Digital Documents

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

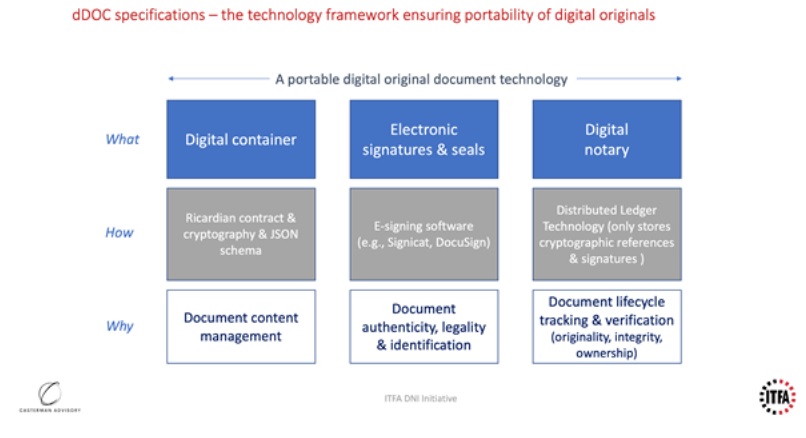

The ITFA has defined the dDOC specifications. The specifications formalize a technology-centric and vendor-agnostic framework to leverage DLT in a manner that remains predominantly interoperable with existing practices, systems, and channels.

The dDOC specifications describe how to leverage advanced document technology to produce, manage, and share digital original documents. Such documents are natively digital originals that are portable amongst financial institutions, their correspondent banks, their clients, and any third-party platform they wish to use for value-added processing (e.g., bill of lading platform, payables and receivables financing). Those specifications have been developed with an “open banking” mindset leveraging hybrid blockchain technologies.

dDOCs vs Paper Documents

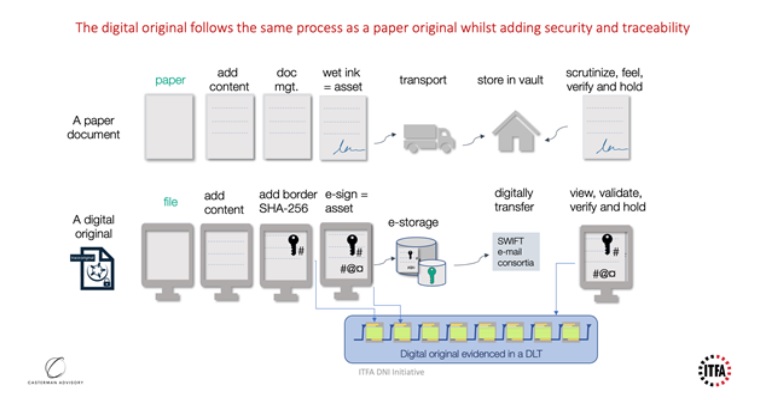

The first step in conceptualizing the dDOCs specifications is to understand how the processes used for a digital document compare to those of its paper counterpart. The following diagram provides a high-level overview comparing the two. Some of the aspects of this diagram will be further broken down and examined in subsequent sections of this paper.

Understanding dDOCs

Until relatively recent advancements in cryptography and the advent of DLT, digital mechanisms for signing and storing electronic documents simply did not suffice in replicating many of the fundamental properties of paper documents needed for legal applicability. A simple PDF file, for example, can be digitally copied any number of times, with each copy indistinguishable from the original and freely editable by any number of players. For many applications, this poses no issue at all, however, when the document in question represents a legally enforceable promise to pay, in some cases, millions of dollars, this lack of digital accountability can pose major concerns.

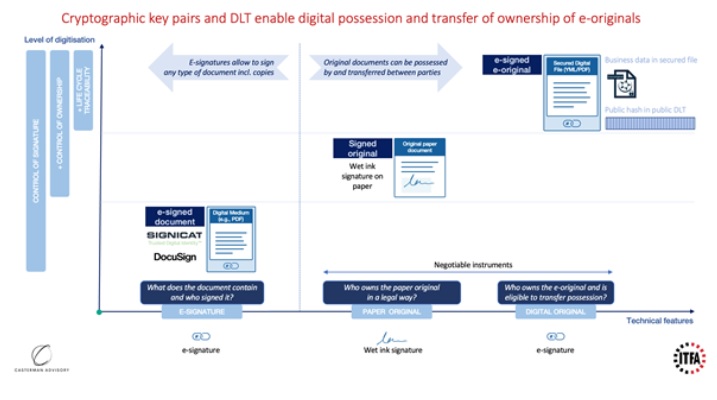

Digitally signed documents do not inherently embed document ownership attributes and specific functions that a negotiable instrument (NI) requires. Digital originals, as designed on the basis of the dDOC specifications, however, embed additional features into digital documents, enabling the digitization of NIs. These features include:

