A new report by contract management provider Agiloft, published today, finds that geopolitical tensions and tariff uncertainty are fundamentally changing the way companies manage contracts in international trade.

The report, which surveyed US and UK firms of all sizes on the impact of recent tariffs and geopolitical disruption, found that tariffs are changing contract terms and increasing complexity across the board. Higher costs aren’t just limited to the direct impacts of tariffs themselves, which companies fear will eat at margins and disrupt supply chains; the knock-on effects of tariffs, including higher compliance requirements and pricier contract management, are raising costs in every aspect of firms’ operations.

Over 90% of firms in the UK and the US have seen significant changes to contract management

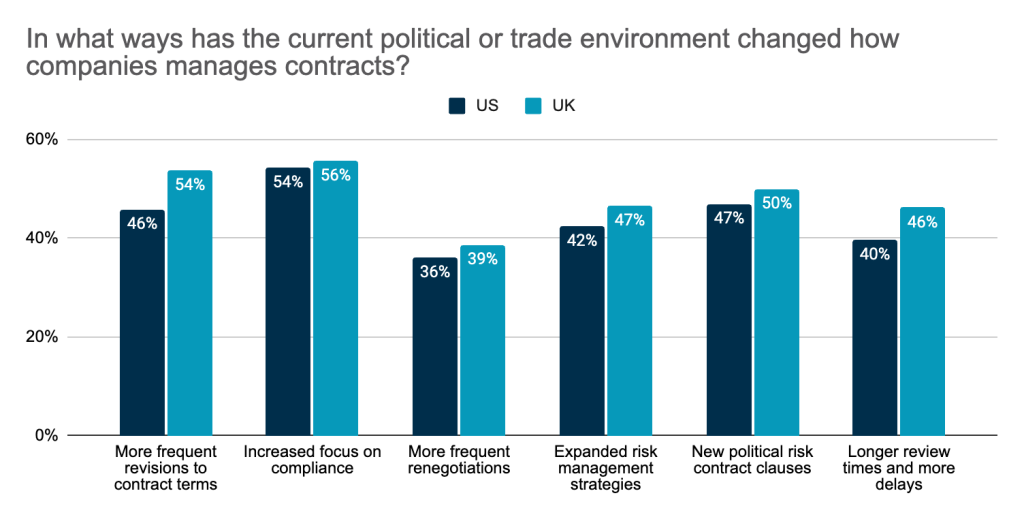

Tariffs and changing regulations are causing more frequent revisions to contract terms, especially in the UK, finds the report. Businesses are reviewing contract terms both in the face of regulatory uncertainty – to stay ahead of any compliance issues – and to adapt to tariff-related shifts or delays.

Source: Agiloft report and TFG

Over half of companies see an increased focus on compliance as the most common disruption to contracts caused by tariffs. Legal teams review clauses more thoroughly and anticipate controversies. The broader trend emerging from this is an increased use of contracts as a risk management tool in international trade, both to protect from the risks in the contracts themselves (like litigation or a lack of compliance) and external risk.

Most importantly, nearly half of all companies have seen longer contract review times and more frequent delays due to tariffs – partly because uncertainty and frequent regulatory changes are prompting renegotiations, which lengthen review times and stretch legal teams’ resources.

41% of respondents said about a quarter of their contracts now included clauses related to tariffs or trade regulations. This signals a broader trend for global trade, which is increasingly building trade restrictions into its core operations. However, the transition won’t be easy. Increased delays and operating costs due to renegotiation and contract changes decrease companies’ margins and cause further delays, disrupting supply chains and potentially leaving exporters without payment for longer while renegotiations are happening.

“While some level of renegotiation and contract complexity reflects today’s tariff uncertainty, our data shows these changes aren’t going away when headlines calm down. With more than 90% of organisations now embedding tariff clauses into contracts, businesses are effectively institutionalising volatility management,” Prashant Dubey, Chief Strategy Officer at Agiloft, told Trade Finance Global (TFG).

60% of UK companies changed suppliers due to tariffs

Nearly half of the companies surveyed had to change suppliers to reduce costs or mitigate risks due to tariffs, and just as many have ended supplier relationships as a direct result of tariff impacts. In the US, this shows the broad-ranging effects of tariffs on companies that heavily rely on imports and are now having to change suppliers as tariffs led costs to surge as much as 50% on goods from some countries like India, Brazil, and China.

This supply chain recalibration will be damaging to importers and exporters alike, the former facing delays and uncertainty ahead of the holiday season while the latter lose crucial business and miss out on growth. As a result of this recalibration, however, US and UK companies are entering new supplier relationships in new markets or regions. This presents new risks as firms expand to markets they are unfamiliar with, but also leads to wide-ranging opportunities for growth for both supplier and importer.

UK the hardest hit by tariffs overall

In nearly every aspect measured by the survey, UK companies were more affected by tariffs and uncertainty than US companies – despite the tariffs in question being enacted by the US government. UK companies were more likely to change suppliers due to tariffs, expand to unfamiliar markets, and report that tariffs overall posed a significant risk to their operations.

This could be due to the knock-on effect of Brexit-related trade complexity (the EU is still the UK’s biggest trading partner), firms whose reserves never quite recovered from the COVID-19 pandemic, with the new US tariffs and trade uncertainty dealing the final blow. Tariffs are straining both ends of the business for UK firms, disrupting supply chains and complicating market demand.

—

The report, published more than six months after the Liberation Day tariffs were first announced, shows the lingering effects of tariffs on supply chains in the US and UK alike. As uncertainty turns into trade complexity, companies are adapting to the new trade restrictions and changing their contracts and trade relationships accordingly.

Some of the issues found by the report may fade as firms adapt and regulations become clearer. However, the report lays bare an international trade environment that has been fundamentally and irrevocably changed by tariffs, whose effect it is hard to fully predict even now.

“International trade has always ebbed and flowed with politics, but what we’re seeing now is a structural shift: contracts themselves have become frontline tools of trade strategy. Companies aren’t just reacting to tariff shocks – they’re hardwiring geopolitical volatility into the way they manage suppliers, pricing, and compliance,” Dubey said.