Estimated reading time: 8 minutes

TFG’s Deepesh Patel (DP) spoke to ITFA’s Chairman, Sean Edwards (SE), about the ITFA Structured Letters of Credit Working Group, and the emergence of Structured Letters of Credit as a variant of Traditional LCs.

The origins of Structured Letters of Credit

SE: Structured LCs have emerged as a variant of Traditional LCs in the last 25 years. Their development came in three phases.

In the first phase, a large commodity trader was approached by its bank with a novel way to use the GSM-102 program offered by the Commodity Credit Corporation of the US Department of Agriculture (the “CCC”) which supported the export of US bulk agricultural products.

The bank told the commodity trader that, instead of selling directly to the foreign buyer, it should set up a subsidiary in countries where it had large bulk sales and sell to it, thereby allowing the subsidiary to be the applicant on the CCC LC. The credit on the LC application was covered by a commodity trade standby letter of credit. Since the subsidiary would not need a loan from the foreign bank it could immediately prepay its obligation from the proceeds of the sight sale to the end buyer at a discount. The commodity trader could use the discount (basically a fee charged to the Issuing Bank for access to cheap funding under the CCC program) as a way to buy down the cost basis on the underlying commodities. In most cases, this allowed the commodity trader to offer more competitive pricing and thus gain market share. They used to refer to it as a “margin stretcher”.

This structure also established the two basic steps in almost all structured transactions: to sell on a term basis to an entity (usually a related party) to set up the debt obligation and then prepay that obligation at a discount with the proceeds of the sight sale.

In the 1990s, commodity traders started to adapt this CCC structure to commodity exports in a variety of geographical areas.

The next structure created was called a Corporate Transit Trade and placed a company in the middle of an existing trading pattern to obtain working capital financing. A commodity trader would sell to a company on 180-day terms which would either sell it back to the commodity trader or on-sell to a related party at sight. These were done while the goods from the original transaction were in transit on the high seas. These were then sold to banks as trade transactions related to the commodity trader under silent funded participation.

SE: Phase Two came in the late nineties, where it became apparent to other commodity traders that at least one of their competitors had some “secret sauce” that allowed it to under-bid the market for its commodity sales and win additional market share. The commodity trader was using its “margin stretcher” strategy to subsidise the cost basis of the underlying commodity sales. The concept of such structures spread to other commodity traders.

SE: In the third phase, trade finance expertise spread, and evolved around the three basic elements namely (i) Origination, (ii) Structuring and (iii) Distribution. Origination identified the entities that required financing; Structuring took care of the details of the transactions, and Distribution laid off the risk into the market and ensured a profit. With these three elements in place, they then needed flows of bulk commodities to complete such transactions.

The basic structures outlined above were used as they were familiar to both origination (borrowers) and distribution (discounting banks). Traders would first contract with a commodity provider to buy and immediately sell back a cargo that was in transit on the high seas. No principal needed to change hands with the contract amounts netting out and the difference between them amounting to a fee paid to the supplier for the use of the flow. While this was being negotiated, the Trader could arrange for an LC opening line of credit with a bank needing financing by way of posting cash collateral in the form of an interest-bearing deposit which would be equal to and cancel the term LC obligation at maturity. Knowing their costs and profit potential they could then arrange to pre-sell the transaction to a discounting bank to lock in a profit. Such transactions do not, however, represent the bulk of the current market.

Structured Letters of Credit – Commercial use today

SE: Structured LC business combines the financing of a real flow of commodities using the instrument of deferred payment LCs with the purpose of providing funding to financial institutions (importers’ bank / LC Issuing Bank) in mainly emerging markets and realising a benefit from other arbitrage (FX / interest rates) for traders.

There are three key counterparties participating in Structured LCs: the trader, the issuing bank and the confirming and discounting bank. Each has their own clear commercial motives associated with their roles in the transaction which enhance their economic position through their use of such instruments.

Examples of the purpose and benefits as they might apply to the parties of a Structured LC:

The Trader

Traders will wish to benefit from the significant volume of cargoes they have on the water at any time as a result of their normal global trading activities by use of their global banking relationships.

With a Structured LC a Trader may benefit from the ‘arbitrage’ differential in price between the deposit rate paid by the emerging market Issuing Bank and the cost of the confirmation and discount rate of the LC from the Discounting Bank, minus the costs of the collateral (cash or ‘A’ rated bank Standby Letter of Credit / guarantee) they must post for the few days prior to issuance of the instrument to presentation of copy documents) and any other transaction costs.

The Traders may also use interest rate and fixed / floating swaps with the banks to generate another fully-hedged revenue stream out of the transaction.

The Issuing Bank

Emerging market banks, often in exchange control countries, suffer a high cost of funding in hard currencies, particularly USD. Their central banks often struggle to maintain sufficient foreign currency reserves to meet their USD denominated import requirements, as their economies do not generate enough USD exports. This creates shortages and pricing inflation for FX liquidity, high sovereign risk premiums and a reluctance for international banks lending dollars to their commercial banks.