- Ownership attributes;

- the ability to demonstrate the uniqueness of the document; and

- the ability to transfer ownership of the document.

Transitioning from paper to digital originals also brings the highest levels of security, integrity and traceability. The following diagram illustrates the relationship that exists between documents when certain additional features are utilized or removed. As can be seen, E-signatures on their own do not provide the same level of control over ownership as a wet ink signature on a paper document. However, when E-signatures added to digital originals are protected with cryptographic key pairs and combined with DLT, the properties of digital possession and transfer of ownership are enabled. In effect, this provides a secure means of substituting E-signatures for wet-ink signatures.

The Benefits of dDOCs

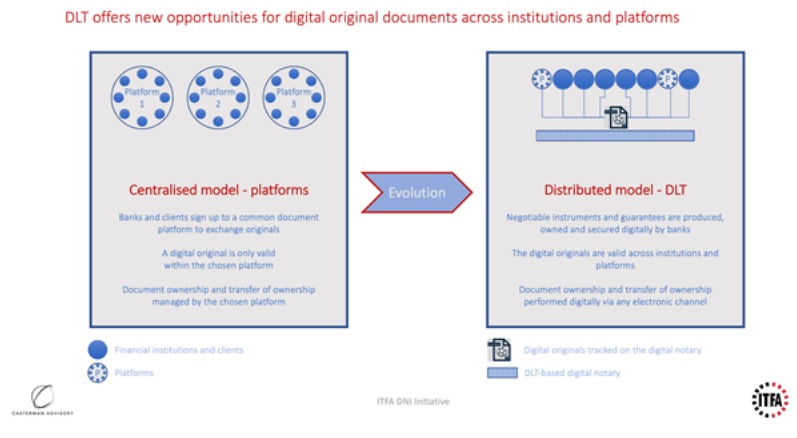

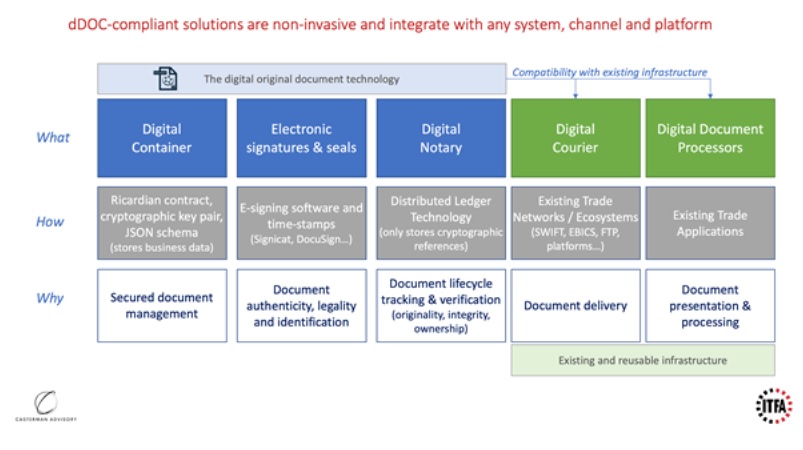

In essence, through the dDOCs standards, ITFA seeks to leverage cryptography and DLT to support the production, ownership, and transfer of digital original documents amongst financial institutions and other stakeholders. To do so effectively, these documents need to be in a form that can be handled in a traditional manner, such as being stored and processed on existing systems and exchanged via existing channels. This means that the dDOC must exist within a decentralized and vendor-agnostic framework.

A traditional platform-based model for sharing digital files is depicted on the left side of the diagram below. Under this model, a digital file is only valid within its specific system, meaning that any recipient of a document must be a member of that platform to receive and confirm the document. Decentralization, as depicted on the right side of the diagram, is an evolution of this platform-based approach. Under this model, digital originals are valid across institutions and platforms with ownership of the digital document transferable via any electronic channel. The trend towards decentralization is also prominent in other use cases such as digital assets and decentralized finance (DeFi).

