cryptographically secure electronic document, independent of any IT system or platform, linked to a public key, and evidenced in a DL where:

- the ePU must carry cryptographic evidence (hash values) of its content that are published on its associated DL;

- the ePU must contain a public key corresponding to a private key, to evidence the possession of the ePU;

- it must be possible to add content to the ePU but impossible to alter previous content;

- the ePU must be able to carry electronic signatures and electronic stamps; and,

- it must be possible for the owner to invalidate the ePU;

In addition to the ePU, the DL evidencing the state and the holder of the ePU must:

- function as an incorruptible cryptographic assurance utility with central governance using a distributed block-chained ledger. The ledger must be continuously and independently validated and approved by its participants;

- be publicly accessible to any holder of an ePU or anyone holding a copy of an ePU; and,

- be associated with a URL where any person or organization can manage and receive an ePU.

The underlying technology solution should also:

- be operationally and technically compatible with the integration of existing and future front-to-back office practices, processes, channels, and systems;

- ensure that all business data stays in the ePU and no business data is, through the underlying technology, shared in any central register or in the associated DL;

- be a utility where participants using negotiable instruments and documents of title can share a common trust in the truth of what an original ePU is, what the current version of an original ePU is, and who the current holder of an original ePU is; and,

- enable the original ePU document and its referred attachments and the secret private ownership key to be stored anywhere the holder sees fit, using a storage technology with security measures deemed appropriate by the holder.

Benefits of Digital Negotiable Instruments

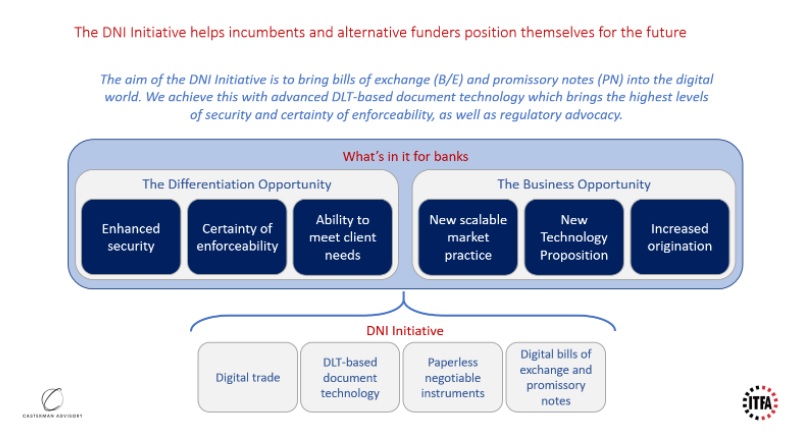

We believe the benefits for banks as well as alternative lenders and export funding platforms are numerous. The DNI Initiative helps them provide additional value thanks to a superior client experience while, at the same time, enhancing the security of the document and certainty around the enforceability of the instrument. The DNI Initiative aims to help banks increase origination volumes thanks to faster processing of client financing requests.

A Summary of the Legal Issues Surrounding an ePU

The BoE 1882, which governs NIs under English law does not explicitly require that a B/E be in paper form. While this is true, the act does require that certain physical actions are able to be performed on the document, namely the actions of writing on, signing, and delivering. As such, in order for an eNI to be recognized as a NI, its underlying system must be able to replicate these actions. The actions of writing and signing are already well-established under English law as actions that can be done electronically. Unfortunately, this is not the case for delivering, which is legally accomplished through the transfer of possession.

While it has been the subject of recent criticism, the current position of English law is that it is not possible to “possess” an intangible. Since an eNI is intangible, it is not possible to legally possess one. As it cannot be possessed, it is not possible to transfer possession of an eNI, one of the physical actions required for a NI. Therefore, it is currently not possible to have an eNI under the BoE 1882.

There are, however, means of achieving sufficient certainty about the delivery of eNIs. One method would be for the UK to adopt the United Nations Commission on International Trade Law (UNCITRAL) Model Law on Electronic Transferable Records (MLETR) or to pass another general eCommerce law that would effectively allow electronic promissory notes (ePNs). Another method would be for the definition of ‘delivery’ under the BoE 1882 to be amended to clarify that the delivery of an eNI in an electronic system is achievable.

There is a third option that can be used in the interim. Under English law, it should be possible to create an electronic instrument that has the features of a NI and that is an enforceable debt obligation but that is not a NI for the purposes of the BoE 1882. Utilizing such an instrument would alleviate the need to consider the transfer of possession under the BoE 1882.

A full legal analysis conducted by Sullivan & Worcester UK LLP can be found in Appendix 1.

Opportunity for Policy Makers

In Q2 2020, ITFA set up the Technology Experts for Regulatory Action (TERA) task force. Recognizing the importance of changing laws in most countries to progress trade digitization, ITFA’s goal is for TERA to act as a centre for the coordination of regulatory advocacy work on priority topics. These topics include such things as DNIs, digital bills of lading, use of cloud computing, use of electronic signatures, use of trade assets to channel public relief efforts, and use of tokenization and digital assets.

Regulators are increasingly being approached by several segments of the financial industry (e.g., securities services, digital assets) with similar requests regarding the use of DLT for recognizing ownership and transfer of intangible assets such as DLT-based payment undertakings.

The dDOC specifications offer the opportunity for policymakers to refer to a vendor-agnostic industry-wide framework when considering the parameters of change and the necessary governance to guide change.

- Digital Negotiable Instruments

- TFG Legal Hub