Emerging market trade finance is typically funded in USD: the international exporter wants to be paid dollars immediately at sight and the emerging market importer needs three to six months or more to receive, condition, distribute and sell the goods in local currency, requiring their emerging market bank to fund USD for the tenor of the underlying cash conversion cycle.

When the emerging market banks attempt to fund these short-term trade dollars, they inevitably find their returns are lower than their cost of equity and are value-destroying to their net margin.

Structured LCs can ultimately be used to gain access to USD funding at competitive pricing.

The Confirming and Discounting Bank

International banks often participate in Structured LCs as Confirming and/or Discounting Banks because the Structured LCs give them access to a shrinking pool of emerging market trade through irrevocable payment obligations of emerging market banks, with good product default characteristics. Structured LC business also provides a conduit for ancillary business with the commodity Traders. Aside from the direct economic benefits of facilitating Structured LCs, there are cross-sell and up-sell opportunities to the Traders and the Issuing Banks through participating in their Structured LC programmes.

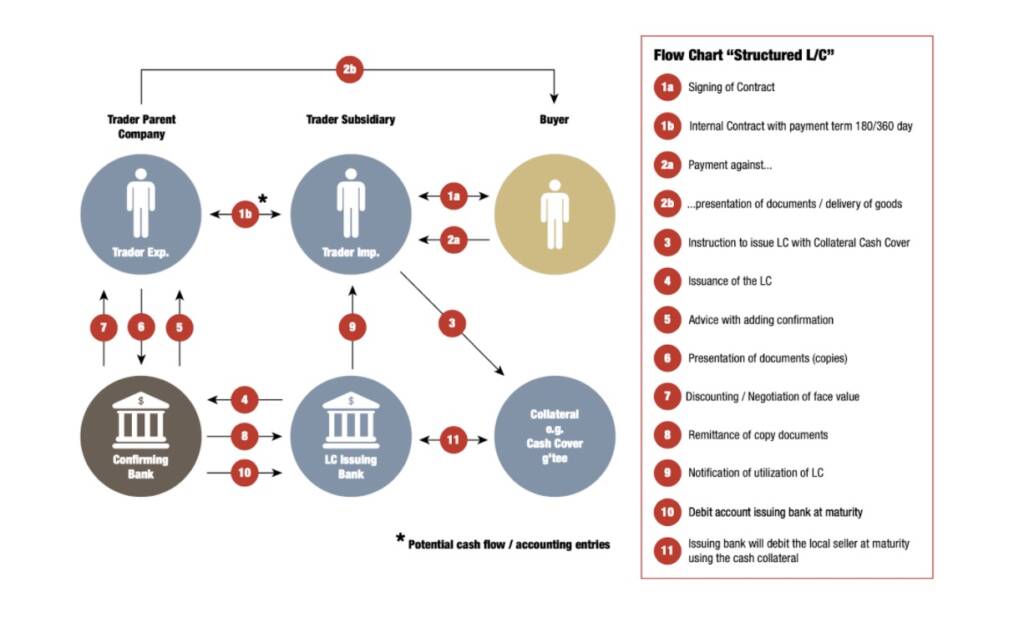

Diagram: How a Structured LC could work

Diagram: Structured LC Flowchart. Source: ITFA

China, and Structured LCs

SE: Following the publication of the Guide in April 2021, the wording of section 5.2 has been amended to clarify the case law analysis referring to the position in China. The previous wording might have been misleading in appearing to suggest that courts in China would adopt a different position compared to other courts that have heard cases involving Structured LCs. ITFA has no reason to believe that the position in China would be any different to the other jurisdictions.

In summary, the analysis suggests that a Structured LC transaction should be documented in line with UCP600. It should be clear that all parties involved in the transaction are aware and informed of its nature and purpose and that there is an underlying trade transaction (which can be between companies in the same group). Cases make it clear that fraudulent transactions would not be upheld.

Download ITFA’s Structured LC Guide here (ITFA members only)

ITFA would specifically like to thank the following members of the Working Group for their contributions:

- Michelle Knowles – Group Head of Trade Finance Product – Absa Group Limited

- George RR Wilson – Head, Institutional Trade – Absa Corporate and Investment Bank; ITFA Africa Regional Committee member

- Thomas Krieger – Head of Institutional Portfolio Management, Risk Distribution – Commerzbank AG; ITFA German Regional Committee member

- Johanna Wissing – Director GTB Asia Pacific – Lloyds Banking Group; ITFA Board member Grant Eldred – Partner – Penningtons Manches Cooper LLP

- Mark Sachs – Partner – Penningtons Manches Cooper LLP

- Ellis van der Vos – Associate – Penningtons Manches Cooper LLP

- Geoffrey Wynne – Partner – Sullivan & Worcester UK LLP; ITFA Market Practice Committee member

- Joseph M. Wagner – Executive Director – Wagner International, LLC