Event Details

Digital revolution in supply chain finance: The potential of the BexNote

Aired 9 October 2024 – 11:00 BST, 12:00 CET

Sponsored by PwC Germany

The bill of exchange is an instrument almost as old as trade, with documented use as early as the 13th century. Merchant Lombards of Northern Italy, for example, usually kept their money in banks in different cities – but regardless of geography, the bill of exchange allowed merchants to receive payment as soon as a seller shipped their goods, simply by showing a signed bill to a banker.

While international trade is unrecognisable from a half-century ago, the bills of exchange have remained paper-based and stagnant. The next push in the industry, to actually progress from 13th-century Italy, is to take these trade instruments digital.

International law, such as the Model Law on Electronic Transferable Records (MLETR) in 2017, legitimises and allows for digital trade documents. But in the revolution to digitise trade documents, it’s really solutions like PWC’s BexNote that act as a catalyst.

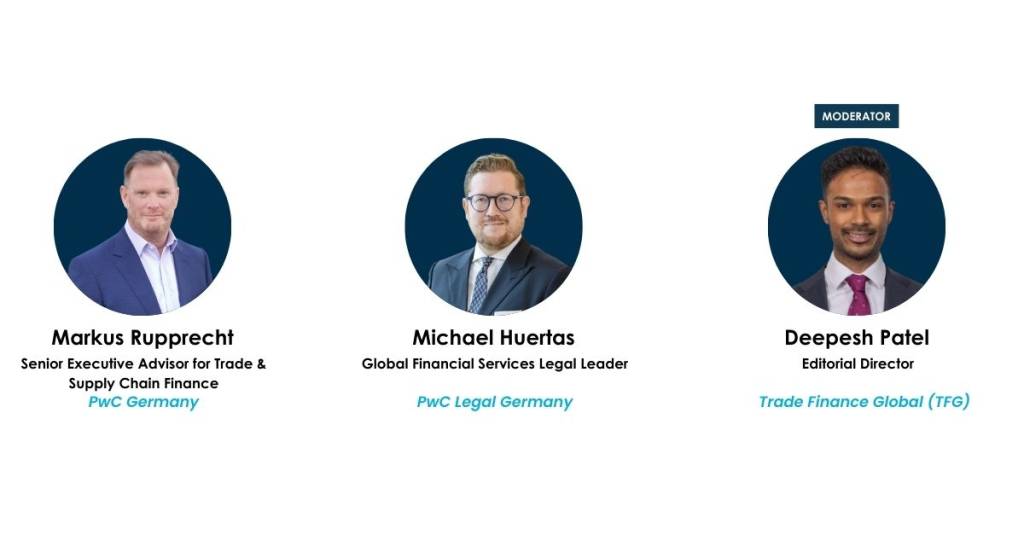

In this livestream, Markus Rupprecht, Senior Executive Advisor for Trade & Supply Chain Finance, PwC Germany, and Michael Huertas, Global Financial Services Legal Leader, PwC Legal Germany, explore the challenges and developments regarding digitalisation within the industry, and the countless advantages which electronic transferable records can bring.

The Panel

Host: Deepesh Patel, Editorial Director, Trade Finance Global (TFG)

Markus Rupprecht, Senior Executive Advisor for Trade & Supply Chain Finance, PwC Germany

Michael Huertas, Global Financial Services Legal Leader, PwC Legal Germany

Key Themes

- An overview of the digitalisation of supply chain finance

- Traditional bill of exchange vs BexNote

- European approach to and adoption of UNCITRAL’s MLETR

- Fungibility and ownership benefits of the BexNote

- The democratisation of supply chain finance using negotiable instruments

- Accounting treatment (IFRS) and liquidity management benefits for corporates

Partners