An ecosystem designed with this decentralized approach at its core does not need to struggle through the early challenge of achieving network effects before its value can be realized by stakeholders. It is inherently born with network effects already achieved because all that is needed to receive and own a document is a computer and an internet connection.

Principles and requirements of dDOCs

2.4.1 Principles of the dDOC specifications

In order to achieve the benefits highlighted above, the dDOC specifications have been designed with interoperability and portability in mind. As such, dDOC-compliant document technology is able to demonstrate:

- Openness to any document format

- Openness to any financial institution and type of client (e.g., SMEs)

- Openness to any third-party trade platform (e.g., bill of lading platform)

- Compatibility with any communication channel (e.g., e-banking, SWIFT)

- Support for structured data, free text, or binary image within the document

- Ability to track the document lifecycle through a public register

- A natively digital design (i.e., no use of paper)

- Compliance with data privacy laws (e.g., full protection and control of client data).

The dDOC specifications enable banks to benefit from technological developments such as JavaScript Object Notation (JSON), cryptography, DLT, electronic signatures, and timestamps. With the power of these advancements in hand, the dDOC specifications are meant to help progress trade digitization in a highly interoperable and therefore scalable way.

2.4.2 dDOC Requirements

There are four fundamental requirements needed to achieve these key principles: the technology, a digital container, a digital notary, and data storage.

Requirement 1: The technology components

The dDOC specifications are designed around three building blocks:

- A digital container represented as an electronic file designed using “Ricardian” contracts (a type of contract that is readable both by humans and machines) and JSON, and secured using cryptographic key pairs;

- Electronic signatures and time-stamps; and

- A public distributed ledger acting as a digital notary to verify the state and ownership of the digital original. A ledger entry anchors a certain version of a digital original cryptographically by connecting it to the latest cryptographic seal in the document. The seal secures the integrity of the document and connects the document state with the ledger.

The combination of the above three technology components produces portable digital originals. These originals are compatible with any existing or future software capability and transport mechanisms.

Requirement 2: Digital container secured with electronic signatures and stamps

The term ‘digital container’ simply refers to the mechanism that is used to store and transport the file under discussion. These digital files exist in a digital container similar to how a paper file might exist in a sealed envelope. The digital container, however, has many more robust verification and security mechanisms than a standard envelope.

First, the digital container embedding the digital original must be:

- a cryptographically secure electronic document,

- independent of any information technology (IT) system or platform,

- linked to a public key (one of a cryptographic key pair, the other being private), and

- evidenced in a distributed ledger (DL).

In addition:

- the document must carry cryptographic evidence (hash values) of its content that are published on its associated DL;

- the document must contain a public key corresponding to a private key, to evidence the possession of the document;

- it must be possible to add content to the document but impossible to alter previous content;

- the document must be able to carry electronic signatures and electronic stamps;

- it must be possible for the owner to invalidate the document.

Requirement 3: Digital notary using DLT

In addition to the digital original, the DL verifying the state and holder of the digital original must:

- function as an incorruptible cryptographic assurance utility with central governance using a distributed block-chained ledger. This ledger must be continuously and independently validated and approved by its participants;

- be publicly accessible to any holder of a digital original or anyone holding a copy of a digital original; and,

- be associated with a uniform resource locator (URL) where any person or organization can manage and receive a digital original

Requirement 4: Technology integration and data storage/privacy

The document technology solution should also:

- be operationally and technically compatible with integrations for existing and future front-to-back office practices, processes, systems (e.g., digital document processors / booking systems/platforms) and channels (digital couriers e.g., file transfer protocol (FTP), electronic banking internet communication standard (EBICS), SWIFT, e-banking);

- ensure that all business data stays in the digital container and no business data is, through the underlying technology, shared in any central register or in the associated DL;

- be a utility where participants using negotiable instruments and documents of title can share a common trust in the truth of what an original document is, what the current version of an original document is, and who the current holder of an original document is; and,

- enable the original document and its referred attachments and the secret private ownership key to be stored anywhere the holder sees fit, using a storage technology with security measures deemed appropriate by the holder.

- Digital Negotiable Instruments

- TFG Legal Hub