Guarantees and Indemnities

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Guarantees and indemnities are used by borrowers to protect themselves from the risk of debt default, which means being unable to fulfil its obligations under a loan agreement.

Given their function, lenders will usually seek a guarantee or indemnity to be taken, especially when they have doubts about the solvency of the borrower. In brief, lenders are seeking extra security by having a guarantor/indemnifier to cover the borrower’s obligations under the loan agreement.

Guarantees and indemnities are two differing types of contract and will come into effect at different times of the contractual relationship.

Guarantees

A guarantee is a contractual promise whereby a guarantor accepts to be responsible for the performance of the obligations of a third party (borrower) to the guaranteed party (lender), if the third party fails to perform such obligations.

It can have two forms: when the payment of the principal and interest is guaranteed to the lender, it is called a conditional payment guarantee; when the guarantee agreement relates to ensuring that the third party (borrower) fulfils its obligation, it is called a pure guarantee.

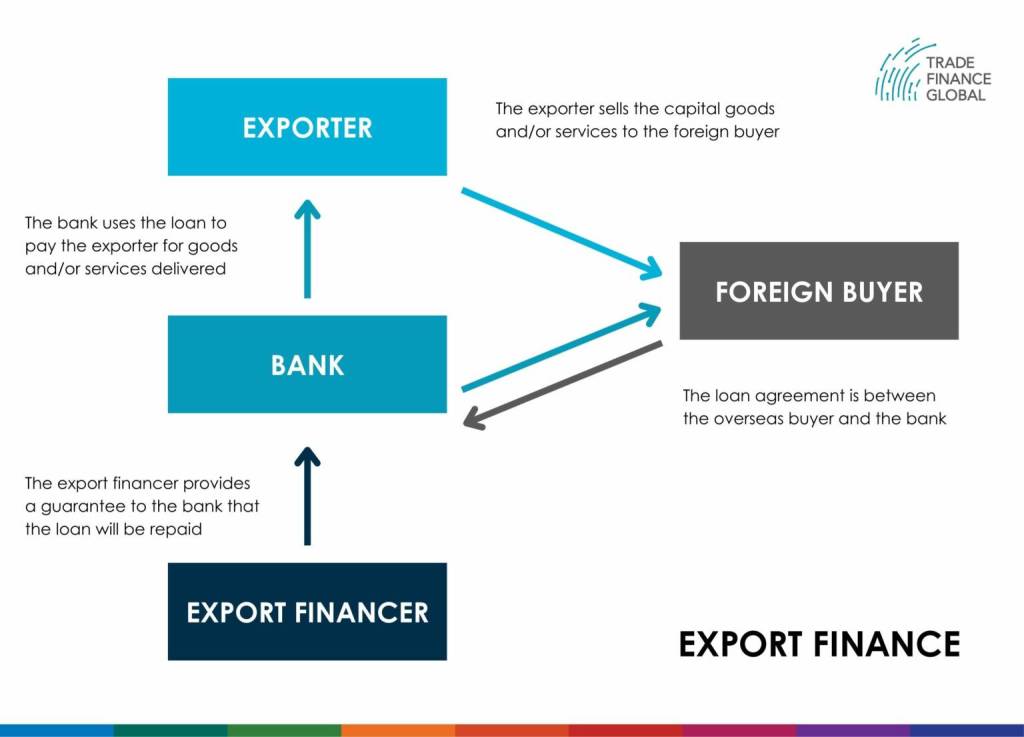

FIG.1: Generally, the lender, typically a bank, requires a guarantee to ensure loan repayment, especially in cases where the borrower defaults.

The guarantee agreement’s key element is the establishment of a secondary obligation, where the fulfilment of the contractual obligation depends on the third party’s (principal or borrower) obligations towards the guarantee beneficiary (lender).

The guarantor is bearing the responsibility for payment of the debt or performance of the borrower’s obligations if the latter fails to perform them. In other words, a guarantee agreement will come into effect when the first obligations are not fulfilled, for instance where the borrower is defaulting.

Case example: Company X wants to buy new manufacturing devices and needs to borrow $1 million from a bank. When negotiating the contract, the bank will ask Company X to provide a financial guarantee for the loan.

Company X will approach Company Z, the guarantor, to sign a guarantee contract that will be attached to the loan agreement. In this contract, Company Z commits to repaying the loan in the event that Company X defaults or fails to fulfil its obligations.

What are the advantages of a guarantee?

Guarantees are generally advantageous for the guarantor since they are granted with certain rights:

- Right to indemnity: once the guarantor fulfils its obligation by paying the beneficiary (lender) under the guarantee agreement, he has a right to claim indemnity from the principal, given that this guarantee was taken at the principal’s request.

- Right of set-off: in case where the principal’s obligations have been discharged, which sets-off against the beneficiary’s liability to the principal, the guarantor will also benefit from this right of set-off and be discharged of its obligations under the guarantee.

- Subrogation: when a guarantor fulfils the principal’s obligations under the guarantee, he will be entitled to all the beneficiary’s rights against the principal under the primary (loan) agreement.

- Marshalling: by virtue of the doctrine of marshalling, a guarantor can obtain the benefit of another lender’s security over the principal’s assets of which he would otherwise not have a security over.

Indemnities

An indemnity is a contractual promise by which the insurer assumes the liability for loss or damages caused by the insured party and agrees to pay the related cost. The traditional example is the insurance contract whereby the insurer agrees to compensate the insured party for damages and losses in return of payment of premiums by the insured party to the insurer.

Unlike a guarantee, an indemnity agreement creates a primary obligation in that the obligation for compensation is independent from the obligation of the third party (borrower) towards the beneficiary of the indemnity (lender). In other words, an indemnity agreement will come into effect when the beneficiary (lender) causes a damage or loss, irrespective of the failure of the borrower to fulfil its obligations under the loan agreement.

Speak to our trade finance team

- International Trade Law Resources

- All International Trade Law Topics

- Podcasts

- Videos

- Conferences