Crypto assets (including Crypto currencies) and the technologies which underpin them are important because of the potentially huge benefits to society they can deliver. It is rightly said that removing legal uncertainty about transactions involving them is critical if they are to be widely used. It is also important because providing clarity as to their standing under English law will determine whether that law will be chosen as the law of the contract and the forum for disputes over others.

Private Property

Property has value because the owner has protection in that other private parties have no right in law over it except that which the owner grants. First, the asset must be capable of being property in a legal sense. Following which the issue of legal ownership by a natural or legal person needs to be established. If both conditions are met, property has more value because it can be accepted as security under agreed priority rules in an insolvency and rights under it transferred temporarily or permanently for consideration.

Under English law, property is generally agreed to come in two flavours: real and personal. Real property, in the form of land, has always played a central role because it can be easily possessed and does not perish. Personal property is everything else that can be owned and this includes objects, living things and intangible things like rights.

English courts can only make awards on private property matters if they fall within their jurisdiction and powers. In doing so, they look first to see if they have jurisdiction and then to see if the subject matter of the dispute is capable of being resolved by applying their powers. English contract law works on the basis that for a dispute to be eligible to be adjudicated, there must be some form of breach causing detriment which the court has the power to remedy. Thus, we have three questions that need to be answered in relation to Cryptoassets qua private property:

- Is the underlying subject matter (the Cryptoasset) recognised as a form of property?

- Does the court have jurisdiction?

- Is the dispute capable of being settled under the court’s powers?

At the top of the list of issues related to the legal standing of Cryptoassets is whether they are private property under English law. Cryptoassets do not exist in one place but rather on a vast number of physically dispersed computers connected via a global network using encryption which prevents modification of the data record. They depend for their existence on an ever-growing chain of digital ‘blocks’, held on a virtual, electronic ledger using Distributed Ledger Technology (DLT) where no one entity or place holds the final record, and all must agree for the state of the record to be validated. Thus, the question of whether Crypto assets can be private property in a practical sense can be reformulated as: Can a distributed ledger record of the status of an agreement concerning a Crypto asset be the subject of a legal claim as property?

Crypto assets

At the top of the list of issues related to the legal standing of Crypto assets is whether they are private property under English law. Crypto assets do not exist in one place but rather on a vast number of physically dispersed computers connected via a global network using encryption which prevents modification of the data record. They depend for their existence on an ever-growing chain of digital ‘blocks’, held on a virtual, electronic ledger using Distributed Ledger Technology (DLT) where no one entity or place holds the final record, and all must agree for the state of the record to be validated. Thus, the question of whether Cryptoassets can be private property in a practical sense can be reformulated as: Can a distributed ledger record of the status of an agreement concerning a Cryptoasset be the subject of a legal claim as property?

The bulk of Cryptoassets are quasi financial investments which involve underlying contracts between buyers, sellers, operators and facilitators. Speculating for a moment, it would appear that the aim of the question is really concerned with how the law will handle disputes, particularly those about ownership or loss arising from claims as to title, breaches of contract, theft, misrepresentation, deception and other torts.

Currency

Although not all Cryptoassets are Cryptocurrencies, the latter are the most important subset of the former. It is therefore worth considering the similarities and differences between Cryptocurrencies and normal currency – the state sponsored, virtual (excluding banknotes), ubiquitous property commonly called money or legal tender.

In the UK, the British Pound exists because the Bank of England gives explicit permission to British banks to create and hold a certain quantity based on capital adequacy rules with incentives to do so moderated by its setting of interest rates. The result is a local ledger entry of the British bank’s own account at the Bank of England which in turn allows that bank to use a multiplier to that amount when creating assets recorded on its own local ledger for its customers. A Cryptocurrency exists because private parties on a computer network agree to create it and the total amount of the Cryptocurrency is also controlled under that agreement to avoid dilution and collapse of value, but with no reference to a bank or central bank. The differences are apparent from the table below:

| Currency (British Pound) | Cryptocurrency | |

| Anonymity | None | Possible |

| Ledger | Regulated Bank | Distributed |

| Legal Jurisdiction | England & Wales | Elected |

| Legal Status | Private property | Uncertain |

| Mode of storage | Digital with paper backup | Digital only |

| Regulator | Bank of England | None |

| Repository | Central Bank ledgers | Public ledger |

| Representation | Physical or electronic | Encrypted, digital |

To summarise, the main distinguishing factor between the British Pound and a typical Cryptocurrency from a legal perspective is state involvement in maintaining the ledger and the fact that the law requires that if parties make contracts involving the use of the British Pound, that arrangement can be enforced in courts which will treat the British Pound as property.

