HSN Codes Explained (Harmonized System Nomenclature)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

HSN stands for ‘Harmonized System Nomenclature.’ The WCO (World Customs Organization) developed it as a multipurpose international product nomenclature that first came into effect in 1988 with the vision of facilitating the classification of goods all over the World in a systematic manner.

How do HSN work?

HSN is a six-digit code that classifies more than 5000 products, arranged in a legal and logical structure. To achieve uniform classification, the HSN is supported by well-defined rules and is accepted worldwide.

HSN classification is widely used for taxation purposes by helping to identify the rate of tax applicable to a specific product in a country that is under review. It can also be used in calculations that involve claiming benefits.

Yet that’s not all – it also applies to import and exports. The HSN code aids in determining the quantity of all items imported or traded through a nation.

The Importance of the HSN Code

While the primary purpose of the HSN code is the systematic classification of goods, it can also be used to gather data and solve problems that would otherwise be difficult to obtain. The result is a more efficient international trade system.

HSN is in use worldwide, with 200+ countries participating. This impressive adoption rate can be chalked up to the benefits of HSN, which include:

- Collection of international trade statistics

- Provision of a rational basis for Customs tariffs

- Uniform classification

Nearly 98% of international trade stock is classified in terms of HSN, further evidence of its reputation as the best form of international classification.

HSN numbers exist for each commodity in every country, and the number remains the same for almost all goods. In some countries, HSN numbers can vary a little because they are entirely based on the nature of the items classified.

HSN in India: One Example

India has been a member of the WCO (World Customs Organization) since 1971. It initially employed six-digit HSN codes to classify merchandise for Customs as well as Central Excise duties. To make the codes more precise, the Customs and Central Excise authorities went on to add two more digits. This resulted in an eight-digit HSN classification.

Almost all goods in India are classified using the HSN classification code, which facilitates the use of HSN numbers for calculations of the Goods and Service Tax (GST). The number is currently being used to categorize goods to compute VAT (Value Added Tax).

HSN code in GST invoices – what to remember

It’s important to remember that the HSN number must be clearly mentioned on GST Invoices when preparing Tax Invoices for GST.

Here’s how the different HSN classifications, from two digits to eight digits, come into play in India:

- The government gives some form of relief to small taxpayers with annual turnover up to Rs. 1.5 crore in any preceding financial year. After this move, there is no need for small taxpayers to mention HSN codes in their taxable income.

- Taxpayers with a turnover between Rs. 1.5 crore up to 5.00 crore must mention only two digits of the HSN code.

- Taxpayers with a turnover that exceeds Rs. 5.00 crore must mention five digits of the HSN code.

Understanding the HSN Code

So, what is the HSN code in full form? The HSN code contains:

- 21 sections

- 99 chapters

- 1244 headings

- 5224 subheadings

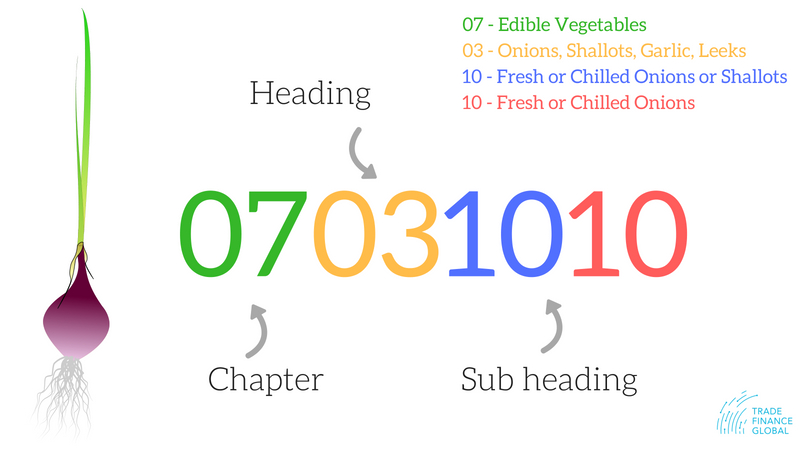

The structure of HSN code has about 21 groups, and these groups are further classified into 99 chapters. The chapters are then divided into headings that are about 1244 in number. The headings are subsequently divided into 5224 subheadings. In the code itself, this plays out in the following manner:

- Each Chapter is named as a two-digit HSN number.

- Each two-digit HSN number is sub-classified into a four-digit HSN code.

- Later, such four-digit HSN codes are further sub-classified into the six-digit HSN code.

How can I find my 8 digit HSN code? To sub-classify the six-digit HSN code number in some countries, there must be an additional two-digit HSN code put into place in order to create an eight-digit HSN code.

Example of an HSN code – schematic

The Importance of HSN Under GST

The HSN system doesn’t only help Customs agents – it also has important implications for GST. It helps in making GST systematic and globally accepted.

By using HSN codes, there is no need to upload a detailed description for each good falling under the GST. This allows for the automation of GST returns, saving time and money for the tax authority.

Get in touch with our Freight Forwarding networking team here.

Testimonials

HSN Codes were required by Sharma Packaging Foods Company to determine what relief it was eligible for from taxpayers.

– Joanna, Sharma Packaging Food Company

Case Study

Goods Distributor

TFG put us in touch with expert HSN experts so that we could ship our goods across the state and also pay the appropriate taxes to the government.

- Customs Resources

- All Customs Topics

- Podcasts

- Videos

- Conferences