Estimated reading time: 4 minutes

The International Trade and Forfaiting Association’s (ITFA) Digital Negotiable Instruments (DNI) Initiative Day, hosted in London on 12 July 2023, served as an important platform for the future of trade finance.

The event convened industry leaders, each contributing their insights into the hows and the whys of removing paper from trade, in a rapidly evolving landscape.

Keynote highlights

The day unfolded with a series of presentations and panel discussions, each revealing the industry’s readiness to embrace digital transformation and its inherent challenges.

Sean Edwards, Chairman of ITFA, opened the day with a legal keynote, preparing the audience for the forthcoming legislation that the UK government is planning to introduce to support the use of digital negotiable instruments.

Edwards highlighted the importance of digitising the trade ecosystem, which could increase trade across the G7 by nearly $9 trillion, or nearly 43% of 2019 values by 2026.

He also emphasised the role of United Nations Commission on International Trade Law (UNCITRAL’s) Model Law on Electronic Transferable Records (MLETR), or equivalent bills such as the Electronic Trade Documents Bill (ETDB), in facilitating the move towards legally accepting digital trade documents, such as promissory notes and Bills of Exchange.

Sean Edwards emphasised MLETR’s need for a “reliable system” in the digitalisation of trade finance, one that ensures the integrity of digital negotiable instruments, provides legal certainty, and fosters trust among all parties involved, thereby facilitating the seamless transition from paper-based to digital transactions.

Merisa Lee Gimpel from Lloyds Bank followed with a business keynote, discussing enhancing client satisfaction with digital negotiable instruments.

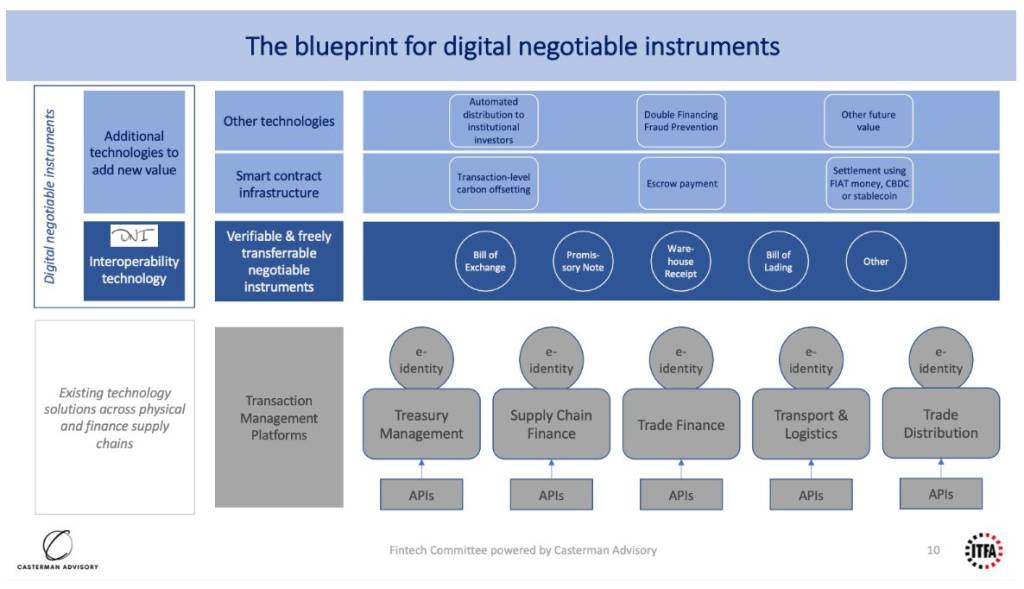

André Casterman, MD at Casterman Advisory and ITFA Board Member, delivered a technology keynote on leveraging distributed ledger technology (DLT) in trade finance, the world of Web3 and digital assets’ role in trade.

Casterman presented the blueprint for digital negotiable instruments, emphasising the need to align policy with technological advancements, focus on interoperability, add new value to digital flows, promote open platforms and ecosystems, and expand supply chain finance.

The role of Digital Negotiable Instruments

One of the highlights of the day was the discussion on the UK’s first digital promissory note purchase, completed by Lloyds Bank in 2022.

This marked a significant step towards the application of digital negotiable instruments. Casterman said, “The DNI Initiative aims to digitise negotiable instruments across transport, logistics, and banking, aligning policy with technological advancements.”

The challenge of interoperability

Interoperability emerged as a consensus among the audience as a critical factor for the successful digitalisation of trade finance.

However, the delicate issue of banks’ limited participation in primary transactions was also noted.

The event underscored the necessity of collaboration beyond the trade finance ecosystem, highlighting the importance of partnerships with Treasury Management providers.

Interoperability, in this context, is an umbrella term that encompasses technical standards, commercial partnerships, and open systems.

The DNI Initiative and the future of trade finance

The DNI Initiative Day also provided a deep dive into the ITFA’s DNI initiative.

The adoption of MLETR-compatible instruments is scaling up, and additional value is being added to digital flows.

The event also spotlighted the importance of open platforms and ecosystems in the digitalisation of trade finance.

The emergence of DLT and “digital assets” is extending Open Banking practices with “asset and value transfer”.

This capability is particularly suited to achieve the level of interoperability required for title documents such as negotiable instruments.

Path forward

The day concluded with a forward-looking discussion on the future of trade finance, with a focus on expanding Supply Chain Finance.

The potential of digital Bills of Exchange, embedded in a supply chain payable workflow, was suggested as a potential game-changer, replacing proprietary payment service agreements.

ITFA’s DNI Initiative Day marked a significant step towards the digitalisation of trade finance.

The event underscored the industry’s readiness to embrace digital transformation, the challenges that lie ahead, and the strategies to overcome them.

As the industry continues to evolve, events like these will be pivotal in guiding its path towards a digital future.

The pace of change, particularly in regions like the Middle East, is rapid and iterative, with developments building on each other.

ITFA is contributing significantly to this evolution, and with legal changes happening quickly and attracting a lot of interest, the future of trade finance is bright.

Editors note:

MLETR map was updated on 18.06.23 to reflect recent changes.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.