Convertibility

Convertibility into recognised property also seems to be central. With the British Pound, English law provides the rules of ownership and transferability and allows disputes about ownership or loss arising from an alleged breach of contract, theft, misrepresentation or deception involving the British Pound to be adjudicated in court. It would therefore be logical to assume that matters relating to a Cryptoasset convertible into the British Pound (and other fiat currencies), should be able to rely on that convertibility to benefit from the same treatment under the law. That logic may not apply to a situation where the Cryptoasset is not directly convertible by way of a contract but through optional, voluntary acceptance. Legal clarity on this is essential as there are a growing number of Cryptocurrencies which differentiate themselves on what rights or property they are convertible into.

Derivatives & Wrappers

Unconventional assets which are deemed private property in English law have been around for centuries. Examples include Bills of Exchange, insurance contracts, club memberships and even betting slips. It seems that anything which can have value to someone can be considered property in law. It also seems that for a ‘thing’ to be property it must be exchangeable for property or currency, consumed (e.g. a service) or represent a right. Moreover, financial engineers have for decades created assets with no intrinsic value but which have value because they are linked to legally recognised private property. Examples include:

- Futures and Forward contracts (convertible into commodity),

- American Depository Receipts (convertible into shares in the USA),

- Swaps (cash settled on underlying indices),

- Contracts For Difference (cash settled on underlying indices)

- Exchange Traded Funds (convertible into underlying shares).

All of these assets are recognised as legal property under English law. Many are commonly referred to as ‘derivatives’ because their value derives from, and is directly linked to, another underlying asset which is legal property. Many have an option to convert into the underlying asset as a term of the contract. Some, such as ADRs and ETFs are just wrappers for collections of underlying assets which are property. All are different from Crypto assets in how and where they are created, stored and exchanged. All are exchangeable into recognised property or represent a financial claim but none exists only in cryptographically secured, digital representations on a distributed ledger although some are being ‘tokenised’ with the ‘tokens’ themselves becoming Crypto assets. Some Crypto assets are created by and can be exchanged for money at any time, and others are exchangeable only for other assets (often ‘Tokens’) or rights or even services. Tokens for mainstream investments which are convertible into currency or financial securities or investments are already considered by HM Treasury, the FCA and the Bank of England to be within the regulatory perimeter. Thus, these Cryptoassets, which are neither state created nor state sanctioned, must either be implicitly recognised by the UK to be property under English (and probably international) private law by virtue of regulation. Or alternatively, and this seems less likely, these state institutions are seeking to regulate something which is not unequivocally legal property.

Non-Convertibility

Given the apparent importance of convertibility into legal property as a necessary condition to give a Cryptoasset status as legal property, we need to ask two further questions: Under what conditions can it be the subject matter of a legal agreement and when can it be adjudicated in a court? Is it possible before it is exchanged into legally recognised property provided there is a right to convert or is there a requirement for conversion to have happened?

For the purposes of discussion, let’s imagine a Cryptoasset which is convertible only into something which is not legally recognised as property such as a human body or information in a database (both of which are accepted as not being property in English law). And let’s call this Cryptoasset “Imagicoin” and agree that it:

a) Required no upfront payment in currency,

b) Is permanent and immutable,

c) Is transferable,

d) Displays the history of ownership, but

e) Exists on a public Distributed Ledger,

f) Can only be exchanged for human bodies or information in a database.

Imagicoin can of course be owned, transferred and even be converted into human bodies or even information held in a database with counterparty consent. It is also worth noting that Imagicoin has almost identical characteristics to the British Pound in terms of a), b) and c) above but not as regards d), e) and f).

As a privately created asset sold by a seller to a buyer, Imagicoin does not need recognition by the government of the UK to exist. Yet, ironically, both the British Pound and Imagicoin rely on having a value solely from the continuing belief of users that their respective ledgers are reliable, secure and widely accepted. However, could Imagicoin be considered property and so treated as such by an English court in the event of a dispute? Could an English court consider it had the powers to decide a dispute arising from an Imagicoin given it could never be converted into legally recognised property?

