Non-ferrous metals (SIC 24450)

Trade Finance without Barriers

Informing Today’s Market, Financing tomorrow’s Trade.

Get Trade FinanceWe offer flexible non-ferrous metals finance for the purchase of metals and equipment. Purchases such as these bulk items could negatively impact on your cash flow. However, by working with us to create financing packages you could benefit from a cash injection into your business to assist in boosting your cash flow and reduce your operating costs.

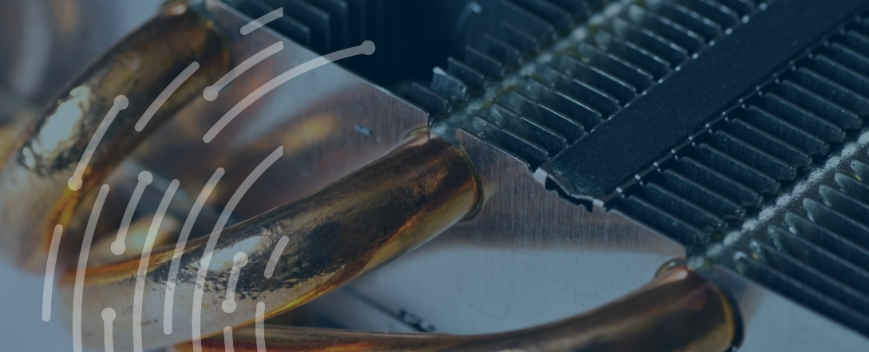

Non-ferrous Metals Finance

Types of non-ferrous metals we finance

Key non-ferrous metal products include:

- Aluminium

- Copper

- Brass

- Zinc

- Tin

- Gilding metal

- Aluminium alloys (Duraluminium)

- Lead

Trade Finance Requirements

- Your business is looking for £50k+ trade finance

- You want to import or export stock and have suppliers/ buyers

- Your business is creditworthy

How the transaction works

When a business wants to trade internationally, the exporter would typically want to be paid up front by the importer. The bank would issue a Letter of Credit, which guarantees this payment to the exporter upon receipt of documentary proof that the goods have been shipped. This is then repaid once the importer has paid for the goods, which could be anything between 30-180 days later.

What is the SIC Code for Non-ferrous Metals Finance?

SIC Code

24450

Other non-ferrous metal production

Other SIC Codes that could also be used are:

- 07290 Mining of other non-ferrous metal ores

- 24540 Casting of other non-ferrous metals

Case Study

Bauxite Mining Company

A growing bauxite mining company that works with buyers from around the world was facing increasing orders. The company focused on buyers in England, but was moving into new markets. The client was looking for finance in order to fund the expansion and so turned to trade finance in order to do so. Access to funding has allowed the company to expand and move into Europe and North America.