Cricket Receivables Finance

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContent

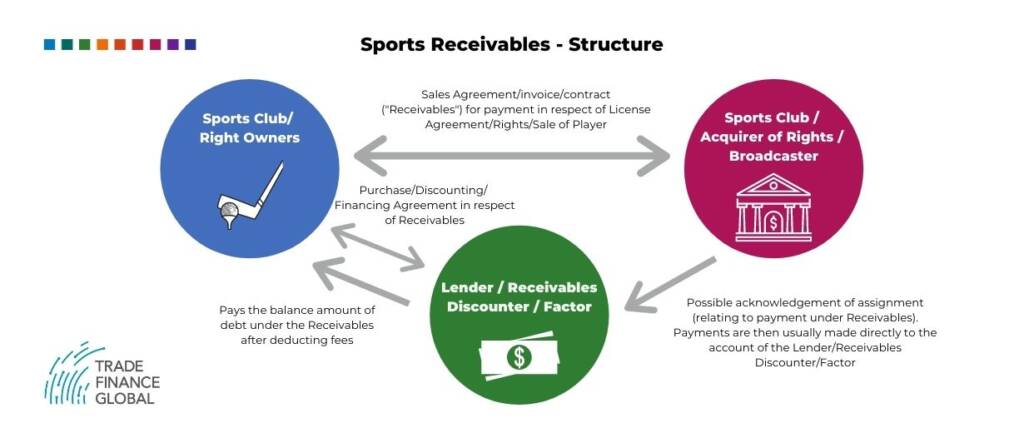

Account receivables financing is a financial method, which allows companies, businesses, sports organizations and clubs to receive capital financing against a percentage of its accounts receivables (AR). There are multiple ways to structure an accounts receivables finance structure and corresponding receivables finance agreement.

How accounts receivables financing works?

Accounts receivables financing basically allows the lending party, such as cricket clubs, to get access to immediate cash in return for their accounts receivables. AR is a cricket club’s assets that are equal to the due or outstanding balances of their invoices billed to business partners, broadcasting companies, customers, and viewers.

These are due invoices not paid yet, but these account receivables reflect as assets on cricket clubs’ financial balance sheets. These current assets are invoices that are due for payment within a year’s timeframe.

A General Formula for Cricket Sports

Account receivables in sports such as cricket is also a variant of liquid assets. It comes into play when calculating and identifying a cricket club’s quick ratio to help analyze its liquid assets.

Quick Ratio = Marketable securities + Cash Equivalent + Account receivables due within 12 months /current liabilities

Whether externally or internally, account receivables is a highly liquid asset and transforms into a theoretical value for both financiers and lenders. Many cricket teams and clubs may believe account receivables to be a burden. It is only because they are bound assets in the form of pending invoices, which means they cannot convert into immediate cash. Another reason is the hassle when it is time to collect these invoices from different parties.

As the cricket and sports sector is evolving dynamically, so are the financial and other business related issues. However, more and more external financiers are stepping in to help the game meet its needs.

The accounts receivables, and corresponding financial process is also known as factoring or invoice factoring. One can call the lending company, a factoring company. A factoring company generally focuses on the business model of accounts receivables financing, but factoring can be a practice of any financial organization.

How accounts receivables works in the cricket and sports

Before we get into factoring, let us find out how the cricket space works financially and how it generates revenue.

Cricket Revenue Generation

The professional cricketing industry is parallel to any other sports entertainment sector. The financial value of any cricketing body or club is easily measurable by the revenue it generates through playing games. Another important factor to understand is their expense on resources employed to produce an entertaining match or a series.

A more direct way for cricket to earn revenue is by selling tickets to the fans directly, whereas more complicated ways include selling broadcasting rights to different television channels and radio stations.

Cricket Expenses

Cricket clubs and teams employ numerous resources to achieve a reputable standing in the sports world arena. Their expenses include recruiting cricketers, buying playing gears and equipment, building a stadium, etc. Other expenses include employing resources for talent hunting the new and upcoming cricketers, and their training for further skills development.

The value of a cricket club is a sum of both their revenue and expenses made by each institution. These include the price paid for each cricketer’s service and the expenses towards their training by the team. The reason is that the more talented and skilled the players in the team, the more it will increase the team’s chances to win matches, competitions and be world-class. It will bring in more revenue via sponsors, prize money, and other subsidiaries by the International Cricket Council (ICC).

How Does Factoring Help Cricket?

One of the most critical aspects that guarantee a cricket team’s success is the number of quality players it has in the squad. Cricket clubs buy and sell cricket players from each other all the time, every year.

Let us take Surrey Cricket Club and Essex Cricket Club as an example. Surrey’s team buys a cricketer from Essex Cricket Club, but the transfer will happen at the end of next year’s county cricket season. Until then, the player will keep playing for Essex, and when the transfer happens, Surrey will make the payment to Essex for the player bought. However, the Essex club needs the money to keep running its day-to-day operations. Plus, they need the money to renovate their stadium with a new training ground.

So what do they do? Answer – Here is when factoring comes into the picture.

A financier, lender, or a bank will extend their services to the Essex club. The lending organization will make the immediate cash equivalent to the player’s value, which Essex is expecting to receive from Sussex. However, the lender will charge a fee for providing this finance. Essex can use the money to fulfill their financial needs.

When the transfer of the player and payment by Sussex becomes due, either Essex will collect the money and hand it over to the lender, or the lender will usually take on the responsibility to collect the money themselves.

Other Scenarios

Other scenarios where invoice factoring can help cricket clubs and teams is where clubs can sell their pending invoices to the lender. The lender will buy these invoices by offering 10 to 30 percent lesser value of the invoices. The cricket clubs will get the immediate cash, and the lender will collect from the end debtors when the invoices become due.

Similarly, cricket clubs and teams can borrow money against their broadcasting monies, prize monies, and other expected funds. The lender provides immediate cash against a fee and collects the monies mentioned above when they become due.

Accounts receivables in Cricket is Unsecured by Low-Risk Financing

Cricket teams can also borrow against their fixed assets, such as stadiums, training grounds, and other premises. However, this is difficult for the banks and lenders because they will face a backlash by the local councils and fans if they try to sell the stadium and recover their losses.

Accounts receivables in the cricketing sports arena is more like unsecured loans and is gaining in popularity amongst banks and lenders.