Conclusion

The doctrine of freedom of contract under English law is clear: parties have the freedom to enter into contracts provided there is no illegality and it is not against public policy. Moreover, recent Supreme Court decisions confirm this and further that courts should refrain from reading things into contracts by implying terms which were not explicitly agreed however disadvantageous a bargain may

turn out to be. As such, this doctrine should be capable of supporting the argument that, as result of party consent, Cryptoassets should be treated as property and thus capable of being resolved by the application of existing law of private property. For it is not the business of a state to tell its citizens what it considers to be a suitable asset to be bought and sold provided it does not go against some doctrine fundamental to running a civilised society such as public policy.

It would also appear that Cryptoassets are already considered property under English law to the extent that they are capable of being exchanged or converted into property or confer rights which are enforceable in law. For those types of Cryptoassets which are not considered as meeting this test, a clear statement needs to be made by the authorities reviewing this to set out the qualifying criteria. And although the devil is in the detail, there is a strong commercial case to be made, without jeopardising legal integrity, that almost all Cryptoassets around today have characteristics which by analogy allow them to be treated as falling into the category of property in law. If it is considered that this is not the case for important classes of existing Cryptoassets, the English legal system needs to either a) declare that they are, b) define the characteristics required to give them private property status in law, or c) innovate and consider creating a legal fiction to do so.

These, and for sure many other questions not considered here, need to be decided immediately if the jurisdiction of England & Wales is to compete as a place from where to create contracts and resolve disputes in the Crypto assets domain.

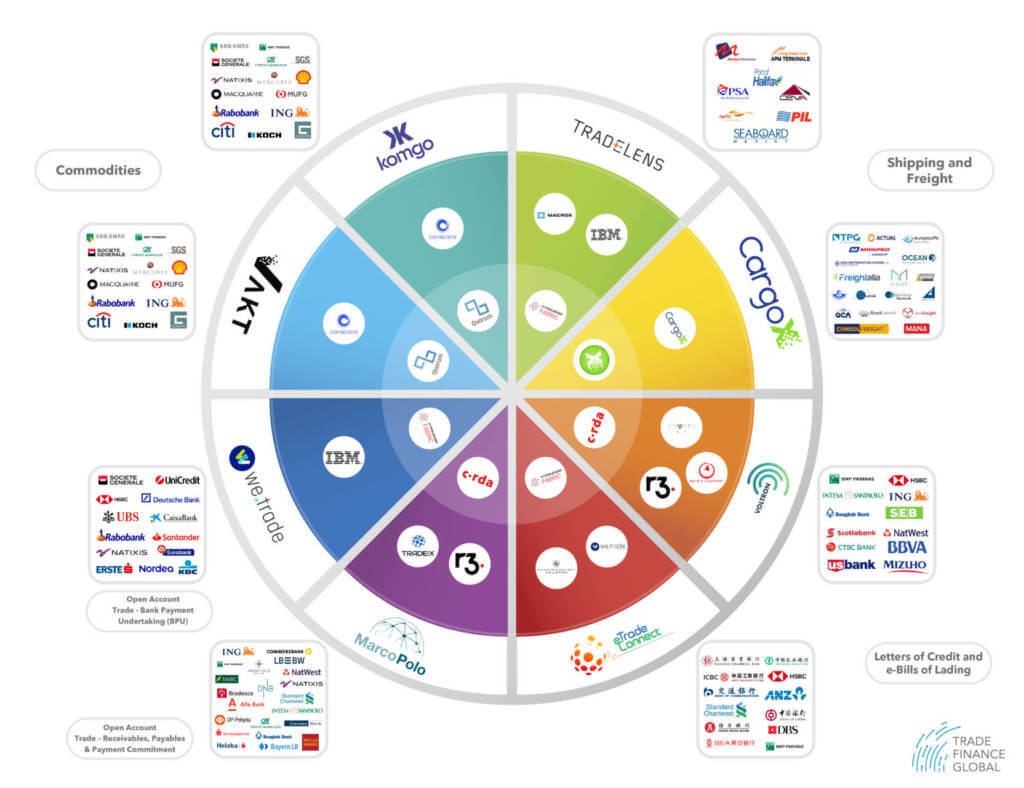

Want to find out more about Consortia, Networks, and the state of trade technology with respect to DLT?

See the interactive diagram

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.